Stipulation And Order Of Dismissal

Description

How to fill out Stipulation For Dismissal?

It’s widely known that you cannot transform into a legal expert instantly, nor can you swiftly master the preparation of Stipulation And Order Of Dismissal without possessing a focused background.

Drafting legal documents is a lengthy endeavor that demands particular education and expertise. So why not entrust the drafting of the Stipulation And Order Of Dismissal to the experts.

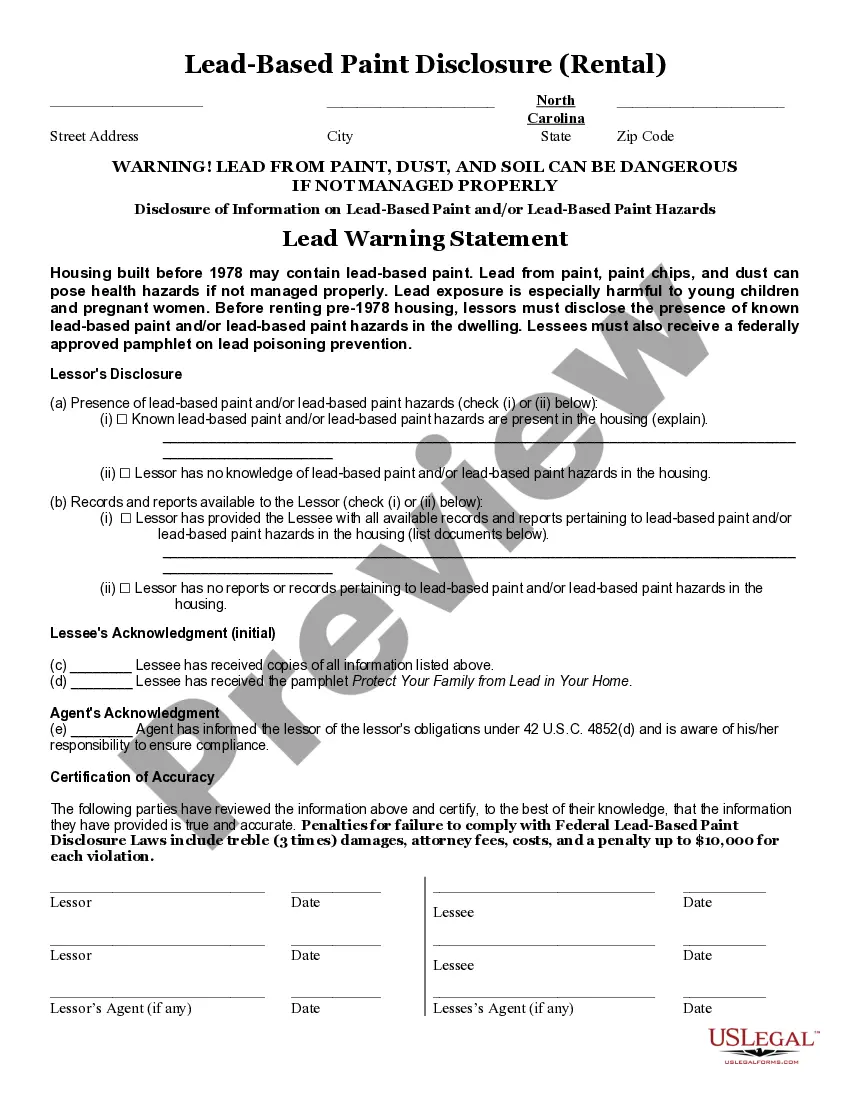

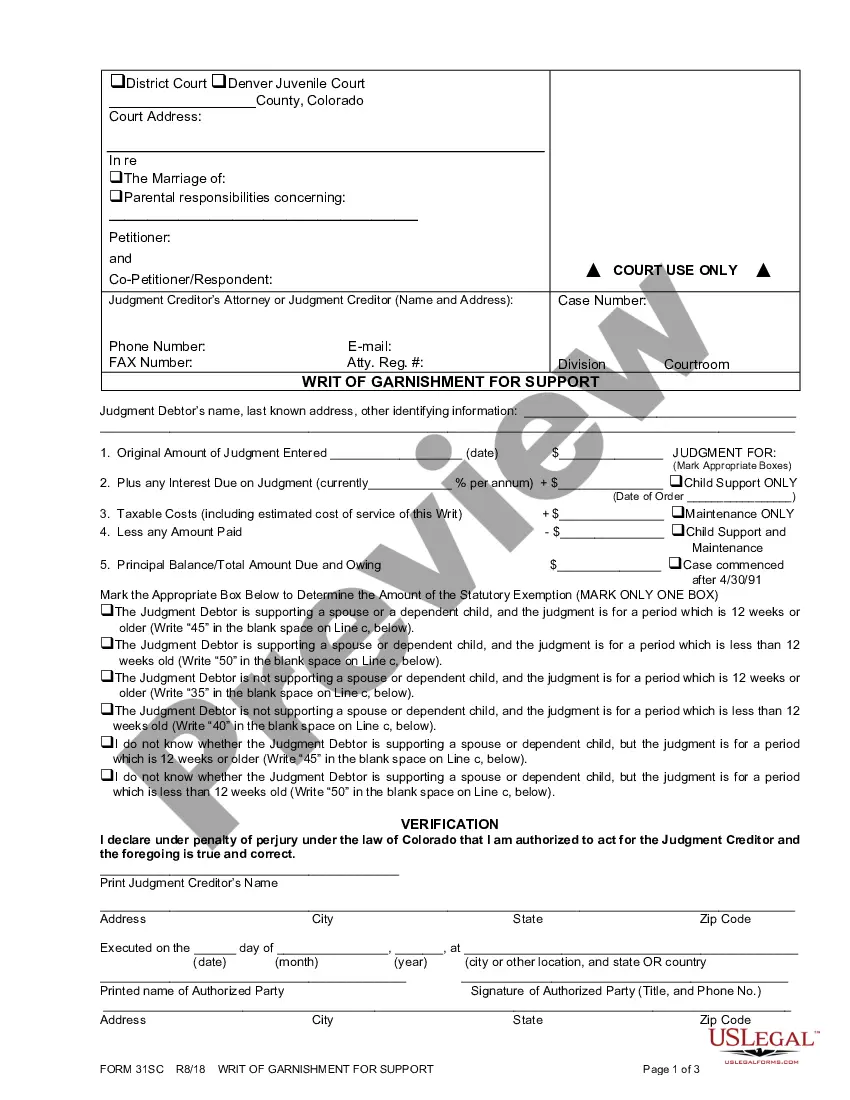

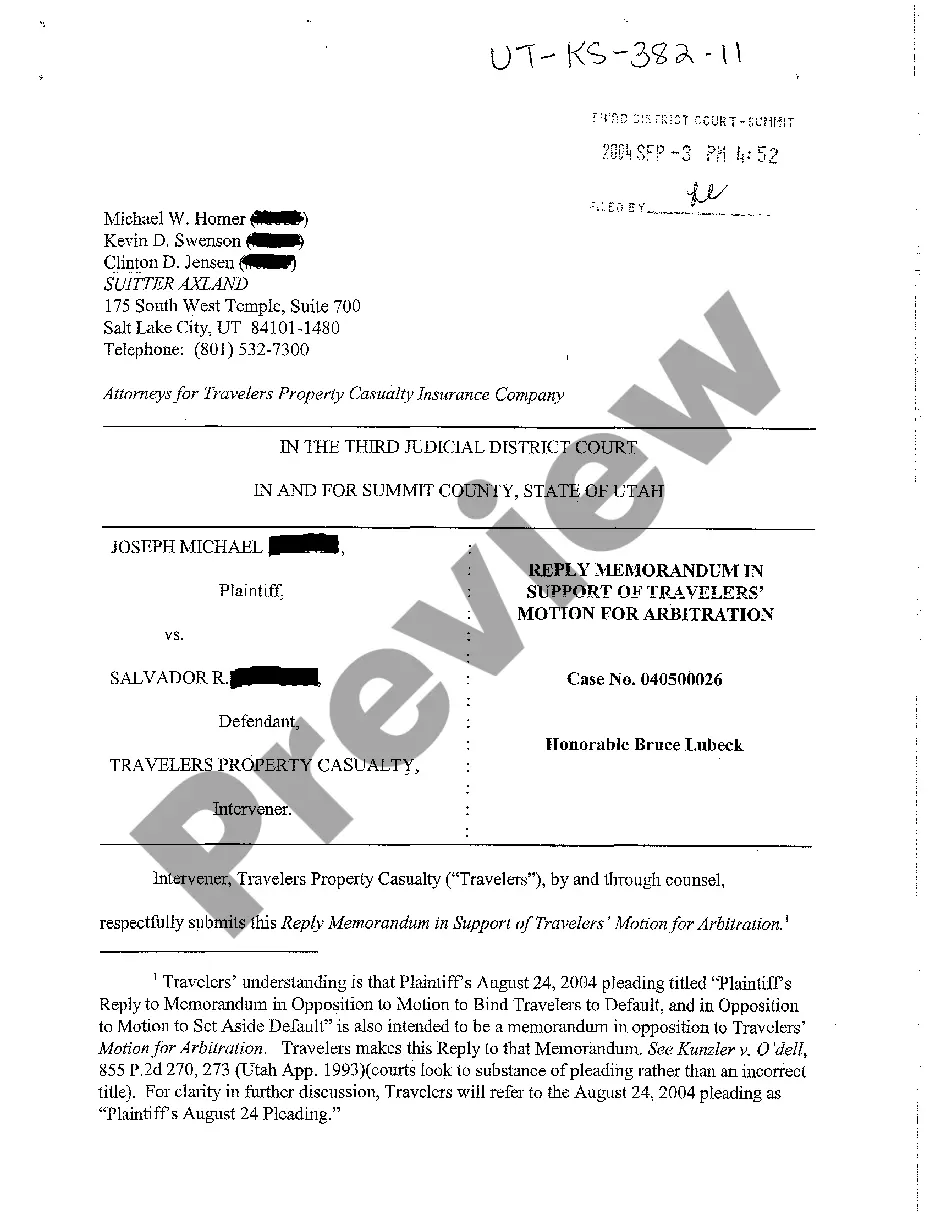

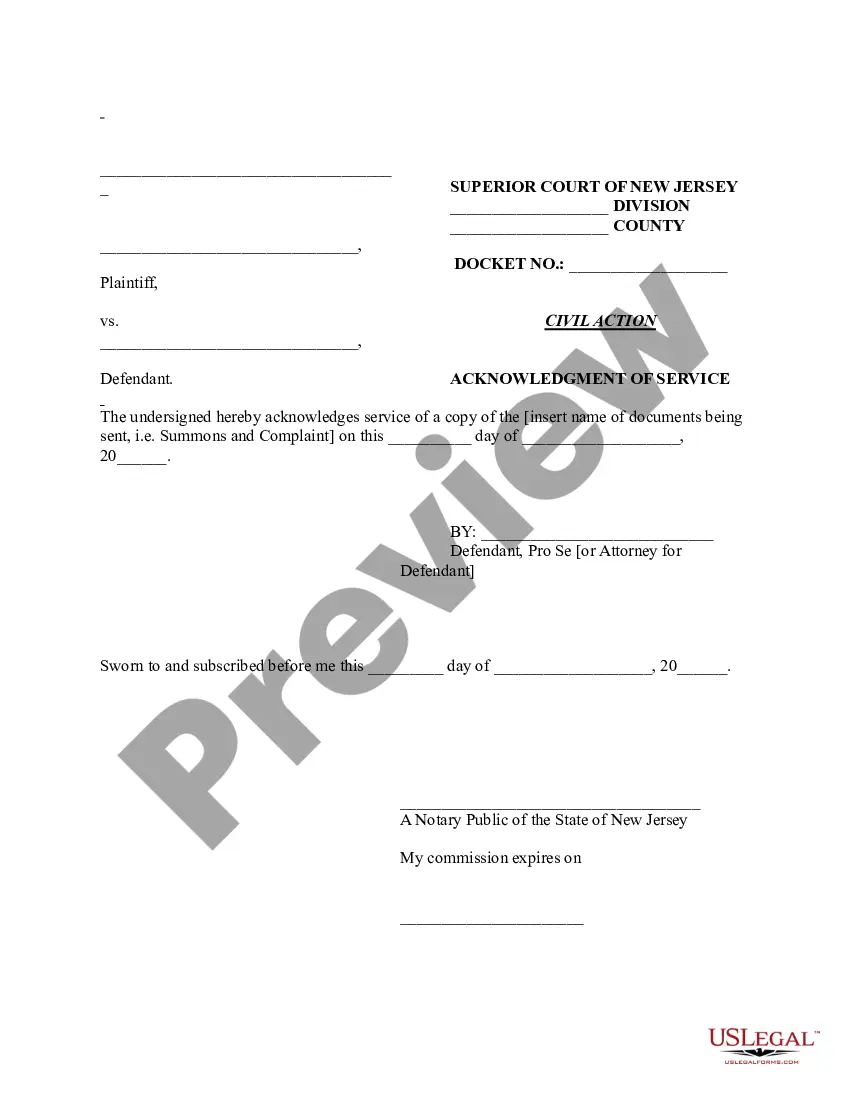

With US Legal Forms, one of the most comprehensive legal document libraries, you can discover everything from court documents to templates for internal business communication. We understand how vital compliance and adherence to federal and local regulations are. That’s why, on our platform, all templates are location-specific and current.

You can access your documents again from the My documents tab at any time. If you’re a returning customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your paperwork—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the form you require by utilizing the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to determine if Stipulation And Order Of Dismissal is what you need.

- Begin your search anew if you require a different form.

- Create a free account and choose a subscription plan to purchase the template.

- Select Buy now. Once the payment is finalized, you can download the Stipulation And Order Of Dismissal, complete it, print it, and forward or mail it to the intended individuals or entities.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be required to pay back the loan in ance with a payment schedule (unless there is a balloon payment).

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

It's important to make sure that you have a legally binding contract in place, whether you borrow or lend money. Major lenders will require you to sign an agreement before they disperse funds, but if you're setting up an agreement with friends or family, it makes sense to create your own personal loan contract.