Trust Fund Withdrawal

Description

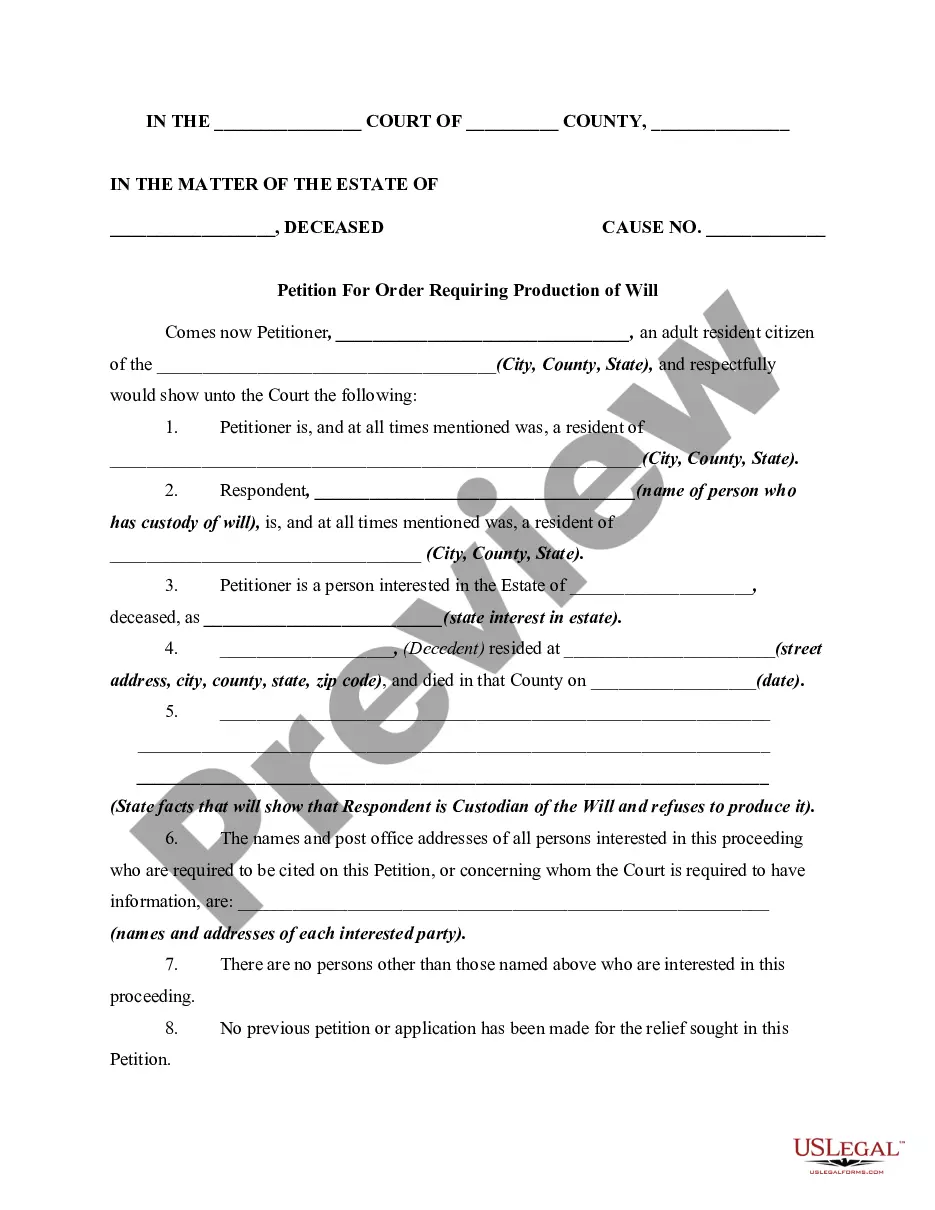

How to fill out Irrevocable Trust Funded By Life Insurance?

It’s obvious that you can’t become a law expert immediately, nor can you grasp how to quickly draft Trust Fund Withdrawal without the need of a specialized background. Creating legal documents is a long process requiring a particular education and skills. So why not leave the creation of the Trust Fund Withdrawal to the professionals?

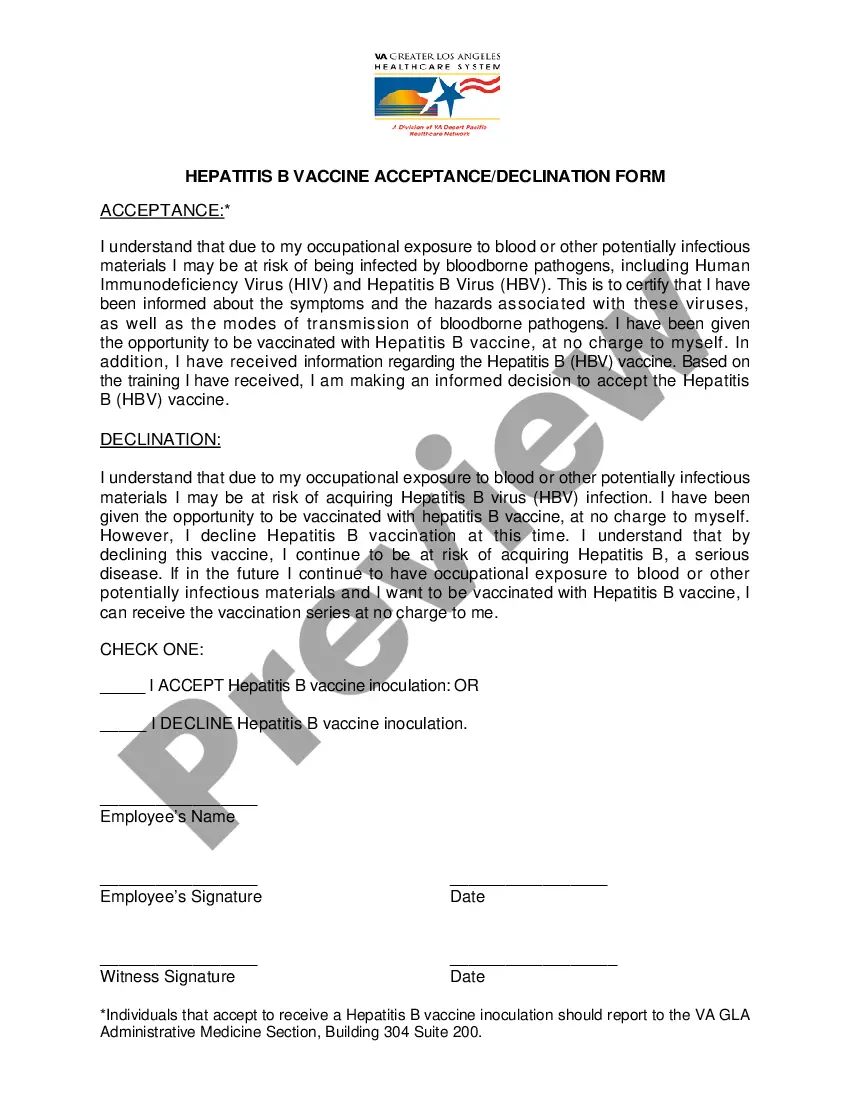

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and get the document you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Trust Fund Withdrawal is what you’re searching for.

- Begin your search over if you need a different template.

- Set up a free account and select a subscription option to purchase the template.

- Pick Buy now. As soon as the transaction is complete, you can get the Trust Fund Withdrawal, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

When a trustee needs to withdraw money to fulfill their duties, they can use the bank account to write checks, withdraw cash, or complete wire transfers. It is imperative to note that trustees are responsible for managing all withdrawals of money from a trust account.

Trust beneficiaries must pay taxes on income and other distributions from a trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Just choose your preferred account on the ATM screen. If you use the credit card function on your Trust card at an ATM, this means you are taking a cash advance. Note that supplementary cardholders cannot take out a cash advance. If you use the debit card function, you are withdrawing cash from your savings account.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.

Approaching the Trustee Another possible way to get money out of a trust fund is to request a cash withdrawal. This would require putting the request in writing and sending it to the trustee. The trustee might agree. But that individual or entity must also fulfill their fiduciary obligations.