Trust Grandchildren Form For Future

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

The Trust Grandchildren Form For Future you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Trust Grandchildren Form For Future will take you only a few simple steps:

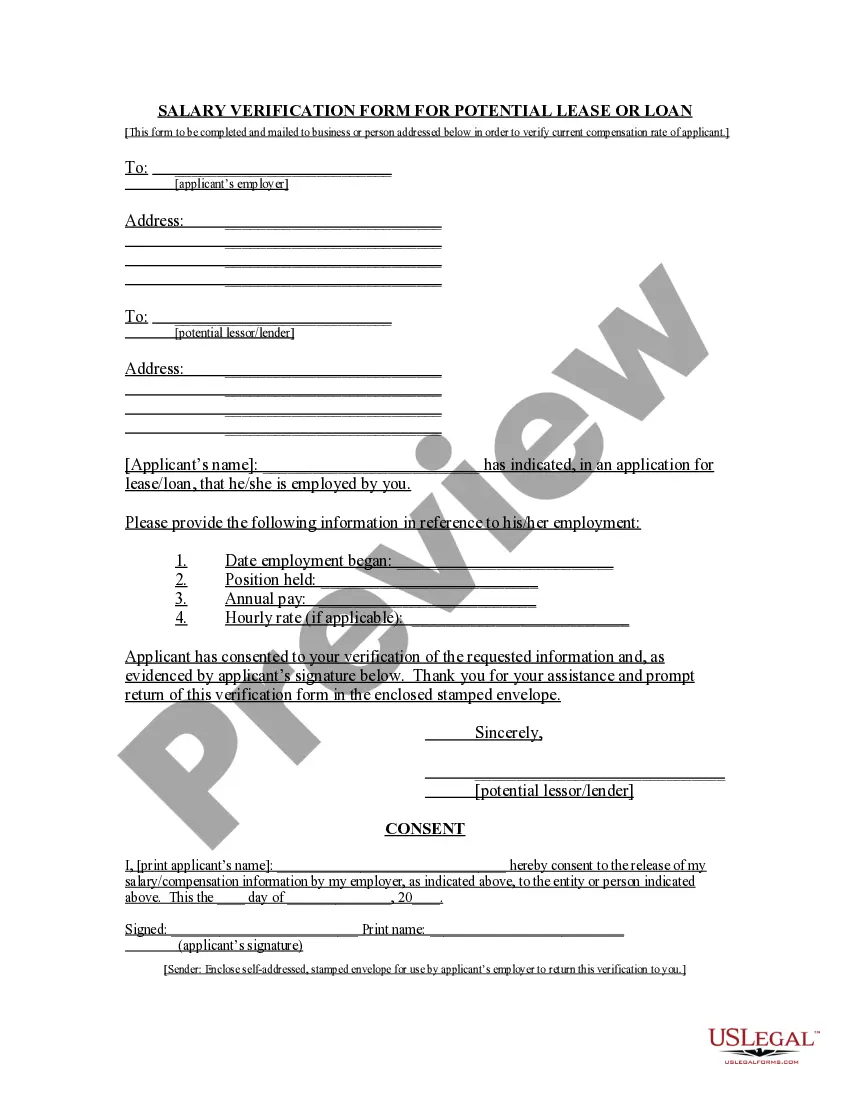

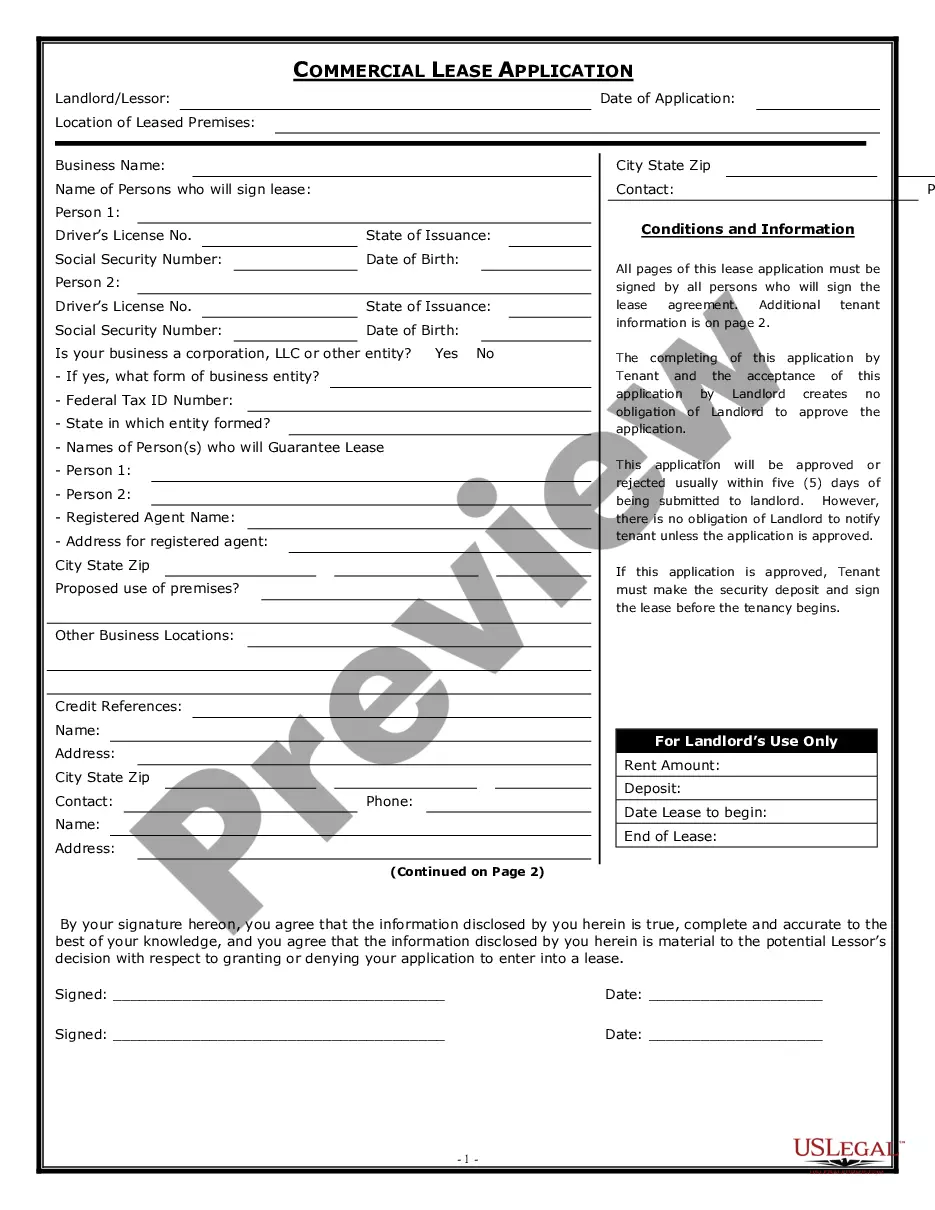

- Look for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it suits your needs. If it does not, utilize the search option to find the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Trust Grandchildren Form For Future (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your papers one more time. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Trusts can be especially beneficial for minor children, as they allow more control of the assets, even after your death. By setting up a trust, you can state how you want the money you leave to your grandchildren to be managed, the circumstances under which it can be distributed, and when it should be withheld.

?There is a risk of beneficiaries changing over time during estate planning. Grandchildren are often added to estate plans as they become available.

One way to get around this problem is to leave assets in trust for the grandchildren. When doing so, it is vital to consider an appropriate age for the child to receive the inheritance, so that they are mature enough to use it wisely. An age contingent trust such as this is normally written into the will.

Trusts can be especially beneficial for minor children, as they allow more control of the assets, even after your death. By setting up a trust, you can state how you want the money you leave to your grandchildren to be managed, the circumstances under which it can be distributed, and when it should be withheld.

Establishing a trust Since trusts for grandchildren are legal structures, you'll work with an attorney to establish them. However, you may also want to discuss wealth planning and investment options with your contacts at Wells Fargo Private Bank before you finalize your plans, Sowell says.