Trust Grandchildren File Format

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Dealing with legal documents and operations can be a lengthy addition to your day.

Rely on Trust Grandchildren File Format and similar forms which typically necessitate that you locate them and find the most efficient way to fill them out properly.

For this reason, if you are managing financial, legal, or personal issues, possessing a comprehensive and user-friendly online directory of forms at your disposal will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and various resources to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, granting you access to the forms directory and Trust Grandchildren File Format. Then, follow the steps below to fill out your form: Ensure you have located the correct form by utilizing the Preview option and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits you best. Choose Download and then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting users in managing their legal documents. Acquire the form you need today and streamline any process with ease.

- Explore the collection of suitable documents available with just one click.

- US Legal Forms offers state- and county-specific documents accessible at any time for download.

- Protect your document management processes with high-quality services that enable you to assemble any form within minutes without any additional or hidden fees.

- Simply Log In to your account, locate Trust Grandchildren File Format, and obtain it directly from the My documents section.

- You can also access forms that you have saved previously.

Form popularity

FAQ

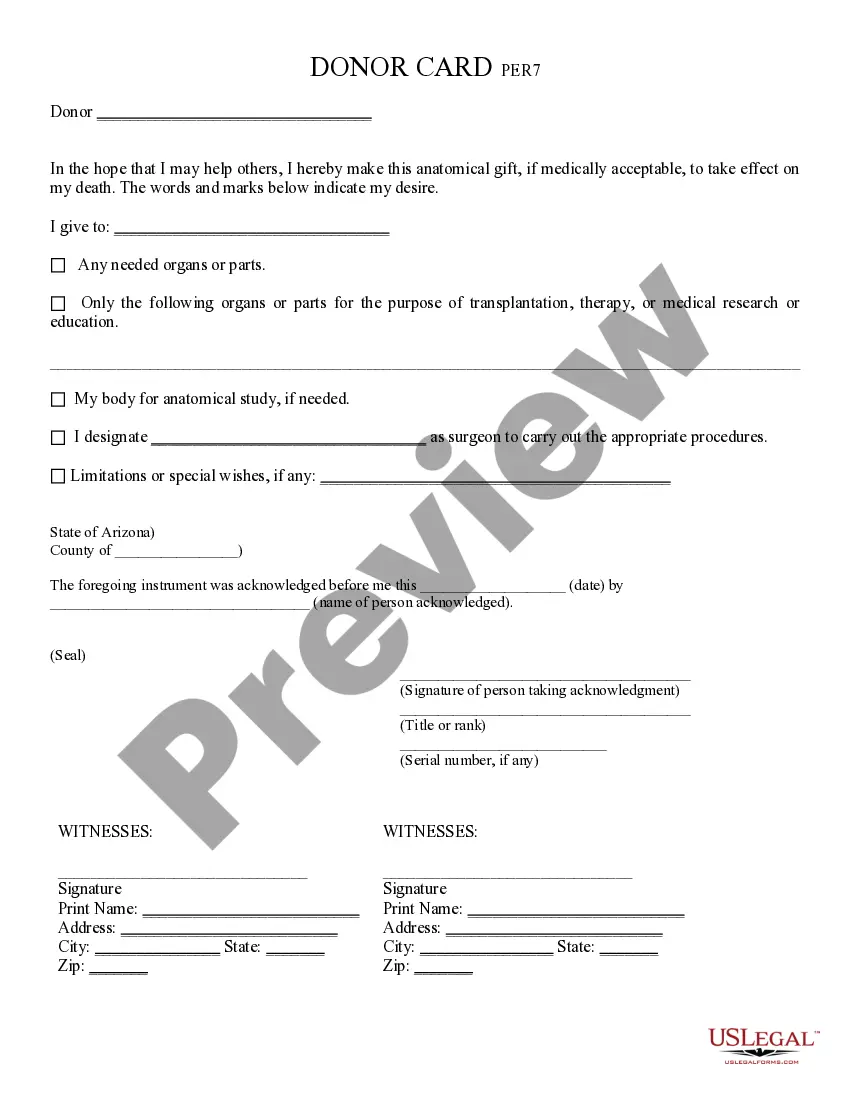

Establishing a trust Since trusts for grandchildren are legal structures, you'll work with an attorney to establish them. However, you may also want to discuss wealth planning and investment options with your contacts at Wells Fargo Private Bank before you finalize your plans, Sowell says.

A revocable living trust is an excellent estate planning tool for making gifts to grandchildren for several reasons.

Consider a lifetime trust. First, if you give your children the right to withdraw trust money, it becomes their own money and is subject to their creditors as well as their divorcing spouse. Keeping the monies in trust for the child's lifetime will provide better liability protection.

For minor grandchildren You might also want to plan to help cover the cost of college education through insurance, or to provide for grandchildren into adulthood, as well. Trusts can be especially beneficial for minor children, as they allow more control of the assets, even after your death.

How to Set Up a Trust Fund for a Child Specify the purpose of the Trust. Clarify how the Trust will be funded. Decide who will manage the Trust. Legally create the Trust and Trust Documents. Transfer assets into and fund the Trust.