Note Mortgage Statement With Credit Card

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

Managing legal documents can be exasperating, even for the most adept experts.

When you're seeking a Mortgage Note Statement With Credit Card and can’t spare the time searching for the appropriate and updated version, the process can be arduous.

Access a valuable repository of articles, guides, handbooks, and resources pertinent to your circumstance and requirements.

Conserve time and effort searching for the documents you need, and utilize US Legal Forms’ sophisticated search and Review feature to find the Mortgage Note Statement With Credit Card and obtain it.

Make sure that the sample is valid in your state or county. Select Buy Now when you are ready. Choose a monthly subscription plan. Select the file format you desire, then Download, complete, eSign, print, and submit your documents. Leverage the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Change your routine document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Examine your My documents tab to review the documents you previously downloaded and organize your folders as desired.

- If you're new to US Legal Forms, create an account and gain unlimited access to all benefits of the library.

- Here are the steps to follow after locating the form you need.

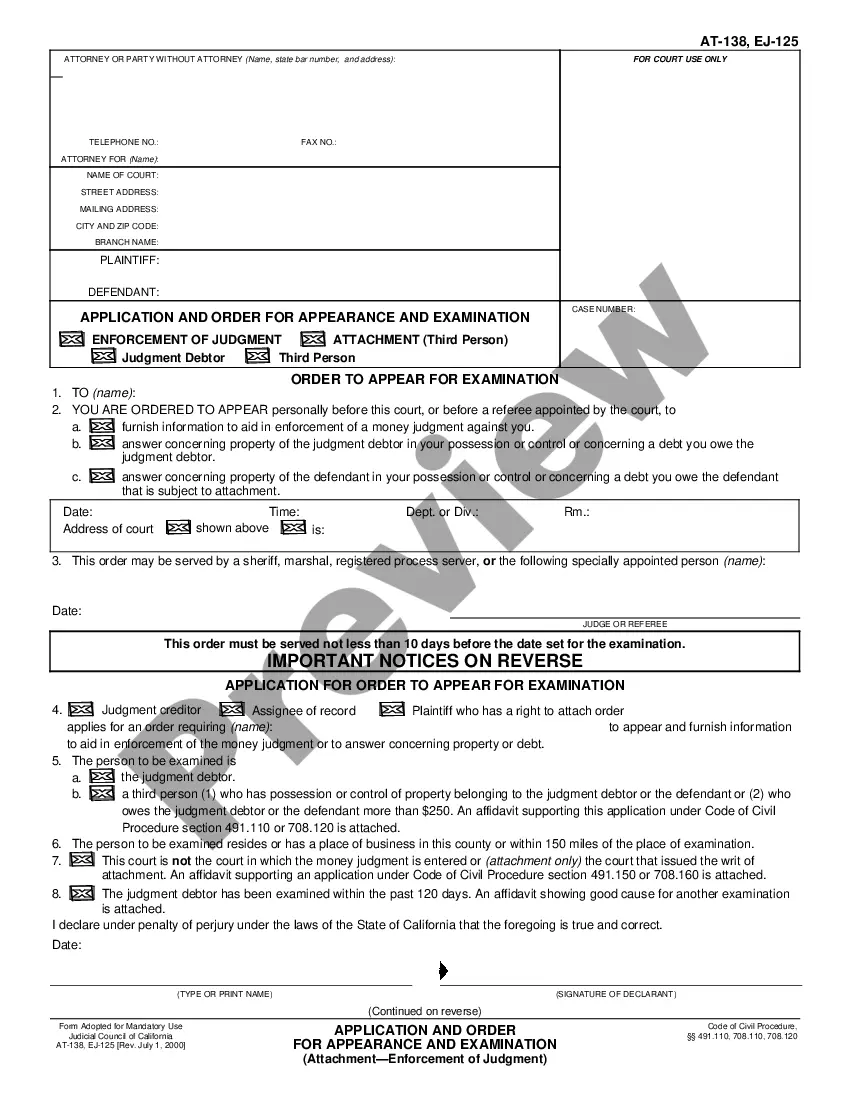

- Confirm it's the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, from personal to business paperwork, all in one location.

- Utilize advanced tools to complete and manage your Mortgage Note Statement With Credit Card.

Form popularity

FAQ

To put a note on your credit file, you must contact the credit bureaus directly. You can provide a statement explaining your situation, such as a note mortgage statement with credit card details. This note can help clarify any disputes or provide context for future lenders. It's essential to keep a record of your communication with the bureaus for reference.

To obtain a mortgage statement, you can log into your lender's online portal or contact their customer service. Most lenders provide statements on a monthly basis, and you can request additional copies if needed. For those who prefer a simplified approach, US Legal Forms can help you acquire your note mortgage statement with credit card details seamlessly.

You can obtain a copy of your mortgage note by contacting your mortgage lender or servicer directly. They will guide you through the process of verifying your identity and requesting the document. If you're looking for a more efficient way to handle this request, consider using US Legal Forms to help you secure your note mortgage statement with credit card integration.

The 3 7 3 rule in mortgage refers to a guideline used to help borrowers understand their mortgage statements. This rule indicates that lenders must provide borrowers with a clear statement three days before closing, seven days before the first payment is due, and three days before any significant changes happen. Understanding this rule helps you stay informed about your mortgage obligations, including how they interact with your credit card payments. By using tools like a Note mortgage statement with credit card, borrowers can better manage their finances and ensure timely payments.

At this time, we do not accept payments made with a credit card; however, we do accept debit card payments (State and loan status restrictions may apply).

Can I pay my mortgage with a credit card? Yes. Technically paying down your mortgage with a credit card is possible, but it is a complicated process. Mortgage lenders do not accept direct credit card payments, so you will need to find a workaround service like Plastiq in order to carry out the transaction.

While you're waiting to close on a home, you can still use your credit card, but it's best to only use it for small purchases and pay off the balance in full.

Mortgage lenders don't typically review credit card statements when assessing an application, but will need to know if a portion of your monthly income is going towards credit card debt. This will be factored in when they are calculating your loan-to-value ratio.

It's possible to pay your mortgage with a credit card, but it takes a little effort. Mortgage lenders in general don't accept credit cards. One reason is that mortgage lenders would incur transaction-related fees. Lenders also don't like the idea of your paying one debt by taking on another debt.