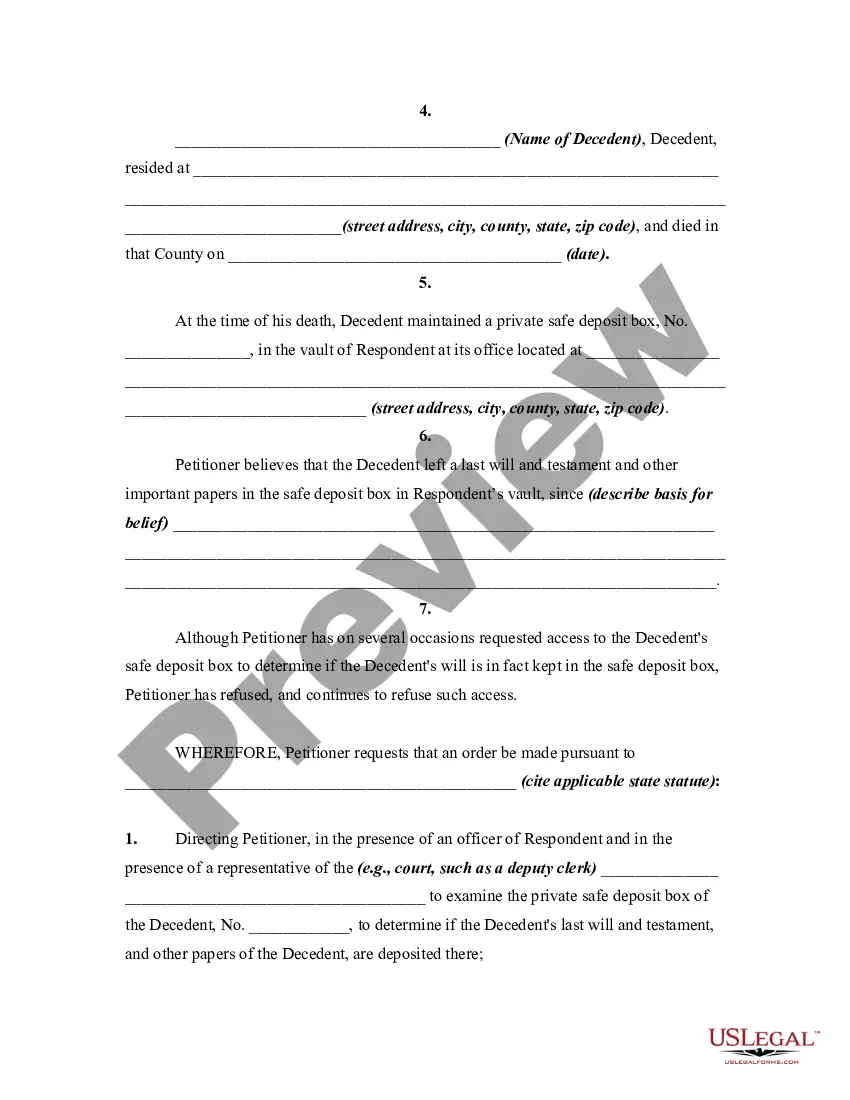

Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Safe Deposit Box Form With Bank Of America

Description

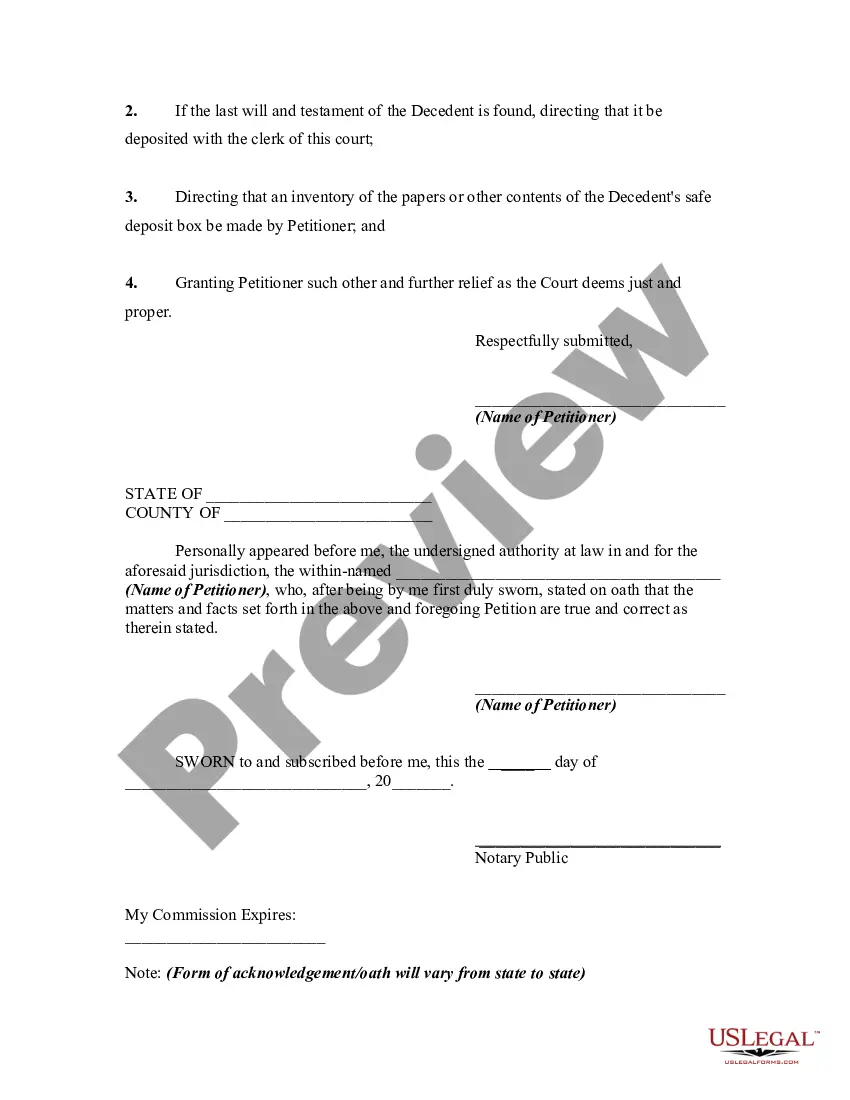

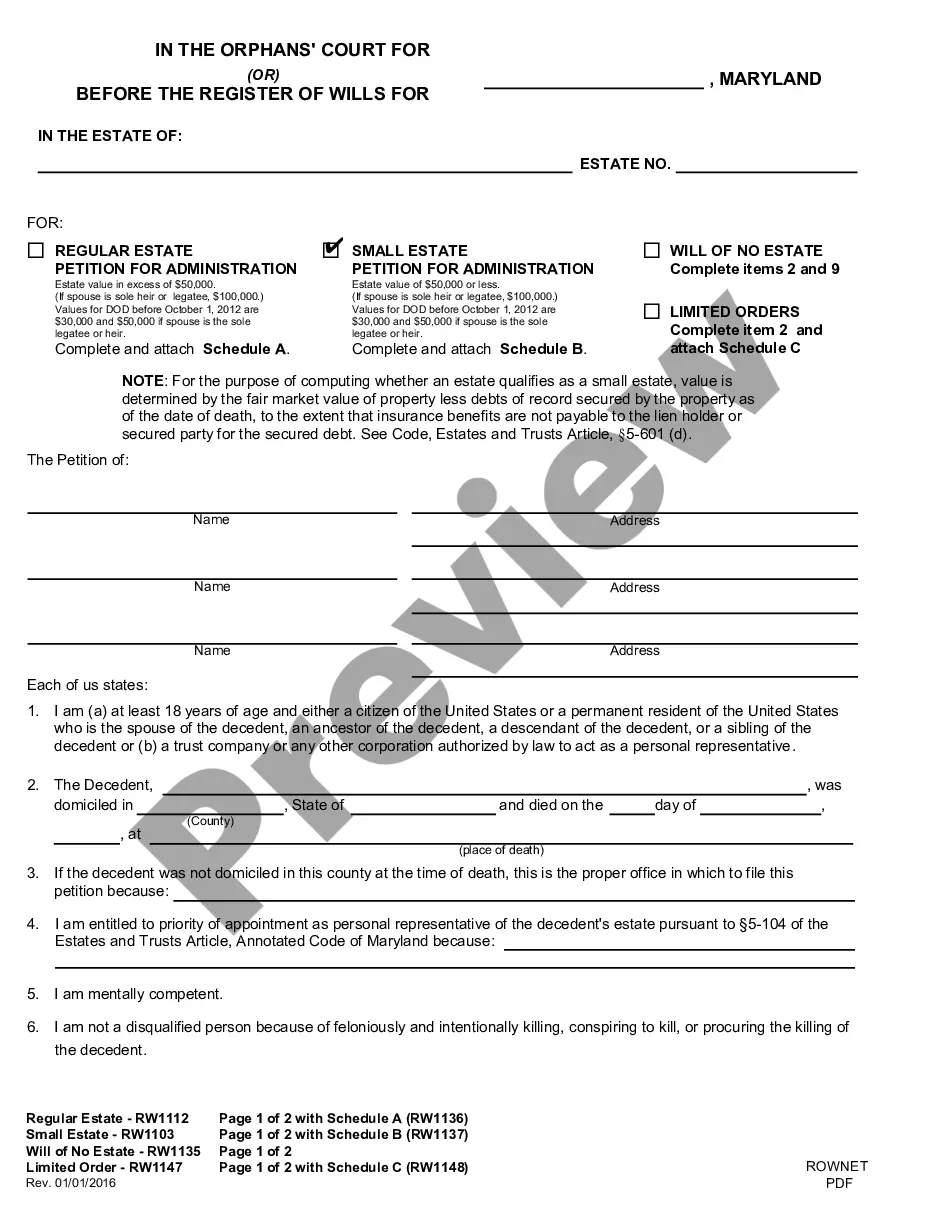

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

The Safe Deposit Box Form With Bank Of America you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Safe Deposit Box Form With Bank Of America will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it suits your requirements. If it does not, make use of the search bar to find the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Safe Deposit Box Form With Bank Of America (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

The word ?Financial Center? means a location where Bank of America maintains safe deposit boxes. Columbia. CONTENTS NOT INSURED: (1) The contents of the Box are not insured by the Bank, the Federal Deposit Insurance Corporation (FDIC), or by any government or private insurance company.

Annual cost of safe deposit boxes by bank and size 3" x 5"10" x 10"Bank of America$75$300Chase$50$190Wells Fargo$80$175US Bank$63$1843 more rows ?

You're better off keeping the following items out of your safe deposit box: Passports. Only copies of living wills, advanced medical directives, and durable powers of attorney. Valuables you have not insured. Cash. Anything illegal.

Items You Shouldn't Keep In a Safety Deposit Box Passports, medical directives, the only copies of wills and powers of attorney, and other documents that you may suddenly need are better kept in a secure spot at home, such as a fireproof home safe that's bolted to the floor or wall.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.