Deudas Pagar Formulario

Description

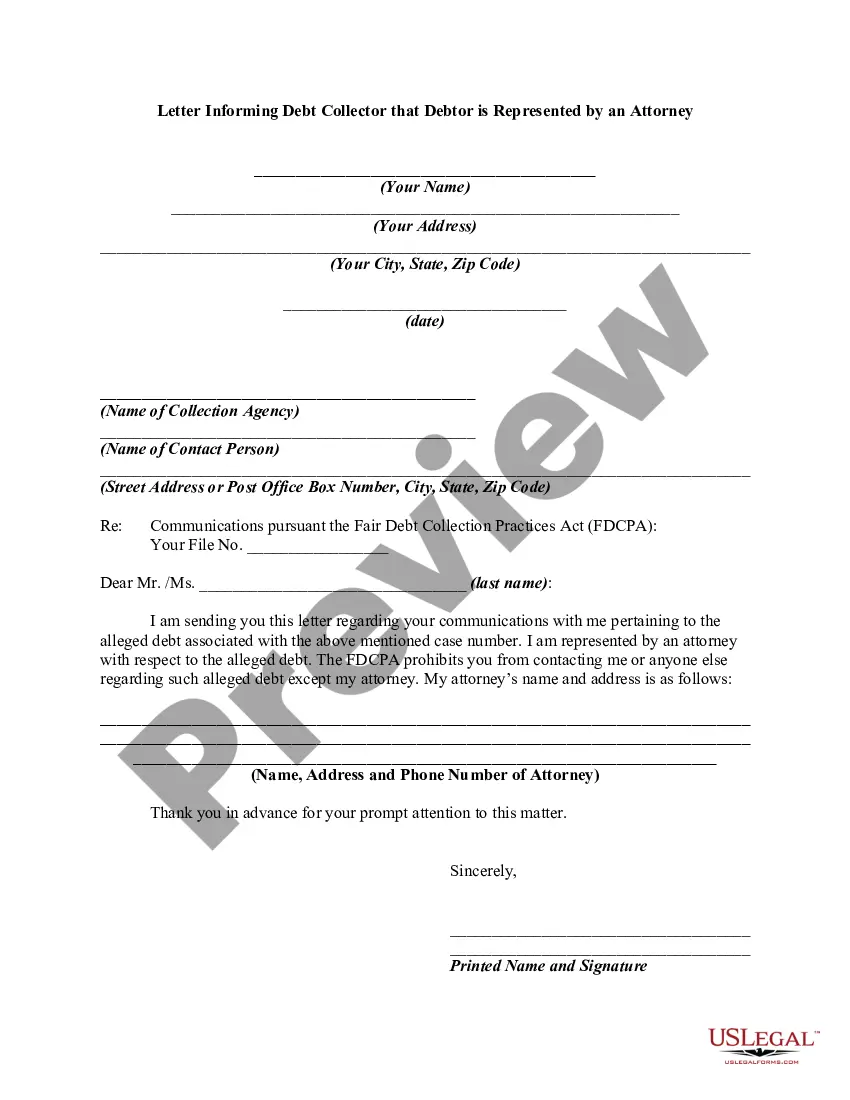

How to fill out Letter Informing Debt Collector To Cease Communications With Debtor And That Debtor Refuses To Pay Alleged Debt?

Handling legal documents and processes can be a lengthy addition to your schedule.

Deudas Pagar Formulario and similar forms generally necessitate that you search for them and grasp the most effective way to fill them out accurately.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a thorough and efficient online database of forms at your disposal will be greatly beneficial.

US Legal Forms is the leading online resource for legal templates, featuring over 85,000 state-specific documents and a variety of tools to help you complete your paperwork with ease.

Is this your initial time using US Legal Forms? Sign up and establish an account in a few moments and you will gain access to the form catalogue as well as Deudas Pagar Formulario. Then, follow the steps outlined below to complete your document.

- Browse the collection of pertinent documents accessible to you with a single click.

- US Legal Forms provides state- and county-specific forms that can be downloaded anytime.

- Secure your document management tasks by using high-quality support that enables you to create any form within minutes without additional or hidden fees.

- Just Log In to your account, locate Deudas Pagar Formulario and obtain it instantly in the My documents section.

- You can also retrieve forms that you have downloaded previously.

Form popularity

FAQ

To complete an EZ tax form, gather your income documents and expenses. Next, follow the outline for earnings, ensuring you report all sources accurately. Remember to check the box for claiming standard deductions to make your deudas pagar formulario easier and more efficient.

Filling out a W9 form is straightforward. Start by entering your name and business name, if applicable. Then provide your address and check the appropriate box for your business entity type. Don't forget to include your Taxpayer Identification Number, as this is essential for any reports related to your deudas pagar formulario.

To request a first-time abatement penalty from the IRS, you need to submit Form 843 along with your explanation of eligibility. The IRS allows this option for taxpayers who meet specific criteria, such as a clean compliance history. If you're unsure about the process, using a Deudas pagar formulario from US Legal Forms can simplify your request.

Every equipment lease should include the following fundamental contract elements: Lessor: The equipment owner who will be renting out the equipment. Lessee: The renter who will be paying for the privilege to use the gear. Term: The length of time the lessee will lease the equipment.

In general, lease-to-own refers to methods by which a lease contract provides for the tenant to eventually purchase the property. One common lease-to-own strategy is to include an ?option to purchase? provision in the lease.

An Arizona rent-to-own lease agreement is a rental contract that includes an option to purchase the property under pre-negotiated terms. During the lease, the tenant will have all rights under State law. If the tenant exercises their option to buy, the lease should be converted to a purchase agreement.

Leases are legal and binding contracts that set forth the terms of rental agreements in real estate and real and personal property. These contracts stipulate the duties of each party to effect and maintain the agreement and are enforceable by each.

How to Write a Lease Agreement Step 1: Outline your lease agreement. Lease agreements should be organized, clear, and easy to read for both parties. ... Step 2: Determine important provisions. ... Step 3: Construct your lease clauses. ... Step 4: Consult local laws or a local real estate lawyer. ... Step 5: Formatting and fine-tuning.

Every month, a portion of the rent you pay to the homeowner goes toward a down payment on the home. You have the option to use the money that's accrued to buy the home at the end of your lease term. Keep in mind this credit is limited to the most recent 12 months.

The Cons of Rent-to-Own Higher chance of losing money: If you decide not to buy the property after signing a lease-purchase agreement, then you may lose money. ... Missed payments can void your agreement: Failing to pay rent can result in the whole agreement being voided by the seller.