Benifit Trust

Description

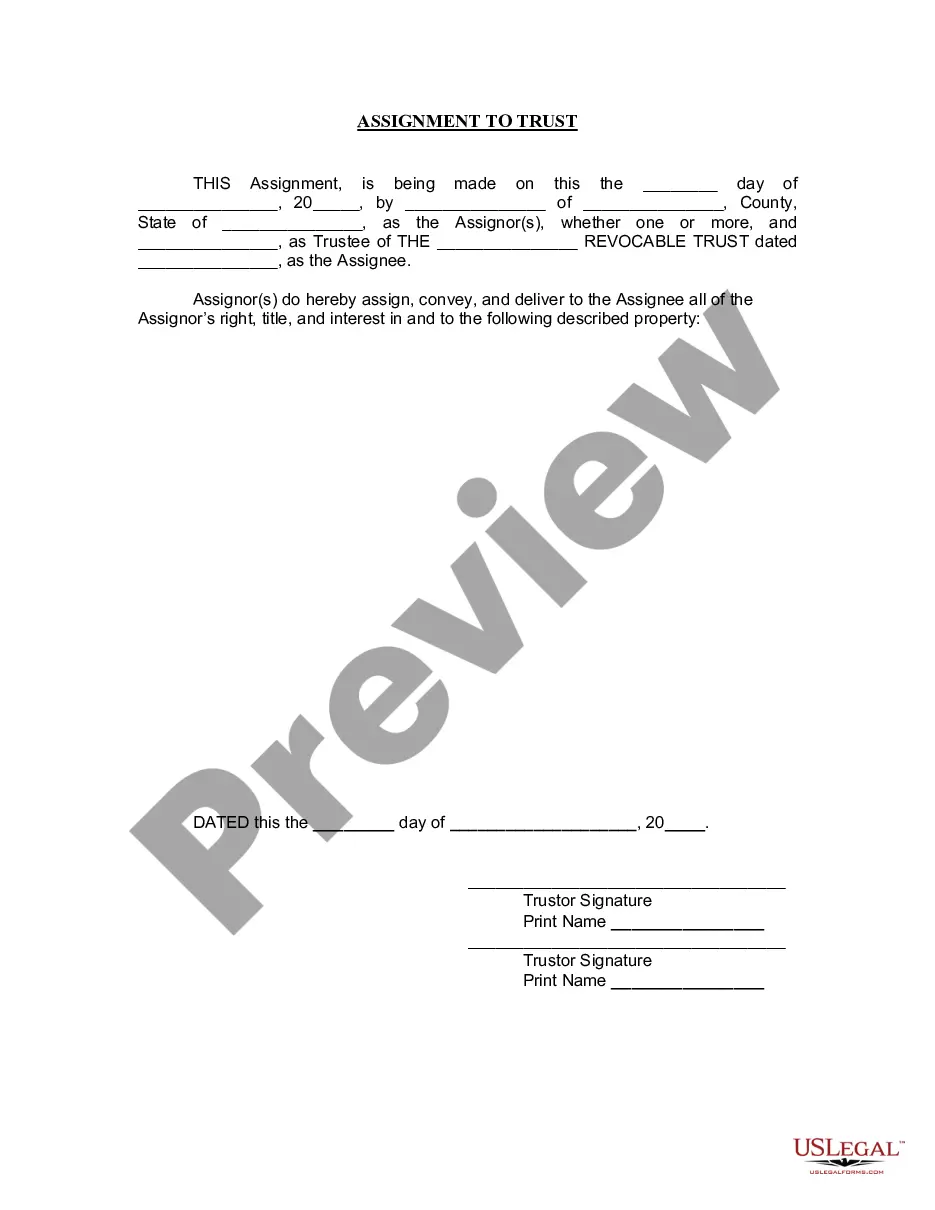

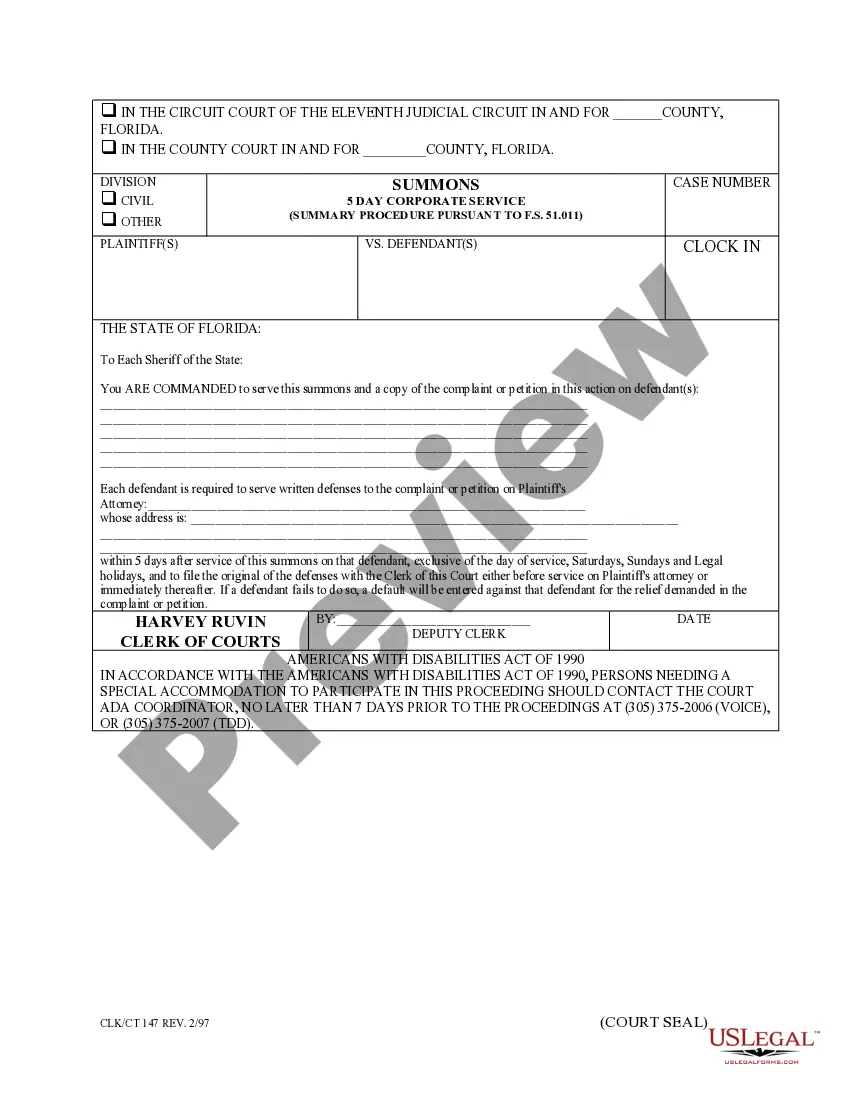

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- Log in to your account if you’re a returning user to download your required form template. Confirm that your subscription is active. If not, renew it based on your chosen payment plan.

- For new users, start by previewing the form you need to ensure it meets your specific requirements and adheres to local jurisdiction guidelines.

- If the selected form does not meet your expectations, utilize the Search tab to find an alternative template that suits your needs better.

- Once you find the right document, click on the Buy Now button to choose your preferred subscription plan. You’ll need to create an account to gain full access to the resources available.

- Complete your purchase by providing your payment information through credit card or PayPal.

- After purchase, download your form directly to your device. You can access it anytime through the My Forms menu in your profile.

Accessing US Legal Forms is your first step toward simplifying the process of obtaining legal documents. With its vast selection and expert assistance, you're in good hands to ensure your documents are accurate and legally compliant.

Don't wait any longer—join US Legal Forms today and unlock the full benefits of reliable legal document preparation.

Form popularity

FAQ

The main difference between a 401k and a defined benefit plan lies in the structure of benefits. A 401k is a defined contribution plan where employees contribute a portion of their salary, while employers may match those contributions. On the other hand, a defined benefit plan promises specific benefits at retirement, regardless of contributions made. Understanding these differences helps employees choose the best option for their financial future, and employing a benefit trust can enhance associated advantages.

A defined benefit trust is a specific type of trust that guarantees a predetermined payout in retirement based on a formula, typically related to salary and service time. This trust structure helps ensure that employees have a reliable income post-retirement. It serves a crucial role in fostering long-term employee loyalty by demonstrating a commitment to their future.

The primary purpose of the employee trust fund is to provide financial benefits and support to employees during and after their employment. These funds help manage retirement savings, health benefits, and other financial resources securely. A robust benefit trust structure can greatly enhance employees' confidence in their benefits package.

An example of a defined benefit would be a traditional pension plan, which promises a specified monthly payment upon retirement based on salary history and years of service. This arrangement ensures predictable retirement income for employees. Utilizing a benefit trust can help secure these types of financial commitments to employees.

The EOT 5% rule refers to a requirement in Employee Ownership Trusts that allows employees to receive a minimum of 5% of profits distributed before taxation. This rule incentivizes employee engagement and ownership in a company. A well-structured benefit trust takes into account such regulations, leading to improved employee satisfaction and trust.

Employee trusts function by holding and managing assets intended for employee benefits. These assets are allocated according to the terms of the trust, ensuring that employees receive their entitled benefits. By creating a benefit trust, businesses can enhance employee confidence in their benefits package and uphold their commitment to workforce welfare.

A benefits trust is a structure designed to hold assets for various employee benefits, including retirement plans and insurance. It separates these funds from the company’s assets, protecting employee benefits even in financial instability. Establishing a benefit trust is vital for ensuring that employees receive the support they need without compromise.

The employee benefit trust is a trust set up to manage and distribute benefits to employees. It acts as a vehicle for providing retirement, health, and other benefits securely. By leveraging a benefit trust, companies can ensure consistent support for their workforce while safeguarding employee interests.

A trust for employee benefit is a legal arrangement that holds assets intended for employee welfare, such as retirement funds or health benefits. This structure ensures that funds are managed for the sole purpose of benefiting employees. Utilizing a benefit trust helps in providing financial security and stability for employees, aligning with their long-term interest.

One disadvantage of a defined benefit plan is its complexity. These plans often involve intricate calculations for pension payouts, which can be confusing for employees. Additionally, they may require significant funding from employers, making them less financially viable in the long run. Understanding the parameters of a benefit trust can provide insights into these challenges.