Irrevocable Trust Trustors With Trust

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Obtaining legal templates that comply with federal and local regulations is essential, and the internet provides a variety of choices to select from.

However, what is the purpose of spending time searching for the correct Irrevocable Trust Trustors With Trust example online if the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates crafted by attorneys for any business and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our specialists keep up with legal updates, ensuring your documents remain current and compliant when acquiring an Irrevocable Trust Trustors With Trust from our platform.

All templates you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, visit the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring an Irrevocable Trust Trustors With Trust is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your preferred format.

- If you are a newcomer to our site, follow the steps below.

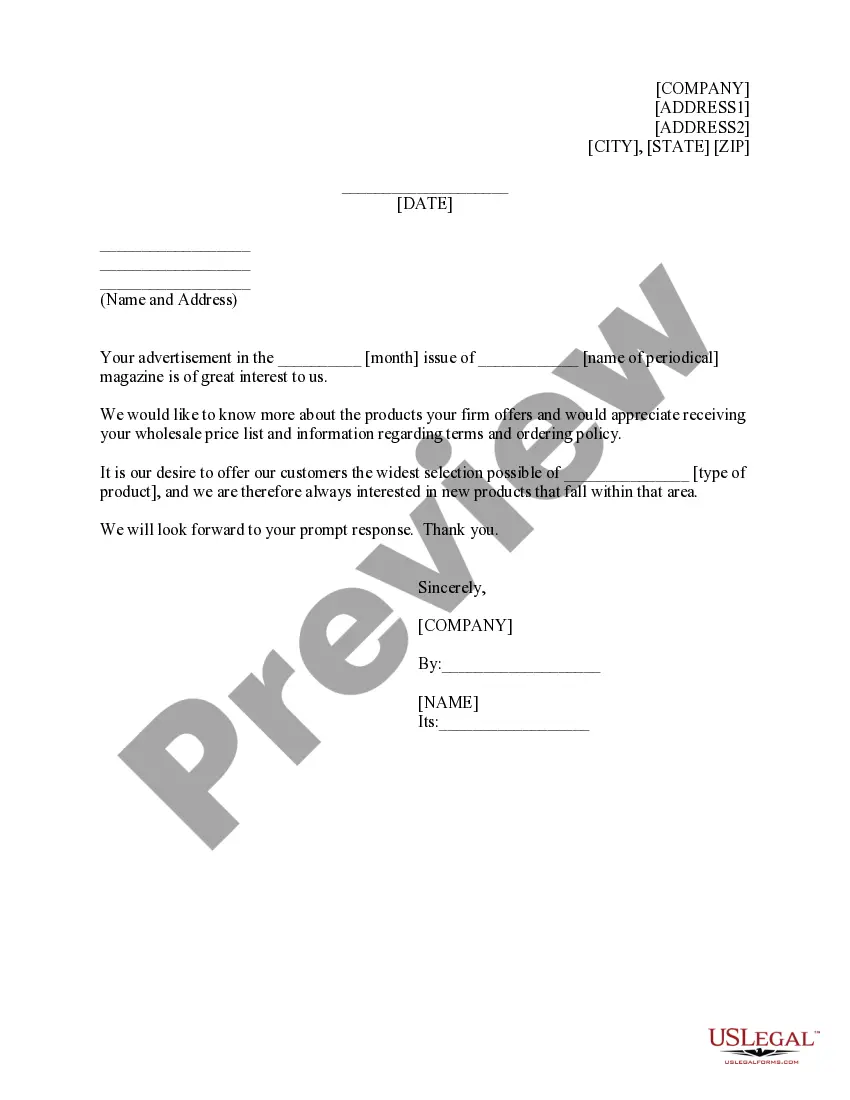

- Preview the template using the Preview function or via the text outline to confirm it fulfills your requirements.

- Utilize the search tool at the top of the page to find an additional sample if needed.

- Click Buy Now once you discover the appropriate form and choose a subscription plan.

- Create an account or Log In and process the payment using PayPal or a credit card.

- Select the desired format for your Irrevocable Trust Trustors With Trust and download it.

Form popularity

FAQ

Fraudulent Use of Identity ? First offense is punished by $5,000 fine and 5 years in prison at most, a second or subsequent offense is not more than $10,000 fine and 10 years prison. Defendants may also need to pay their victims restitution also.

An Identity Theft Report, or Identity Theft Affidavit, is an individual's official statement reporting fraud and/or identity theft to law enforcement. It's generally all you need to get your complaint on record and the ball rolling toward a solution.

Credit Card Offers, Bank Statements, Canceled Checks, and More Documents Containing Financial Information. An identity thief could potentially use anything that comes from a financial institution. ... Documents Containing Personal Information. ... Documents Containing Account Information. ... Junk Mail. ... Child- and School-Related Mail.

Identity theft happens when someone uses information about you without your permission. They could use your: name and address. credit card or bank account numbers.

Identity theft or identity fraud generally involves "stealing" another person's personal identifying information--such as Social Security Number (SSN), date of birth, and mother's maiden name--and then using the information to fraudulently establish credit, run up debt, or take away existing financial accounts.

If you're not sure of the victim's identity, the FCRA allows you to ask for proof of identity, such as a copy of a government-issued identification. You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report.

When a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a Form 14039, Identity Theft AffidavitPDF, to the IRS.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.