Promissory Note Payment Schedule For Delayed

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

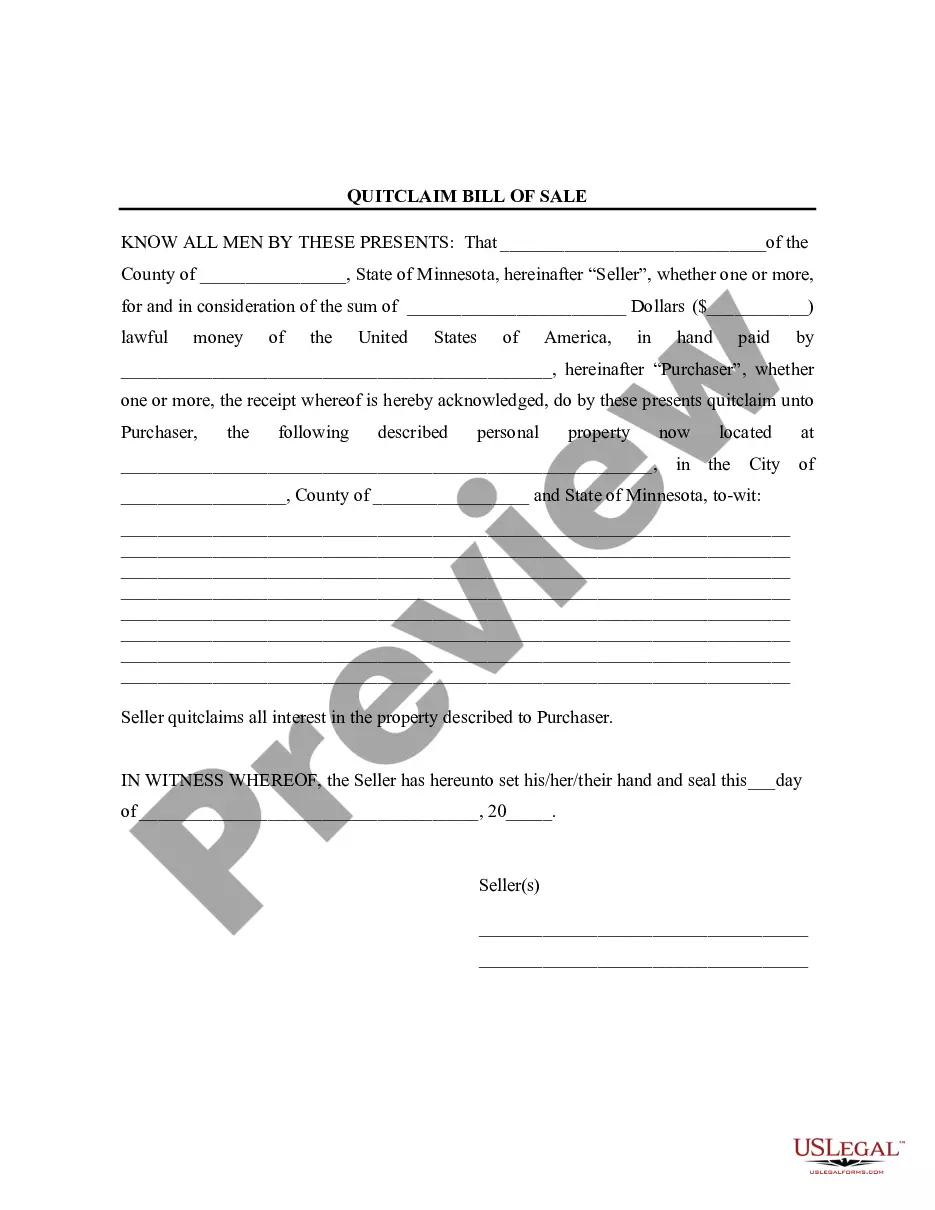

Maneuvering through the red tape of standard documents and formats can be difficult, particularly if one is not engaged in that professionally.

Even selecting the proper format for a Promissory Note Payment Schedule For Delayed will consume considerable time, as it must be accurate and precise to the last figure.

However, you will be able to spend significantly less time finding an appropriate template from a reliable resource.

- US Legal Forms is a service that streamlines the task of locating the correct documents online.

- US Legal Forms is a central location where you can discover the latest examples of documents, verify their usage, and download these instances for completion.

- It is a repository boasting over 85K templates that are applicable in various areas.

- When looking for a Promissory Note Payment Schedule For Delayed, you won’t need to doubt its legitimacy as all documents are authenticated.

- Having an account at US Legal Forms guarantees you access to all necessary samples at your fingertips.

- Store them in your records or add them to the My documents collection.

- You can retrieve your saved documents from any device by simply clicking Log In on the library site.

- If you still lack an account, you can always search for the template you need.

Form popularity

FAQ

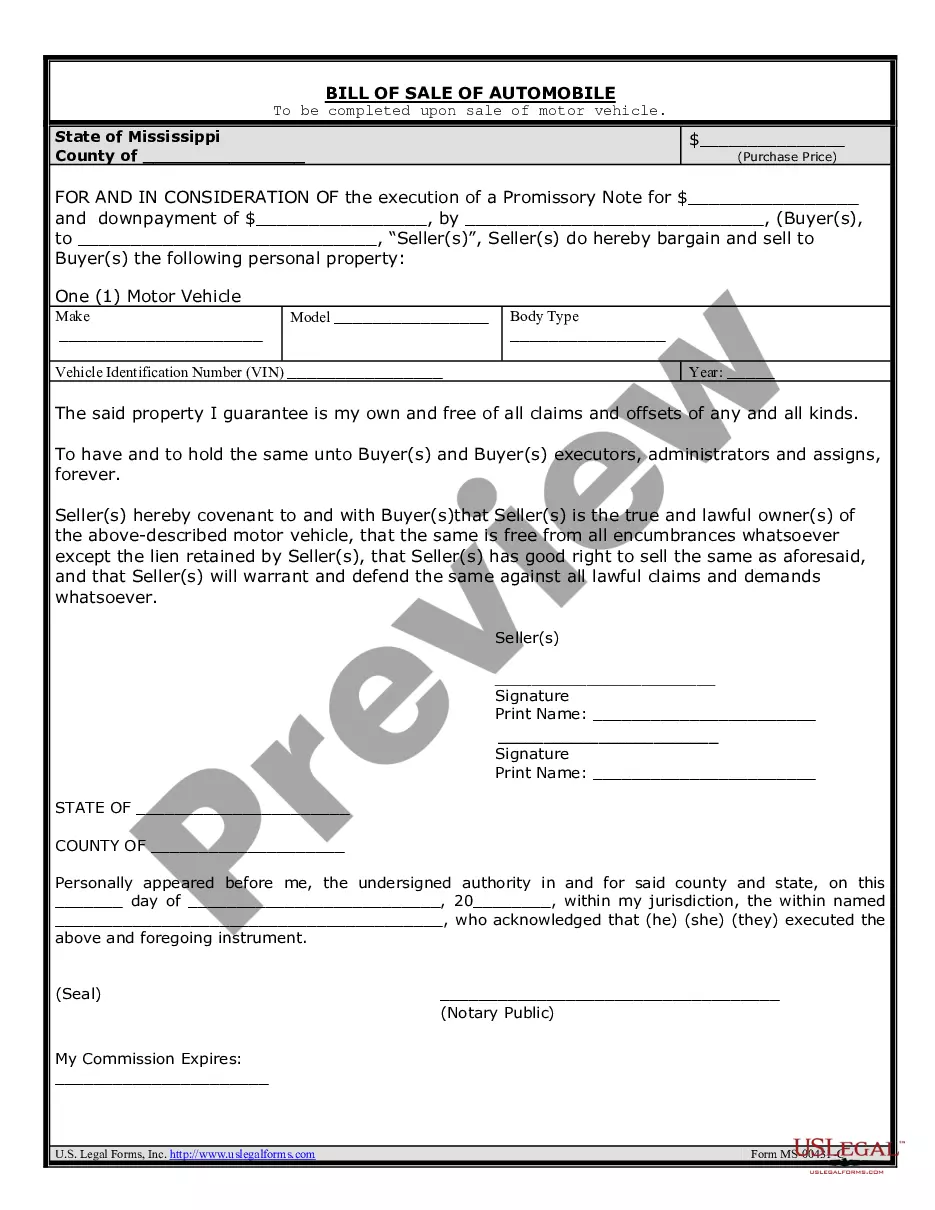

A promissory note extension is a legal document allowing an extension on the borrower's period in paying back a loan. For example, if a borrower has problems paying back their loan, or if the lender is asking for less time to repay it, the borrower can request an extension of their promissory notes.

Circumstances for Release of a Promissory NoteThe debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.