Trust Funds And How They Work With The Government

Description

How to fill out Irrevocable Trust Funded By Life Insurance?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of preparing Trust Funds And How They Work With The Government or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of more than 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates diligently put together for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Trust Funds And How They Work With The Government. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the catalog. But before jumping straight to downloading Trust Funds And How They Work With The Government, follow these recommendations:

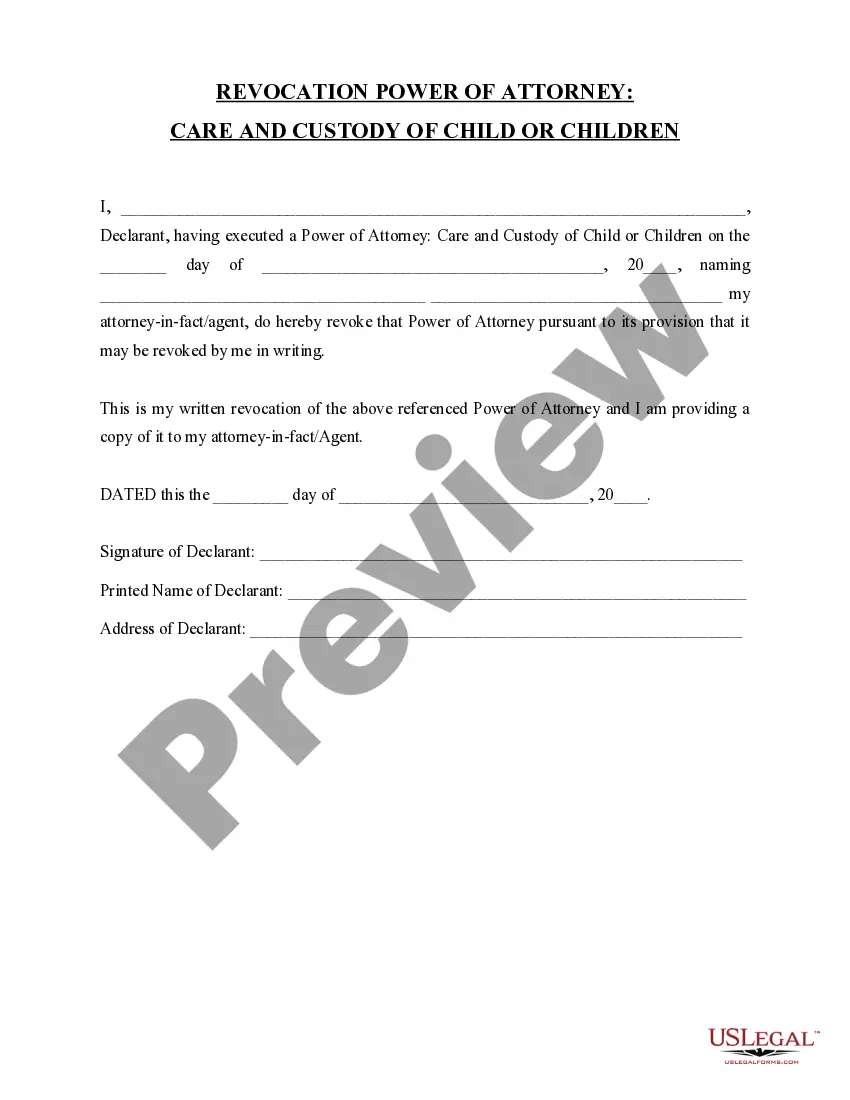

- Check the document preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you choose conforms with the requirements of your state and county.

- Choose the right subscription option to get the Trust Funds And How They Work With The Government.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and turn form execution into something easy and streamlined!

Form popularity

FAQ

You can usually create a trust in four steps: Draft an agreement. A lawyer or other legal entity drafts a formal trust agreement. ... Establish the trust's property. The settlor makes an irrevocable donation into the trust, which becomes the trust property. ... Open a trust account(s) ... Complete the process.

This usually includes allocating living expenses or even educational expenses, such as private school or college expenses, while they are alive. Or they can pay out a lump sum directly to the beneficiary. Trust funds provide certain benefits and protections for those who create them and to their beneficiaries.

To summarize, a grantor creates the trust, the trustee manages the trust, and the beneficiary benefits from the trust. Outside of this, the trustee must ensure the annual trust returns are filed and the assets within the trust are maintained for the beneficiary's benefit.

It is recommended that you to use a lawyer who specializes in estate planning. The costs can range from $5000-$10,000 to set up. As long as you do not make any changes, the yearly cost to maintain your trust is the cost to file the separate trust tax return.

Though a Canadian trust is not a legal entity, it is considered a taxpayer at the highest rates under Canadian law. That is why trustees try to pass on any income earned by trust property to beneficiaries, so they can pay the taxes at their own, presumably lower, rates.