Acknowledgment Paternity Agreement Form California

Description

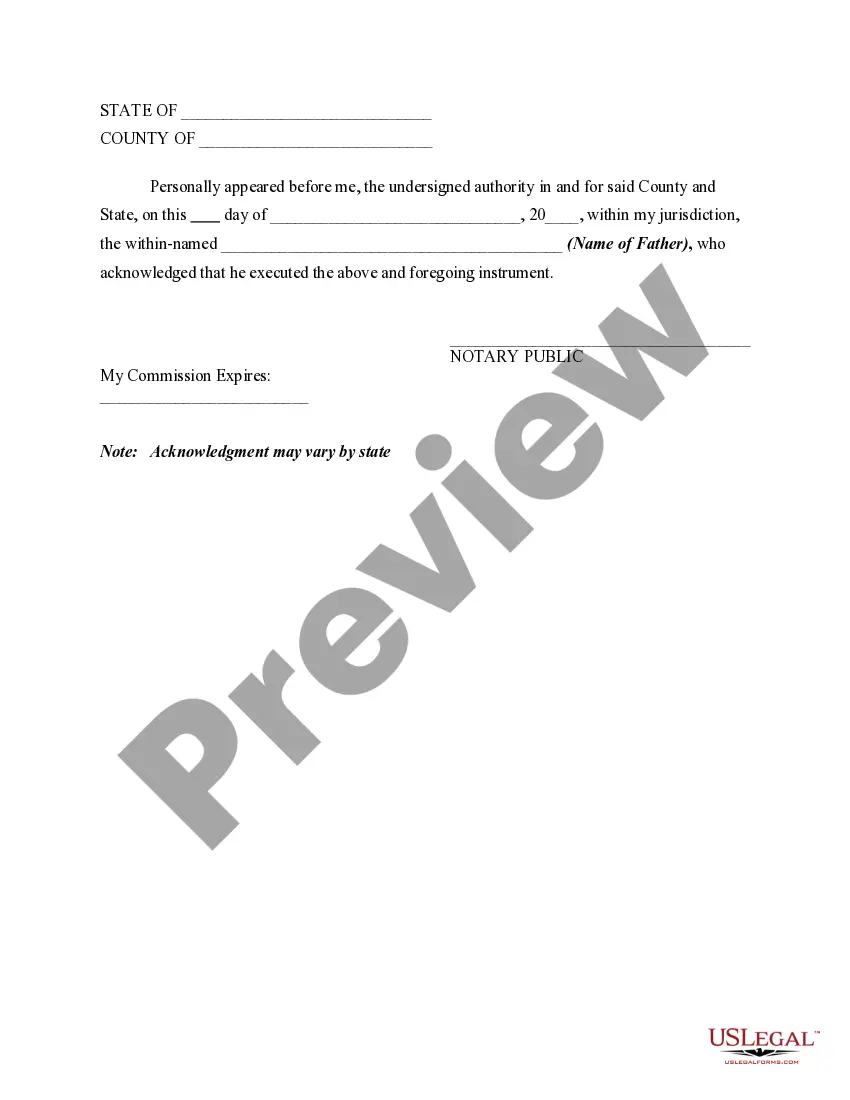

How to fill out Acknowledgment Of Paternity With Declaration That Child Shall Share In Father's Estate?

Legal documents handling can be overwhelming, even for seasoned experts.

When you are looking for an Acknowledgment Paternity Agreement Form California and do not get the opportunity to spend time searching for the right and updated version, the process can be challenging.

Access a collection of articles, guides, and resources relevant to your situation and needs.

Save time and energy searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review tool to find the Acknowledgment Paternity Agreement Form California and obtain it.

Ensure that the template is accepted in your state or county.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to review the documents you have previously downloaded and manage your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and gain unrestricted access to all the benefits of the library.

- Here are the steps to follow after acquiring the form you want.

- Verify that this is the correct form by previewing it and checking its description.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms caters to any needs you may have, from personal to business paperwork, all in one place.

- Utilize advanced tools to fill out and manage your Acknowledgment Paternity Agreement Form California.

Form popularity

FAQ

The form for part-year residents in California is the California Resident Income Tax Return (Form 540). This form allows individuals who lived in California for part of the year to report their income and claim applicable deductions. Moreover, if you are working on completing an Acknowledgment paternity agreement form California, you may also need to consider how your income impacts any child support obligations.

The VS 22 form in California serves as a request to declare insignificance regarding a child's birth records when paternity is established. This form is vital for parents who have accepted paternity through the Voluntary Declaration, streamlining the acknowledgement process. Completing the VS 22 correctly reinforces your acknowledgment paternity agreement form California and provides clear documentation of your parental status.

The place to start for a remote public search of the probate records is through Minnesota's Public Access System. Anyone interested in looking at probate court records can simply search by court file number or just a name of an interested party.

Trusts. One of the most popular ways to avoid probate is by having a revocable living trust as part of your estate plan.

Probate is the legal process of transferring a person's assets and paying their final bills after they die. If a person owns Minnesota real property in solely their own name or is a Minnesota resident with more than $75,000 in personal property, their estate will be subject to Minnesota probate laws.

In Minnesota, probate can take on average 12-18 months and can cost as much as an average of 2 to 3 percent of the estate value. In Minnesota, if a decedent has less than $75,000 of assets and no real estate, they may bypass the probate process. If a trust is involved, there will be a trustee or trustees.

Original wills are are found in probate case files, and certified copies can be obtained from county probate courts. We have Will Books for most* Minnesota counties, though the dates covered by the books varies by individual county.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

Probate attorney fees in Minnesota can range. Sometimes you can expect a range of $500 - $1,000, but that would suggest a very basic, uncomplicated case.

The timeframe for this process in Minnesota can vary widely, typically ranging from several months to over a year, depending on factors such as the size and complexity of the estate, the clarity of the will, and whether or not the probate process is contested.