Order To Open Safe Deposit Box For Home

Description

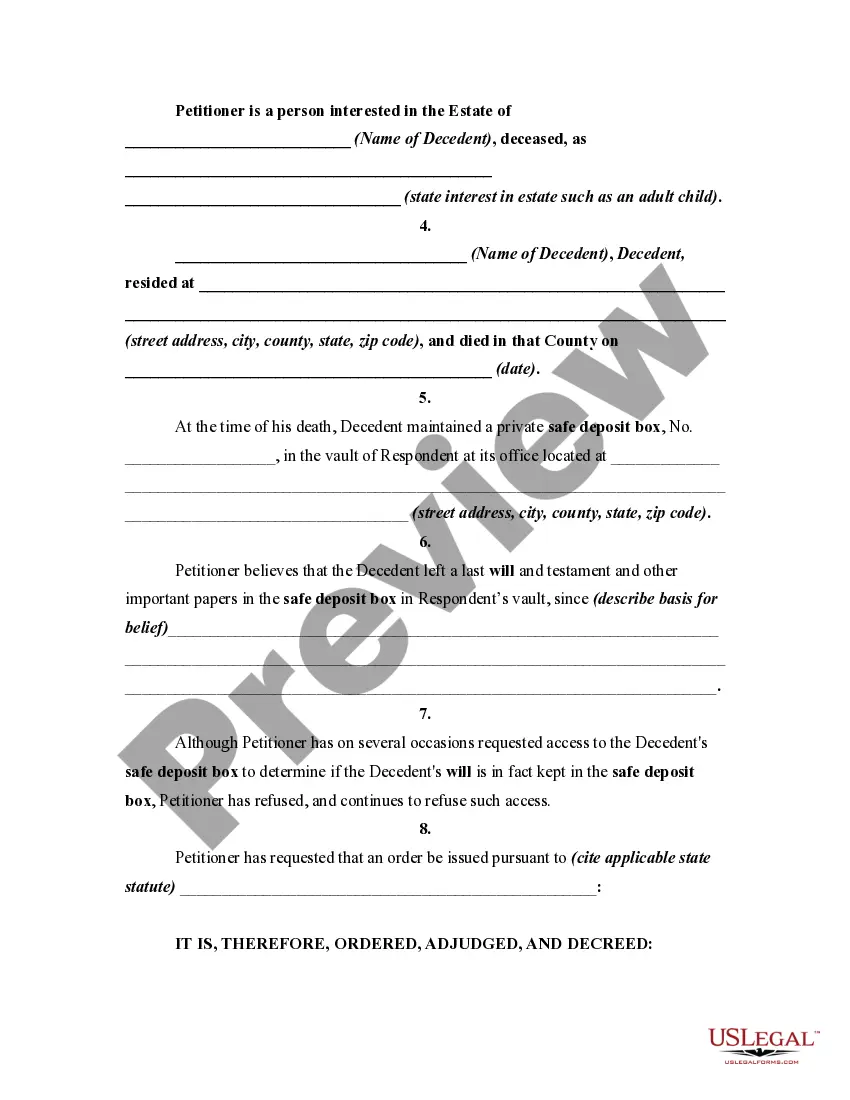

How to fill out Order Authorizing Petitioner To Open Safe Deposit Box Of Decedent?

Locating a reliable source to obtain the latest and suitable legal templates is a significant part of dealing with red tape.

Selecting the correct legal documents requires precision and carefulness, which is why it is crucial to obtain samples of the Order To Open Safe Deposit Box For Home exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the stress associated with your legal documents. Explore the extensive US Legal Forms catalogue where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search feature to locate your document.

- Examine the form’s summary to verify if it aligns with the requirements of your jurisdiction.

- Preview the form, if possible, to confirm it is the document you need.

- If the Order To Open Safe Deposit Box For Home does not meet your specifications, continue searching for the suitable template.

- When you are confident about the form's applicability, download it.

- If you are an authorized user, click Log in to verify your identity and access your selected documents in My documents.

- If you do not possess an account, click Buy now to acquire the template.

- Select the pricing option that fits your requirements.

- Proceed with the registration to complete your acquisition.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Order To Open Safe Deposit Box For Home.

- After obtaining the form on your device, you may modify it using the editor or print it out and complete it manually.

Form popularity

FAQ

Yes, a bank can deny you access to your safety deposit box under certain circumstances. If you have outstanding debts or if there are legal actions against you, the bank may restrict your access. Additionally, if there is a lack of proper identification or documentation, you may face difficulties. To avoid such situations, consider using the Order to open safe deposit box for home service, which provides clear instructions and necessary documentation to ensure smooth access.

Here are the steps to get a safe deposit box: Decide what you want to store. This dictates the box size you'll need. Decide who can access the box. ... Make an appointment with the bank. ... Open the account and sign the agreement. ... Get your key and put your items in the safe deposit box.

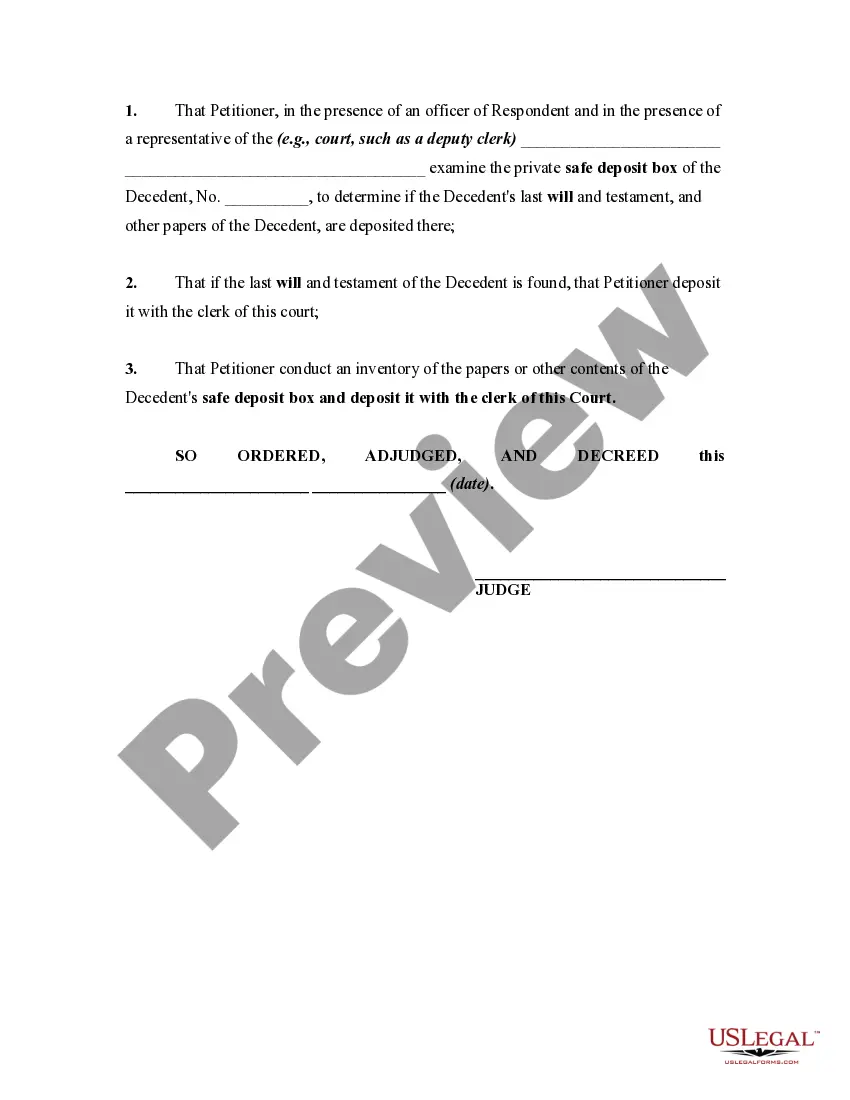

If there is no co-lessee, a court order will be required to enter the box. The first step in obtaining a court order to enter the safe-deposit box is for the Personal Representative to Petition the court to open the safe-deposit box. The Petition has to be filed in a separate proceeding from the probate case.

The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

The first place to check will be with your bank or credit union. Safe Deposit Boxes are kept in a secure vault and are usually limited in quantity. If there are any available, you can rent them on an annual basis. A Safe Deposit Box takes two keys to open ? your key, plus a key kept by the institution.

Pros and Cons Unlike bank accounts, the contents are not ensured. Safes can only be accessed during the bank's business hours. Contents can still be lost due to fire, flood, or other disasters.