Wraparound Mortgage Form For Deed

Description

How to fill out Wraparound Mortgage?

Acquiring legal document examples that comply with federal and local regulations is essential, and the internet provides numerous choices to select from.

However, what’s the benefit of spending time looking for the accurately prepared Wraparound Mortgage Form For Deed example online when the US Legal Forms digital library conveniently has such templates compiled in one location.

US Legal Forms is the largest virtual legal repository with more than 85,000 fillable forms created by attorneys for various business and personal scenarios.

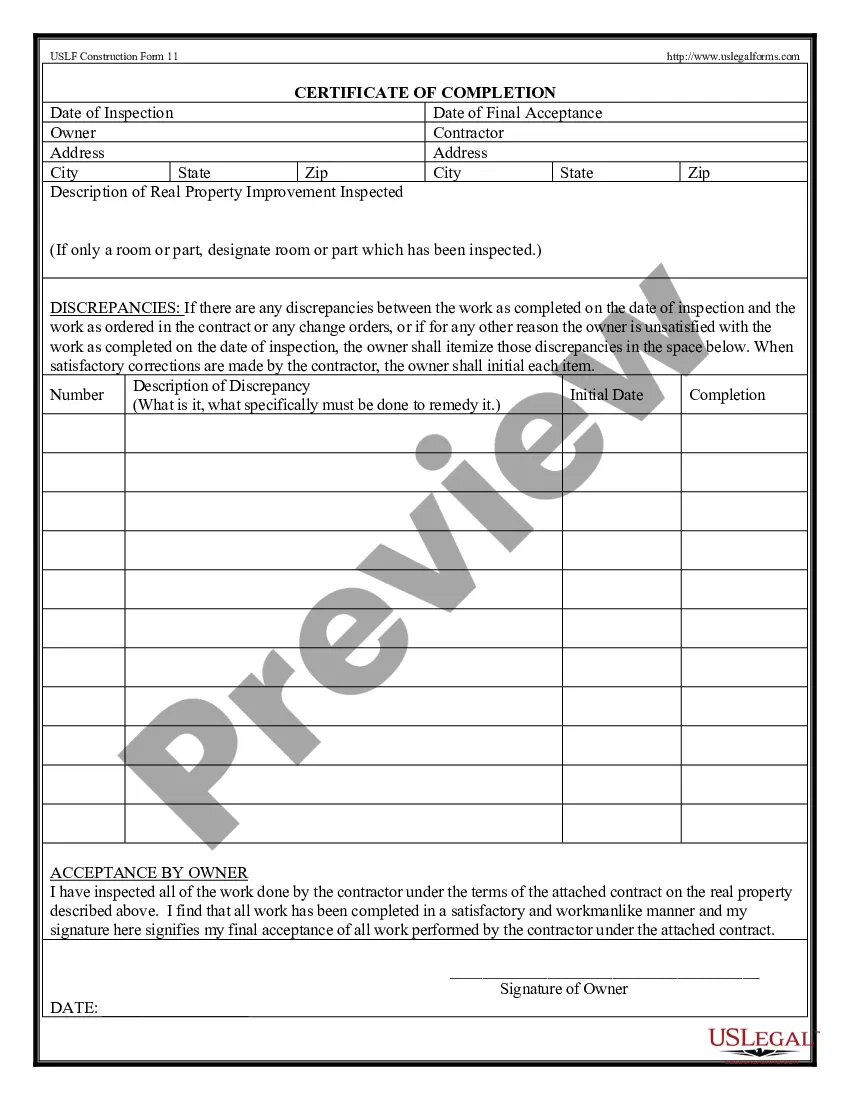

Review the template using the Preview function or through the text description to ensure it fulfills your needs.

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our specialists keep abreast of legislative changes, ensuring your documents are always current and compliant when securing a Wraparound Mortgage Form For Deed from our site.

- Obtaining a Wraparound Mortgage Form For Deed is straightforward and swift for both existing and new customers.

- If you already possess an account with an active subscription, Log In and save the document template you need in the desired format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

In a wrap-around mortgage, the seller typically holds the title to the property until the buyer makes the final payment. This arrangement provides the seller with security while allowing the buyer to occupy and benefit from the property. However, using a wraparound mortgage form for deed can clarify the terms and conditions regarding title transfer, protecting both parties.

Setting up a wrap-around mortgage involves drafting a new mortgage agreement that encompasses the existing mortgage. It is essential to clearly outline the payment terms, interest rates, and responsibilities of both parties. Using a wraparound mortgage form for deed can help ensure that all necessary details are addressed, making the process smoother and more secure.

Individuals may choose a wrap-around mortgage to secure financing without the need for a traditional lender. This option can benefit buyers with poor credit or those looking to expedite a sale. Additionally, a wraparound mortgage form for deed can simplify the transaction by allowing buyers to assume the seller's existing mortgage while making payments directly to the seller.

around contract for a deed is a financing arrangement where the seller retains the original mortgage while creating a new mortgage for the buyer. This new mortgage wraps around the existing one, enabling the buyer to make payments that cover both loans. This approach can simplify the transaction process and can often be facilitated through a wraparound mortgage form for deed.

A contract for deed may leave the buyer at risk of losing their investment if the seller defaults on their mortgage. Additionally, buyers often have limited rights compared to traditional buyers, which can lead to complications if disputes arise. Using a wraparound mortgage form for deed can provide a more secure alternative, allowing you to avoid some of these pitfalls.

While it's not mandatory to hire a lawyer for a wrap-around mortgage, consulting one can provide significant advantages. A lawyer can help you understand the legal implications and ensure that the wraparound mortgage form for deed is filled out correctly. Additionally, they can provide guidance on negotiations and protect your interests throughout the transaction. Ultimately, having legal support can make the process more efficient and secure.

To register a mortgage deed, you need to complete the wraparound mortgage form for deed accurately. First, gather all necessary documents, including the property title and identification. Next, visit your local recording office to submit the completed form along with any required fees. Ensuring that you follow your state’s specific regulations will help facilitate a smooth registration process.