Hsbc Mortgage For Extension

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

- Log in to your US Legal Forms account if you're a returning user, ensuring your subscription is active. If not, renew your plan first.

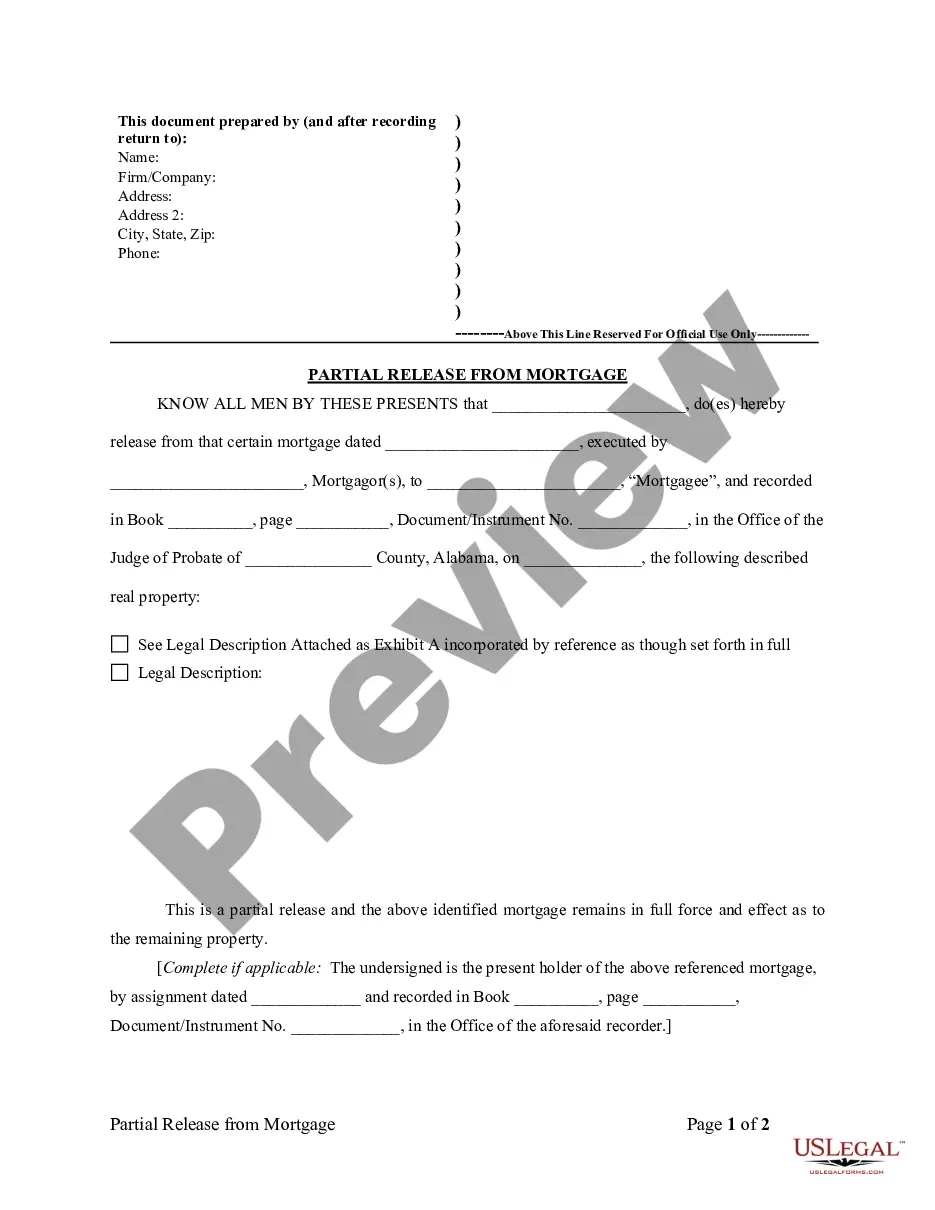

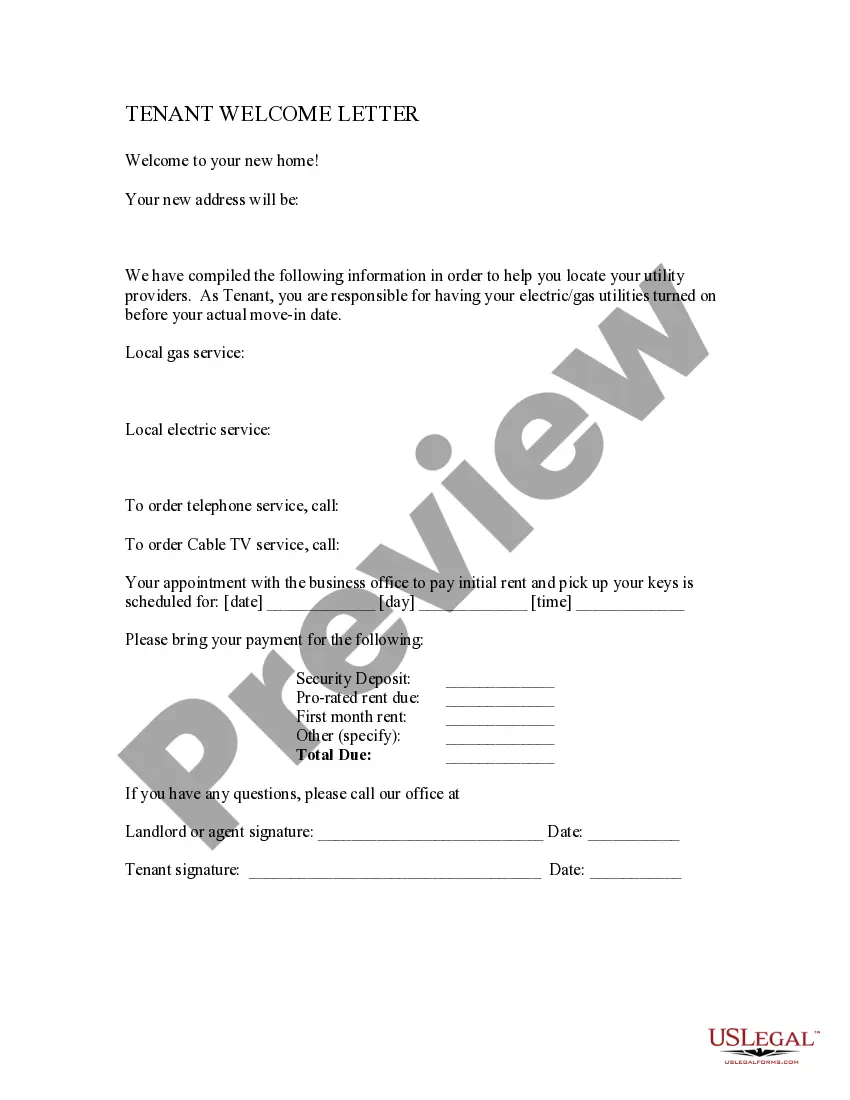

- Explore the Preview mode to review the document details. Verify that the selected form aligns with your requirements and meets local jurisdiction standards.

- If needed, search for alternate templates using the available Search tab to ensure you have the right document.

- Once satisfied, click on the Buy Now button and select a suitable subscription plan to continue.

- Input your payment details via credit card or PayPal to complete your purchase.

- Finally, download the completed form to your device and access it anytime through My Forms in your account.

By utilizing US Legal Forms, you empower yourself with a robust library of over 85,000 legal templates designed for easy completion. With expert support available, you can be sure your documents are precise and legally compliant.

Get started today and streamline your home extension process with Hsbc mortgage and US Legal Forms. Access the resources you need for a smooth experience!

Form popularity

FAQ

Yes, you can extend your mortgage through an HSBC mortgage for extension option. This process allows you to increase your borrowing amount or adjust your terms to better suit your current financial situation. It's essential to evaluate your needs and consult with HSBC or a financial advisor for clarification on the extension process. Additionally, platforms like USLegalForms can help you navigate the necessary paperwork efficiently.

An HSBC mortgage for extension typically lasts for six months from the offer date. During this time, you can finalize your mortgage details and confirm your application. It is important to complete the necessary processes within this timeframe to secure the terms mentioned in your offer. If you require more time, you may need to request a new assessment.

HSBC does offer mortgage extensions under specific circumstances. They evaluate each request based on your current financial situation and overall creditworthiness. It is important to reach out to HSBC directly to explore the options available to you. For additional support, you might find useful legal insights on US Legal Forms when considering your HSBC mortgage for extension.

Yes, it is possible to get extensions on mortgage offers, including those from HSBC. The process might involve submitting new documentation and discussing your financial situation with the bank. Each case is unique, so it’s important to consult with HSBC for tailored advice. You can also enhance your understanding of the process by utilizing US Legal Forms for relevant resources regarding HSBC mortgage for extension.

You may have the option to get an extension on your mortgage payment with HSBC. Often, this involves discussing your financial situation and any temporary difficulties you face. HSBC will consider your eligibility based on its policies and your current mortgage status. For more guidance, exploring resources on the US Legal Forms platform might help clarify your options around HSBC mortgage for extension.

Yes, HSBC can extend a mortgage offer under certain conditions. This usually requires you to demonstrate a continued ability to meet the mortgage payments. It is advisable to speak directly with an HSBC representative to discuss your specific circumstances. Understanding your options can help you make an informed decision about your HSBC mortgage for extension.

Yes, you can extend your mortgage term at HSBC, allowing for a more manageable repayment structure. This option can be particularly useful if you're looking to lower your monthly payments. Reach out to HSBC to learn about your options and how they can assist you in achieving a favorable mortgage term extension. Their advisors are there to help you every step of the way.

To extend your mortgage, you should begin by contacting your lender, like HSBC. They will guide you through the necessary steps to adjust your mortgage term. You may need to provide updated financial information and documentation. Additionally, platforms like USLegalForms can assist in ensuring you have the right paperwork to facilitate the process smoothly.

Yes, you can extend the term of your mortgage at HSBC. They provide various options that might suit your financial needs. By extending the term, you can reduce your monthly payments, making home ownership more affordable. It’s a good idea to explore your options with HSBC to find the best fit for you.