How Do I Write A Mortgage Agreement

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active by checking your account status.

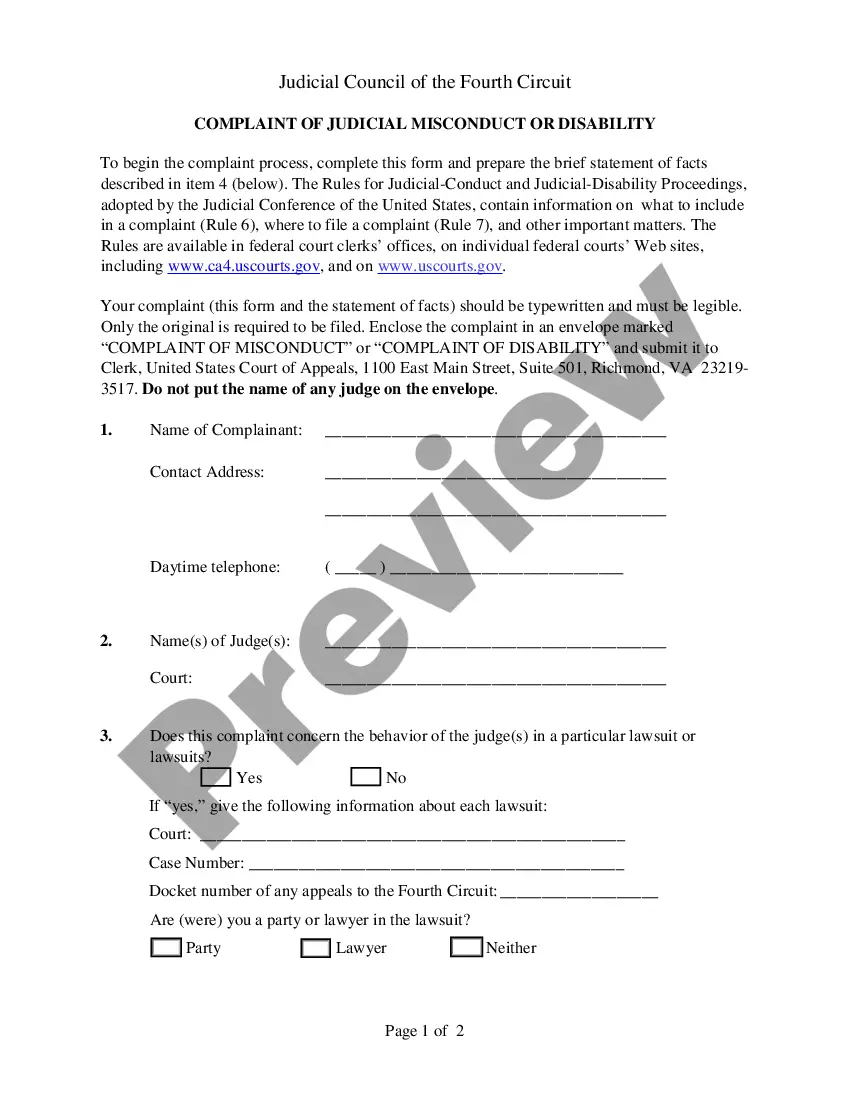

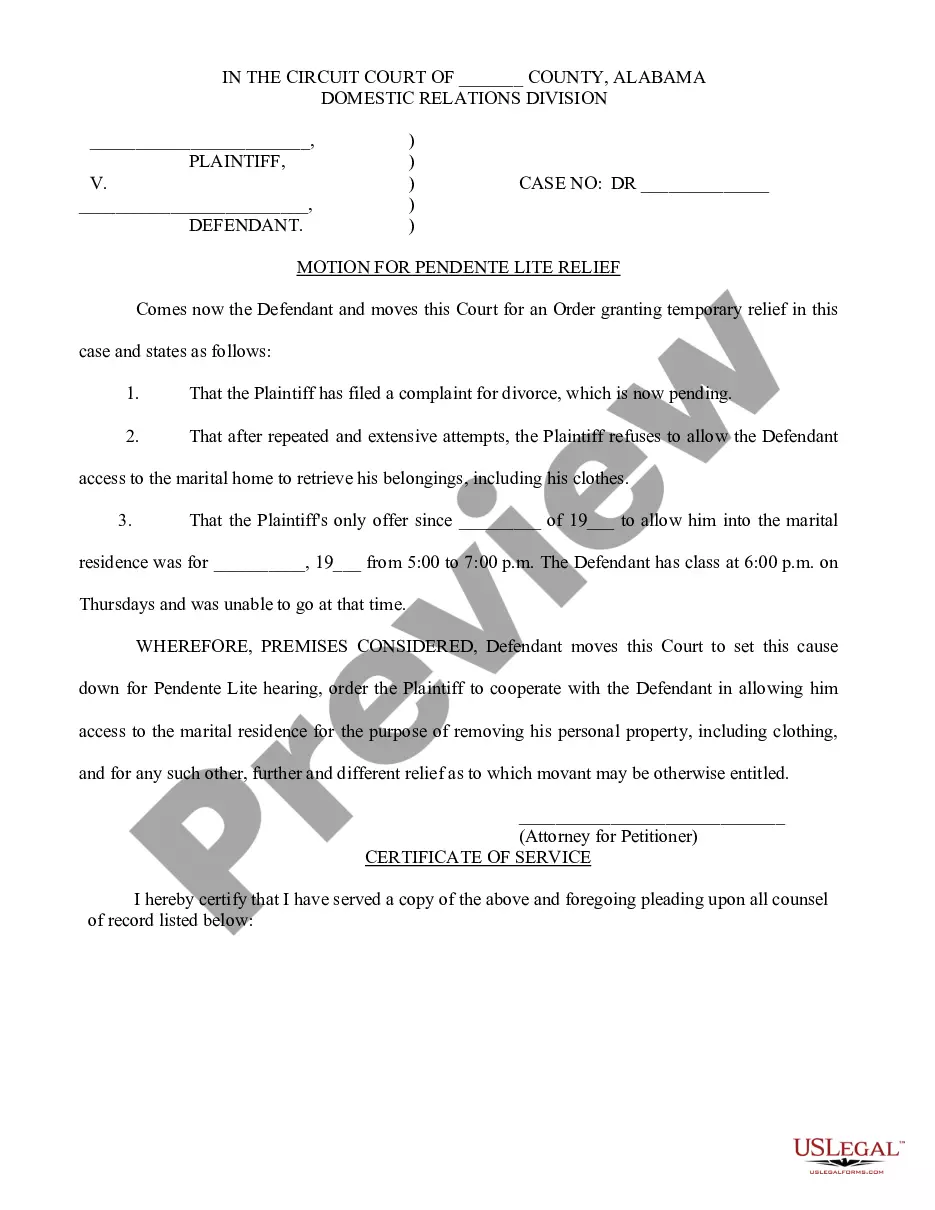

- If you're new to the service, start by previewing the available mortgage agreement templates. Make sure to review the form description carefully to find the one that meets your jurisdiction's requirements.

- In case you don't find the right template, use the Search tab to locate additional options that align with your needs.

- Once you have selected the appropriate form, click the 'Buy Now' button and pick a subscription plan that works for you. You'll need to create an account for full access.

- Proceed to enter your payment details, either through a credit card or PayPal, to complete your purchase.

- After the payment is confirmed, download the form to your device. You can revisit this document anytime via your 'My Forms' section in your profile.

By using US Legal Forms, you can be confident that you are equipped with more legal templates than competitors at a similar cost. With over 85,000 easy-to-fill forms and the option to consult premium experts, you can ensure your mortgage agreement is crafted correctly.

Start crafting your mortgage agreement today with US Legal Forms and simplify your legal document needs!

Form popularity

FAQ

Filling out a mortgage form involves providing necessary personal and financial information, such as your income, employment history, and credit details. Be sure to read each section carefully and gather all required documents to support your application. If you find it challenging, consider consulting online platforms like USLegalForms, which can guide you through the process. Understanding how do I write a mortgage agreement will also enable you to complete these forms accurately.

To obtain a copy of your mortgage note, you can start by contacting your lender or mortgage servicer. They maintain records of your mortgage documents and can provide you with a copy upon request. If the lender has sold your mortgage, you may need to contact the new servicer. Understanding how do I write a mortgage agreement will help you appreciate the importance of keeping copies of all related documents.

You can obtain a mortgage agreement from several sources, such as banks, credit unions, or online legal services. For those wondering, 'How do I write a mortgage agreement,' online platforms like USLegalForms offer customizable templates that simplify this task. By using these resources, you can access legally sound documents that match your specific needs. Just select the format you prefer, fill in your details, and you'll be ready to go.

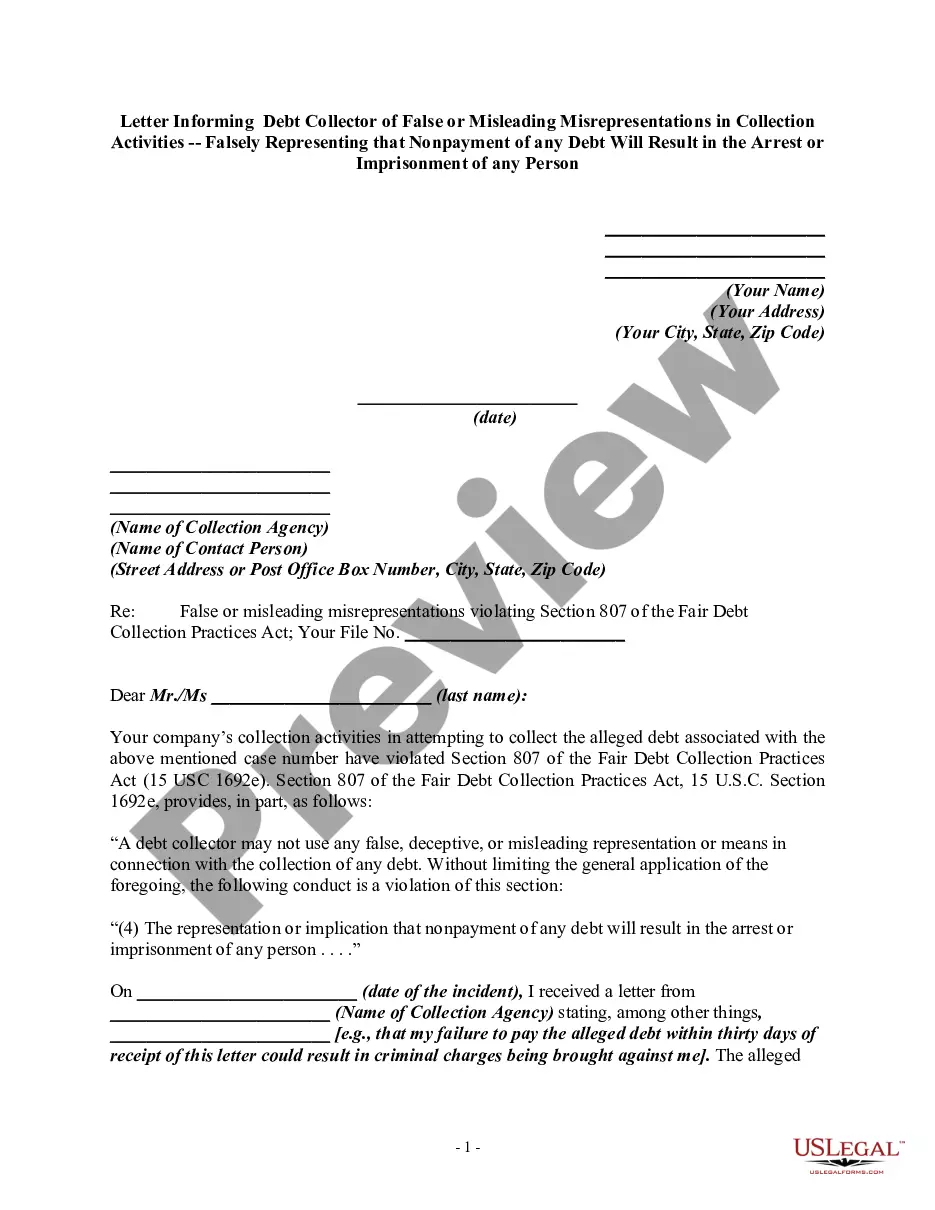

Writing a simple letter of agreement involves stating the basics: the parties involved, purpose of the agreement, and the terms. Use straightforward language to describe expectations, deadlines, and any penalties for non-compliance. Keep the tone professional but personable, ensuring both parties feel secure in their commitments. For additional support in structuring your agreement, consider tools from uslegalforms that clarify processes, especially when you want to explore how do I write a mortgage agreement.

When writing a housing agreement, begin by stating the parties involved, the property address, and the agreement's effective date. Clearly outline the terms, including rent, payment schedule, and responsibilities of both parties. It’s important to keep it concise yet comprehensive to avoid future misunderstandings. For guidance, consider using uslegalforms, which can help you with templates that align with your needs, especially if you also want to know how do I write a mortgage agreement.

To write a personal letter for a house offer, start by introducing yourself and expressing your interest in the property. Explain why you are drawn to the home and how it fits your lifestyle. Add a personal touch by sharing a brief family story or future plans. This connection can help your offer stand out, especially when combined with clear terms in your mortgage agreement.