Loan Agreement With Trust

Description

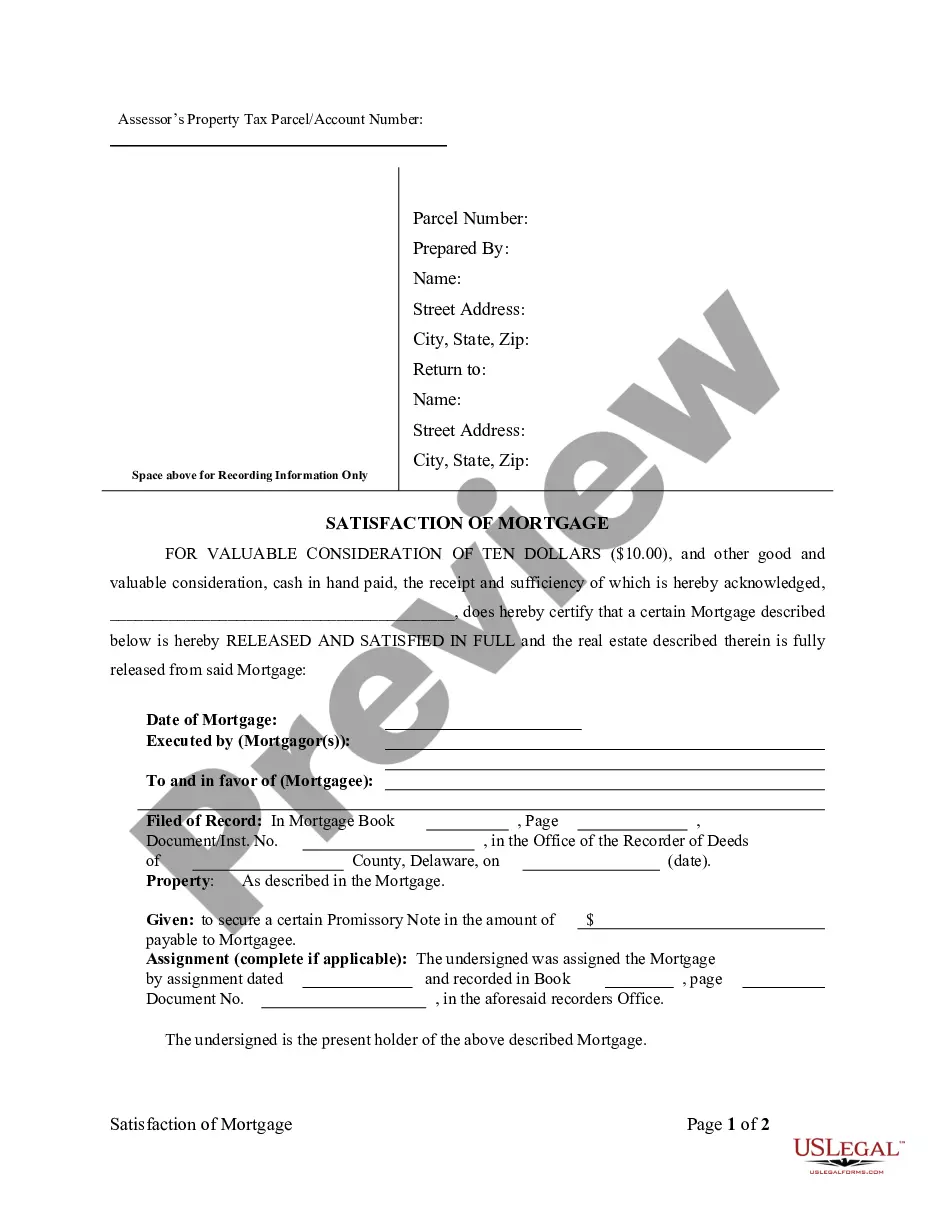

How to fill out Extension Of Loan Agreement Secured By A Deed Of Trust As To Maturity Date And Increase In Interest Rate?

Individuals frequently link legal documentation with complexity that only a professional can handle.

In some sense, it's accurate, as creating a Loan Agreement With Trust necessitates significant knowledge of subject matter, including state and local laws.

However, with US Legal Forms, the process has been simplified: a comprehensive collection of ready-to-use legal documents tailored to state regulations is now accessible online for everyone.

Choose the file format and click Download. You may print your document or upload it to an online editor for a quicker fill-out. All templates in our catalog can be reused: once bought, they remain saved in your profile. You can access them at any time via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and usage area, thus searching for a Loan Agreement With Trust or any distinct template takes merely minutes.

- Previous users with an active membership must Log In to their account and click Download to get the form.

- New users to the platform will first have to create an account and subscribe before they can download any documents.

- Here’s a detailed guide on how to secure the Loan Agreement With Trust.

- Review the page content carefully to ensure it satisfies your requirements.

- Read the form description or view it via the Preview option.

- If the previous form is unsuitable, find another sample using the Search field in the header.

- When you locate the appropriate Loan Agreement With Trust, click Buy Now.

- Select a pricing plan that fits your needs and financial situation.

- Create an account or sign in to continue to the payment page.

- Pay for your subscription using PayPal or a credit card.

Form popularity

FAQ

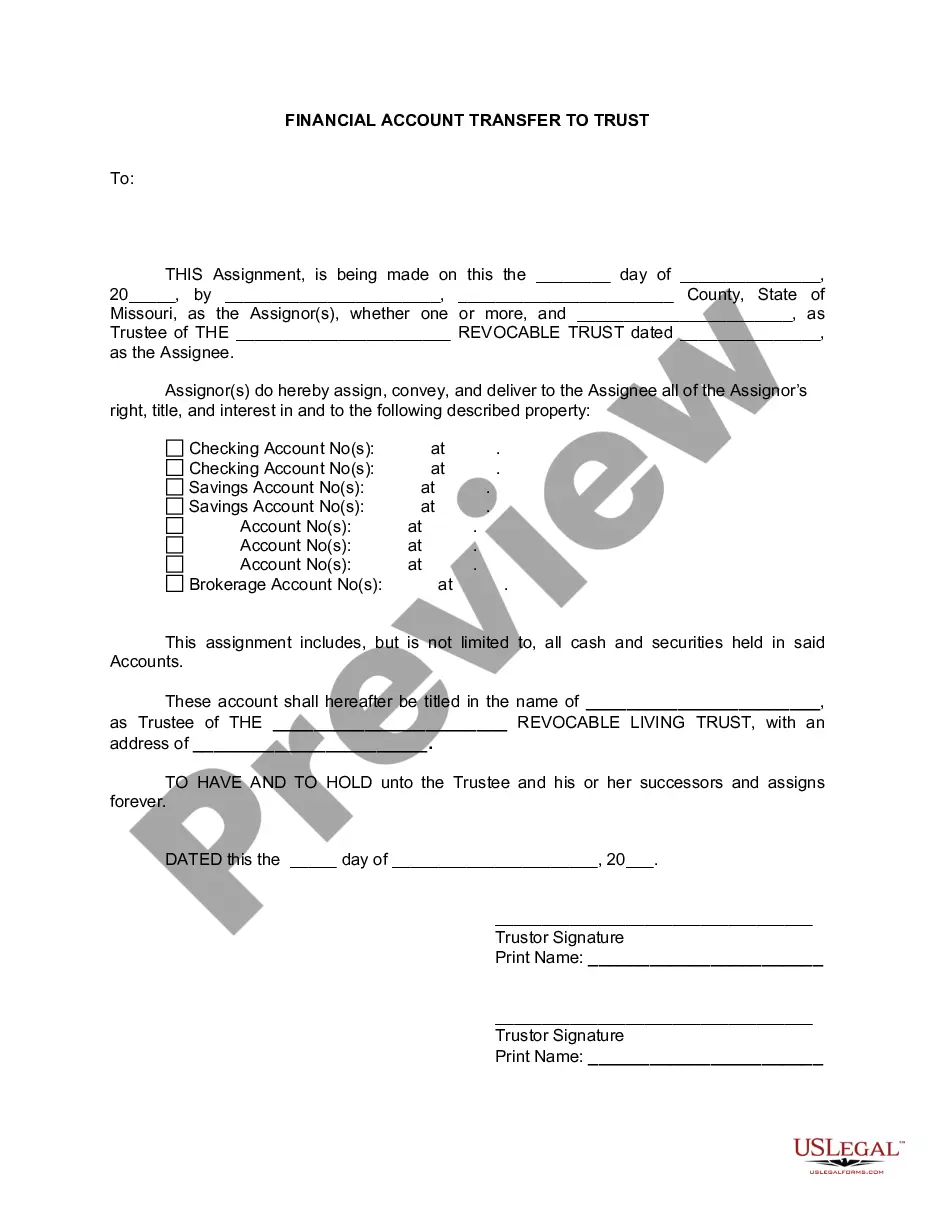

A trust can get a mortgage or loan from a traditional lender if the trust is considered a living or revocable trust. The original trustee who created the trust would still need to be alive for the trust to obtain the traditional mortgage or loan.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

Common items in personal loan agreements.The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

If allowed by the trust documentation, a trust is able to provide a loan to an individual. The individual typically needs to be either the successor trustee or a beneficiary named in the trust.