Complaint Mechanics Lien Without Contract

Description

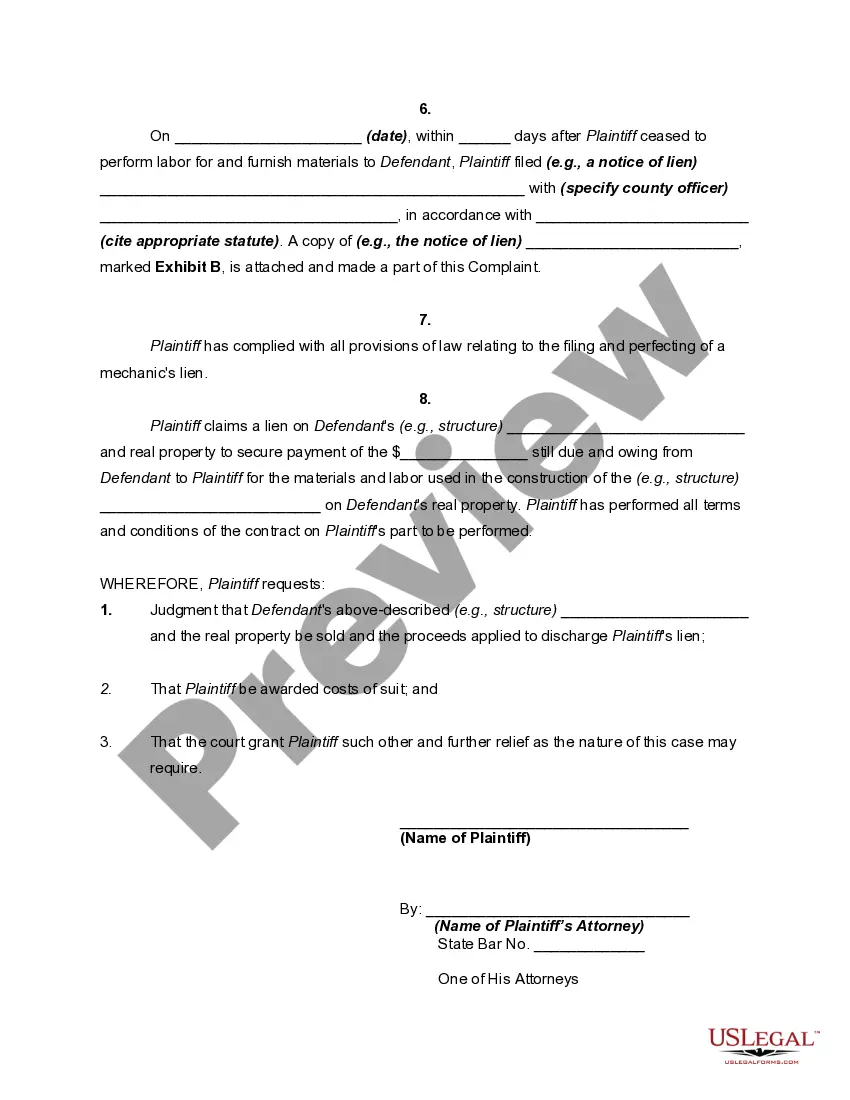

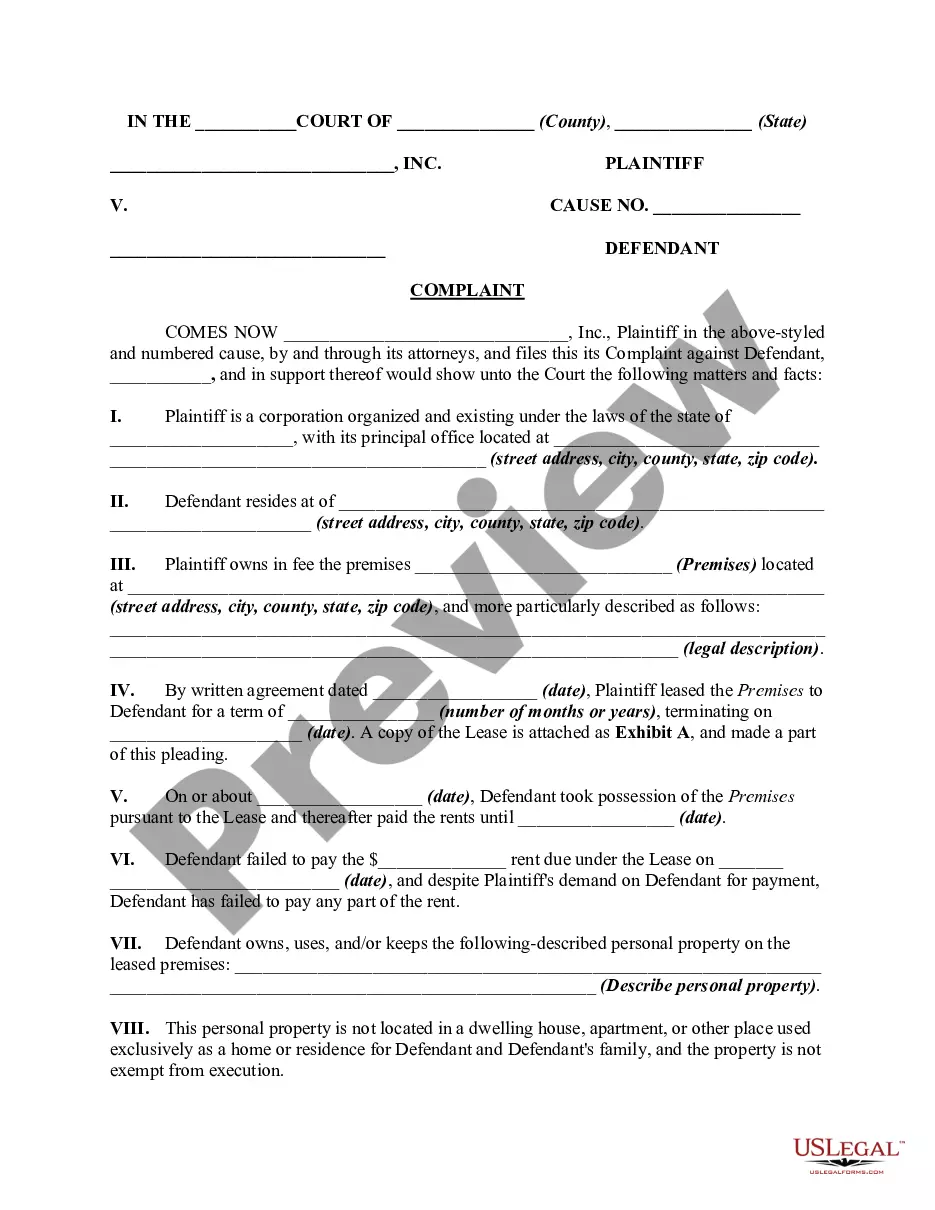

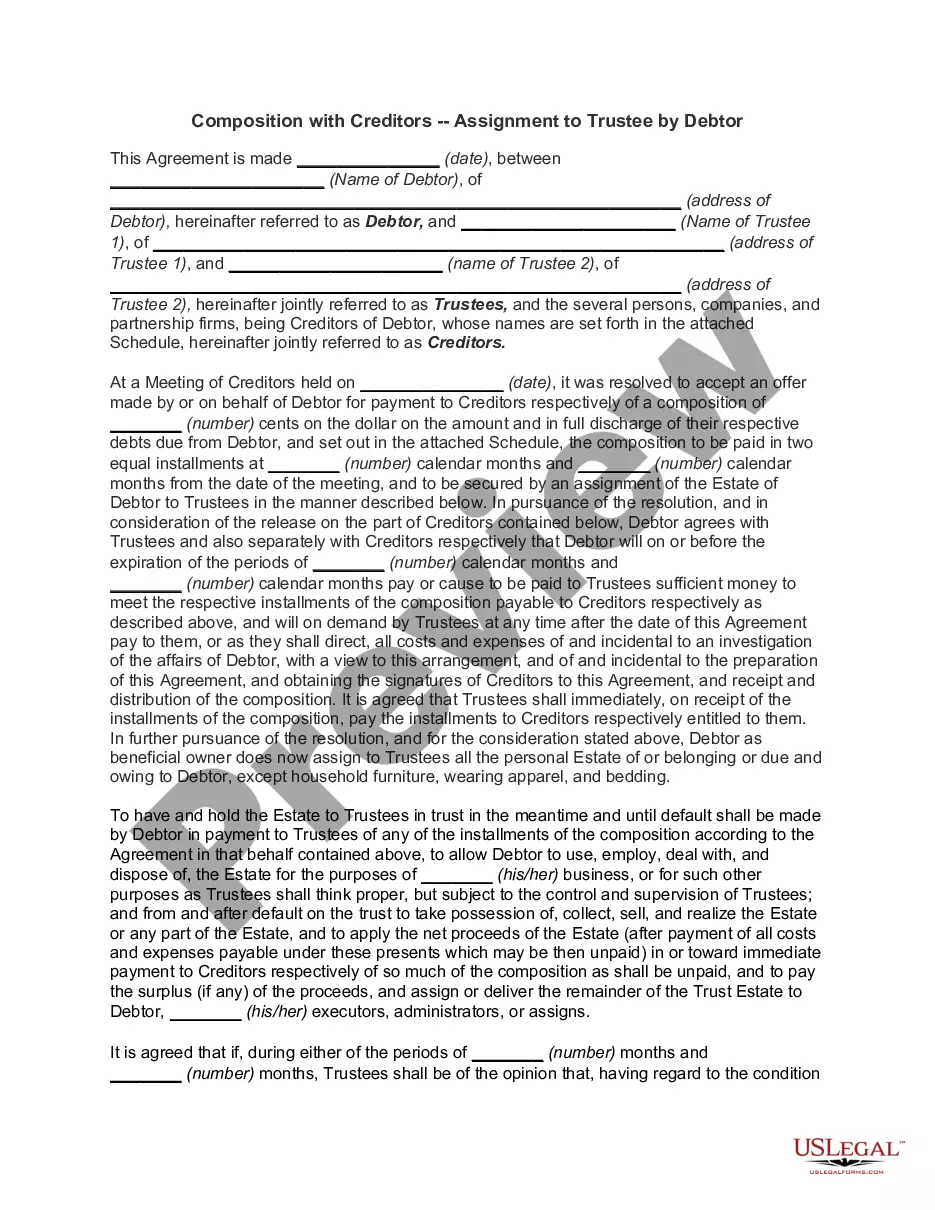

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

Whether for commercial reasons or personal issues, everybody must confront legal circumstances at some stage in their life.

Filling out legal documents requires careful consideration, starting with selecting the correct form template.

Select the desired file format and download the Complaint Mechanics Lien Without Contract. After it is saved, you can fill out the form using editing software or print it to complete it by hand. With a vast catalog from US Legal Forms available, you do not need to waste time searching the web for the right template. Use the library’s easy navigation to find the correct template for any circumstance.

- For example, if you choose an incorrect version of the Complaint Mechanics Lien Without Contract, it will be denied when you submit it.

- Thus, it is essential to have a trustworthy source for legal documents like US Legal Forms.

- If you need to acquire a Complaint Mechanics Lien Without Contract template, follow these straightforward steps.

- Retrieve the template you require using the search bar or catalog browsing.

- Review the form’s details to ensure it corresponds with your circumstances, state, and county.

- Click on the form’s preview to take a look at it.

- If it’s the wrong form, return to the search feature to locate the Complaint Mechanics Lien Without Contract template you require.

- Download the file once it fulfills your needs.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

Form popularity

FAQ

The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.

Federal courts The federal district court in Montana is the United States District Court for the District of Montana. Appeals from this court goes to the U.S. Court of Appeals for the 9th Circuit.

The Individual Income Tax Rebate is a result of the legislature passing House Bill 192 during the 2023 Montana Legislative Session, which set aside $480 million of the surplus to provide income tax rebates. Gov. Greg Gianforte signed HB 192 into law on March 13.

Criminal court records may be preserved in physical or electronic form. In compliance with Montana laws, Montana criminal court records fall under the umbrella of public records and may be viewed or inspected by members of the public, except where prevented by law or court order.

You can search court records in person at the county courthouse where the case was tried. You can also request copies of court records by mail, fax, or email if applicable. To find courts in your area, visit the Court Locator of the Montana Court System website.

We will begin issuing Individual Income Tax Rebates in July 2023. Individual Income Tax Rebates will be issued in the order that a 2021 tax return was filed. All Individual Income Tax Rebates will be issued by December 31, 2023.

Public Access to Court Electronic Records (PACER) You can contact the PACER Service Center at .pacer.uscourts.gov for registration information about obtaining a PACER account. The PACER Locator has the ability to search across multiple court units.

Public records available through the Montana District Court Public Access Portal and the Montana Courts of Limited Jurisdiction Public Access Portal.