Trust Agreement Irrevocable For A Trust

Description

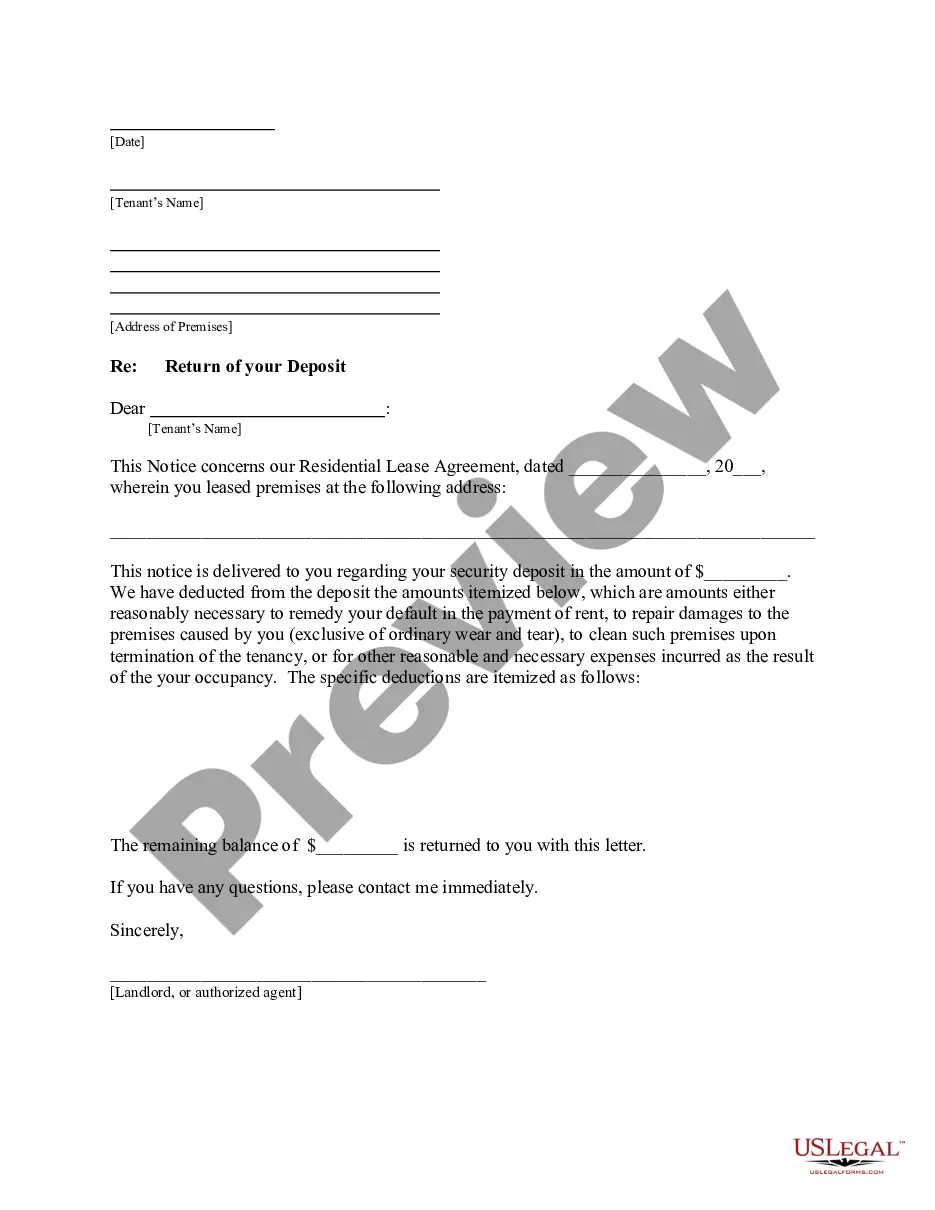

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- If you're a returning user, log in to your account and download the form by clicking the Download button. Ensure your subscription is active; renew if necessary based on your payment plan.

- For first-time users, start by reviewing the form details in Preview mode. Confirm it aligns with your jurisdiction requirements.

- If adjustments are needed, utilize the Search tab to find an alternative template that fits your criteria.

- Proceed to purchase by selecting the Buy Now button and choose your desired subscription plan; creating an account will give you access to our expansive library.

- Complete your purchase using your credit card or PayPal. This grants you access to countless legal forms.

- Finally, download your completed form. It will be available in the My Forms section of your profile for future use.

US Legal Forms stands out with an extensive collection of over 85,000 editable legal forms, ensuring that users have access to all the documents they need for various legal situations.

Take charge of your estate planning today. Start your journey with US Legal Forms to create your trust agreement irrevocable for a trust and ensure your legal needs are met.

Form popularity

FAQ

While a trust agreement irrevocable for a trust offers many benefits, it comes with drawbacks as well. One major disadvantage is the loss of control over the assets placed in the trust, as the grantor cannot alter or dissolve the trust once established. Additionally, there may be tax implications or fees associated with setting up and maintaining the trust. Understanding these factors is crucial before committing to a trust agreement, and platforms like US Legal Forms can guide you through the complexities.

An irrevocable trust agreement is a legal document that establishes a trust that cannot be modified or revoked after its creation. This type of trust transfers ownership of assets from the grantor to the trust, providing benefits like asset protection and tax advantages. For individuals seeking a secure way to manage their estate, a trust agreement irrevocable for a trust can be an effective tool. It ensures that your wishes are upheld and that the assets in the trust are safeguarded for the beneficiaries.

One major downside of an irrevocable trust is that you relinquish control over the assets placed in the trust. Once established, making changes can be very difficult, if not impossible. This underscores the importance of thoughtful planning and, ideally, using tools like uslegalforms to ensure that your trust agreement irrevocable for a trust aligns with your long-term objectives.

Filing for an irrevocable trust typically involves preparing the necessary documentation and submitting it according to your state’s guidelines. While no court filing is generally required, you should still follow local regulations concerning taxes and asset management. Platforms like uslegalforms can assist you in preparing and filing the necessary documents.

Currently, changes in laws regarding irrevocable trusts can impact taxation and how assets are treated. Staying updated on these rules helps ensure your trust remains compliant and effective. Consulting with your financial advisor or legal professional is advisable for a comprehensive understanding of these changes.

Setting up an irrevocable trust on your own is certainly possible, yet it comes with complexities. It's essential to understand the legal implications and requirements thoroughly. Using platforms like uslegalforms can guide you in drafting a trust agreement irrevocable for a trust correctly.

Yes, you can create an irrevocable trust yourself, but doing so requires careful attention to legal requirements. Utilizing reliable resources or templates can simplify the process significantly and reduce potential errors. Just keep in mind that engaging an attorney could provide additional peace of mind.

For an irrevocable trust to be valid, it must meet specific legal requirements, such as having a clear purpose and definite beneficiaries. Additionally, the trust must have been properly executed, including necessary signatures and witnesses. Consulting resources like uslegalforms can help ensure your trust agreement irrevocable for a trust is legally sound.

To write an irrevocable trust document, start by identifying the beneficiaries and detailing the terms of the trust. Clarify how the assets will be managed and distributed over time. Utilizing a trusted platform like uslegalforms can simplify this process, providing templates and guidance tailored to create a compliant trust agreement irrevocable for a trust.

Generally, an irrevocable trust does not require court approval or filing to be effective. However, depending on your state laws, some trusts might need to be registered or reported for tax purposes. It's wise to consult with a legal expert to navigate these requirements accurately.