Security Interest Definition With Loan

Description

How to fill out Assignment Of Interest Of Seller In A Security Agreement?

Obtaining a reliable source for the most updated and suitable legal templates constitutes a significant portion of the challenge when dealing with bureaucracy. Locating the correct legal documents requires precision and meticulousness, which is why it is vital to obtain examples of Security Interest Definition With Loan solely from credible providers, such as US Legal Forms. An incorrect template may squander your time and delay the situation you are facing. With US Legal Forms, you have minimal concerns. You can access and review all the particulars regarding the document’s application and significance for your situation and in your state or county.

Follow these steps to finalize your Security Interest Definition With Loan.

Once you have the form on your device, you can edit it with the editor or print it out and complete it manually. Eliminate the stress associated with your legal documents. Browse the extensive US Legal Forms collection where you can discover legal templates, assess their applicability to your situation, and download them instantly.

- Use the catalog browsing or search function to locate your template.

- View the form’s description to verify it aligns with the requirements of your state and region.

- Check the form preview, if available, to confirm the template is the one you need.

- Return to the search to find the appropriate document if the Security Interest Definition With Loan does not meet your needs.

- If you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the payment plan that meets your needs.

- Proceed to registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Security Interest Definition With Loan.

Form popularity

FAQ

Assignment and Release: A secured party may, at its discretion, assign part or all of a security interest to another party and/or release part or all of the collateral covered by a security interest.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

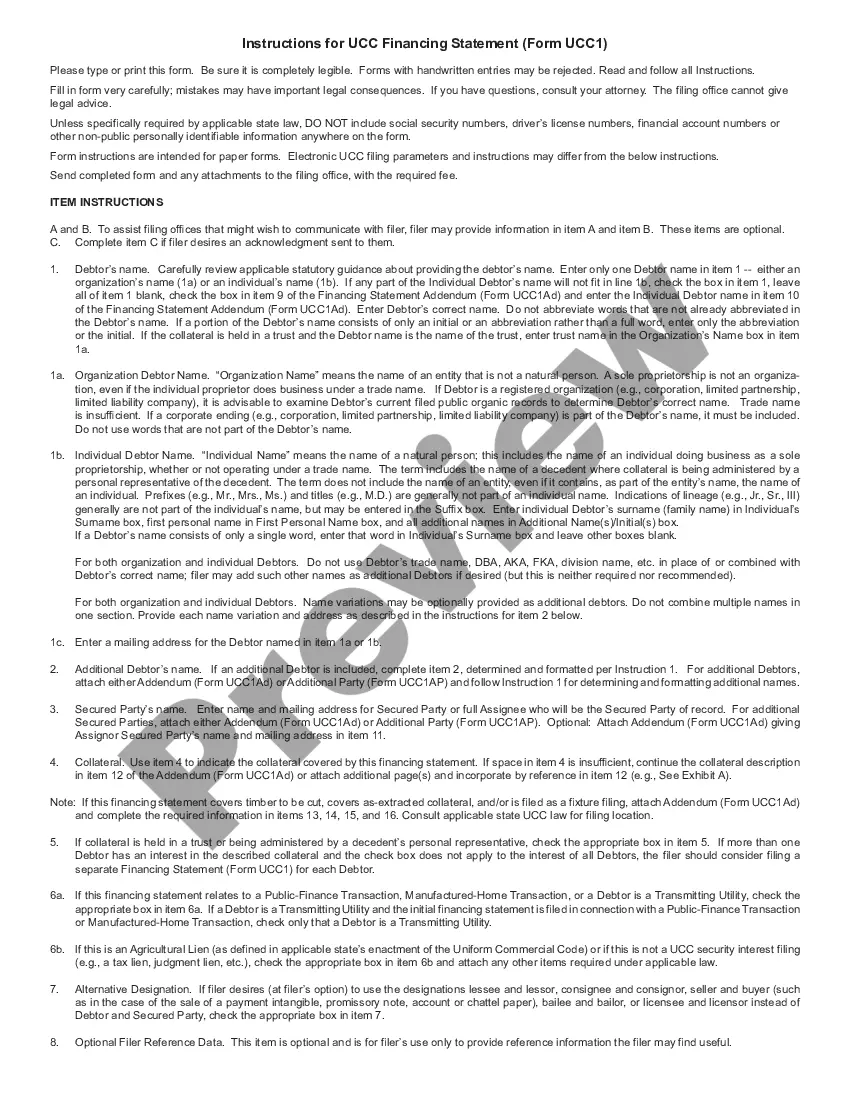

A secured party can perfect a security interest by filing a financing statement with the appropriate state or local office. (3) a description of the collateral by item or type. All of the foregoing information must be accurate, otherwise the filing will not perfect the creditor's security interest.

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad. A security interest lowers the risk for a lender, allowing it to charge lower interest on the loan.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.