Partial Release Mortgage Form

Description

How to fill out Partial Release Or Satisfaction Of Mortgage By A Corporation?

Administration requires exactness and correctness.

Unless you engage in completing paperwork like Partial Release Mortgage Form daily, it can lead to some bewilderment.

Selecting the appropriate example from the outset will guarantee that your document submission will proceed without issues and avert any troubles of having to re-submit a document or perform the same task entirely from the beginning.

Finding the correct and current examples for your paperwork is just a few minutes away with an account at US Legal Forms. Eliminate the bureaucratic worries and enhance your efficiency when working with forms.

- Locate the template using the search feature.

- Confirm that the Partial Release Mortgage Form you’ve discovered is suitable for your state or locality.

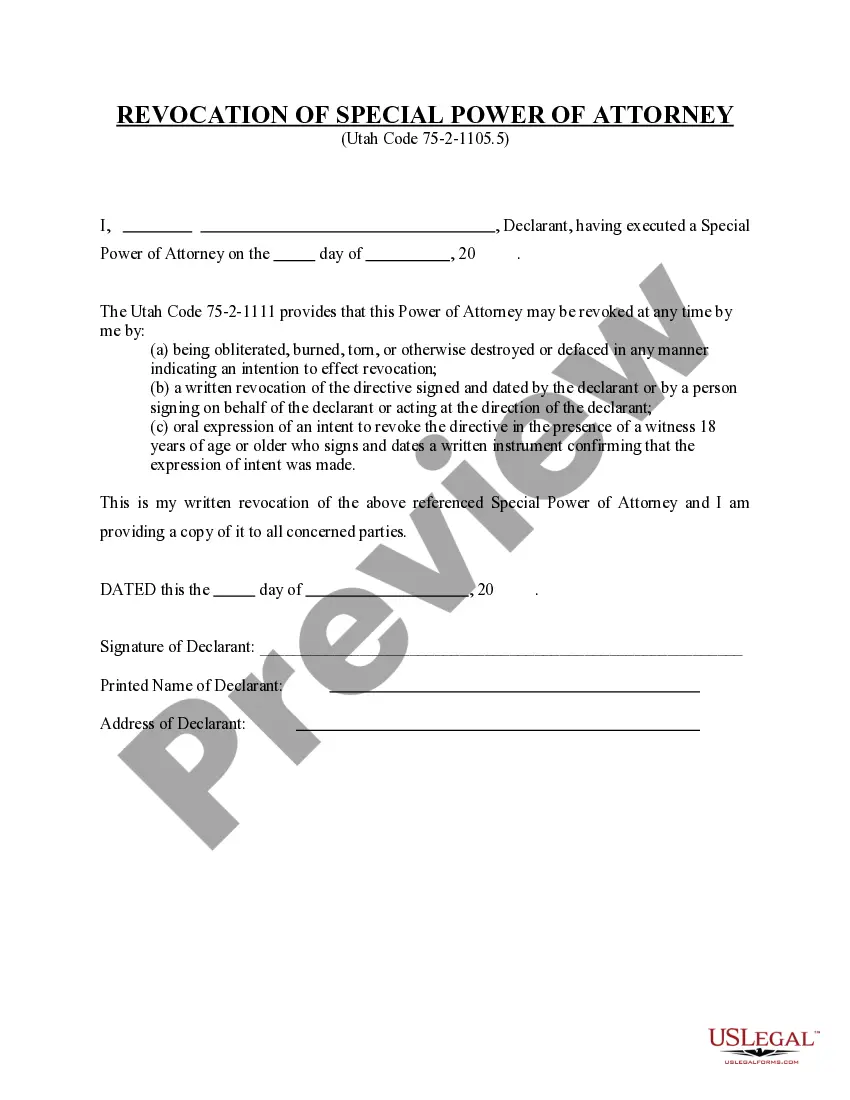

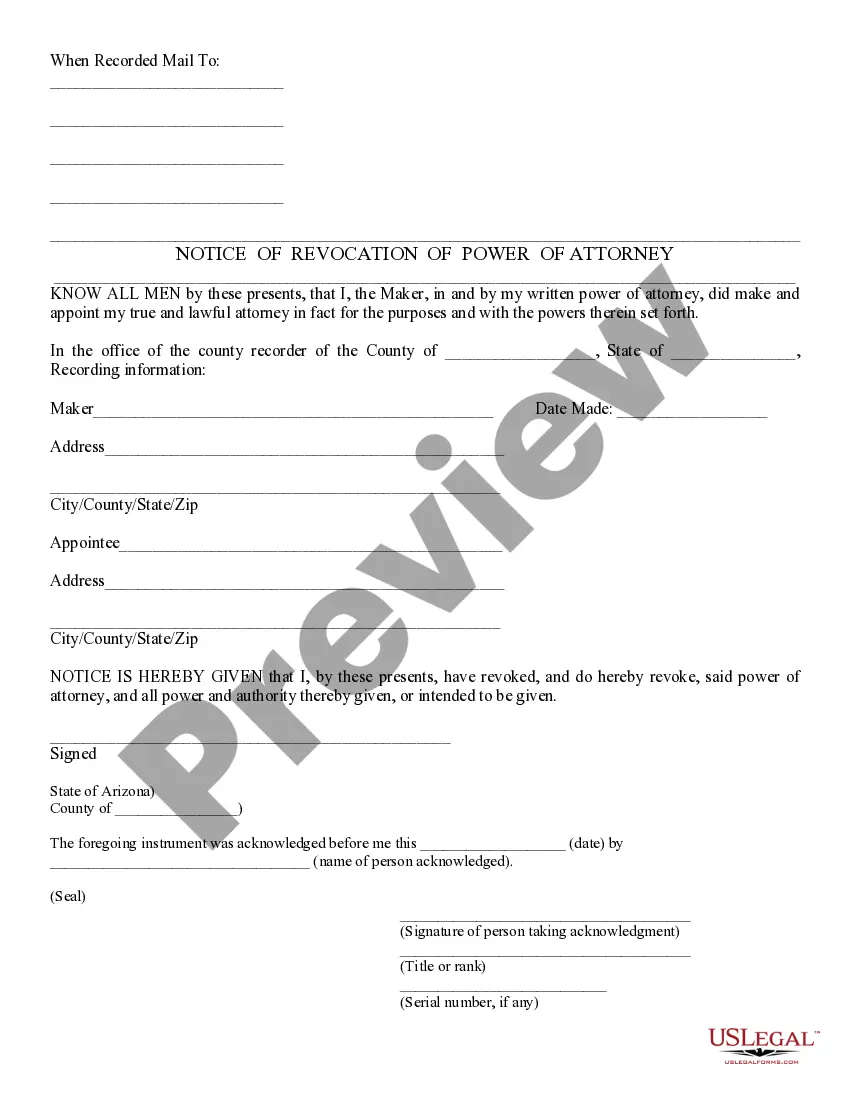

- Review the preview or read the description which includes the details regarding the use of the template.

- If the outcome matches your query, click the Buy Now button.

- Choose the suitable option among the suggested pricing plans.

- Log In to your existing account or create a new one.

- Finalize the transaction utilizing a credit card or PayPal payment method.

- Download the template in the file format you prefer.

Form popularity

FAQ

When a partial release of mortgage is granted, specific sections of the property in question will be removed from the collateral backing the debt. This can be particularly useful in scenarios where a borrower is attempting to sell a portion of their property still covered by the mortgage.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.

Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release. Borrowers may need to pay fees to the lender and to the county recorder's office. A mortgagor may request a partial release when they wish to sell a portion of the land on their property.

Requirements for a Partial Release of a MortgageYou've had the mortgage for at least 12 months, in most cases. Your mortgage is current, meaning your account has not been more than 30 days past due within the last 12 months. No borrower can be released from their liability of the loan as part of the transaction.