Transfer of title to personal property is normally made by a bill of sale. A bill of sale also constitutes a record of what has been sold, to whom, when, and for what price. A sale of animals ordinarily involves the same considerations as the sale of a

Akc Puppy Contract With Breeders

Description

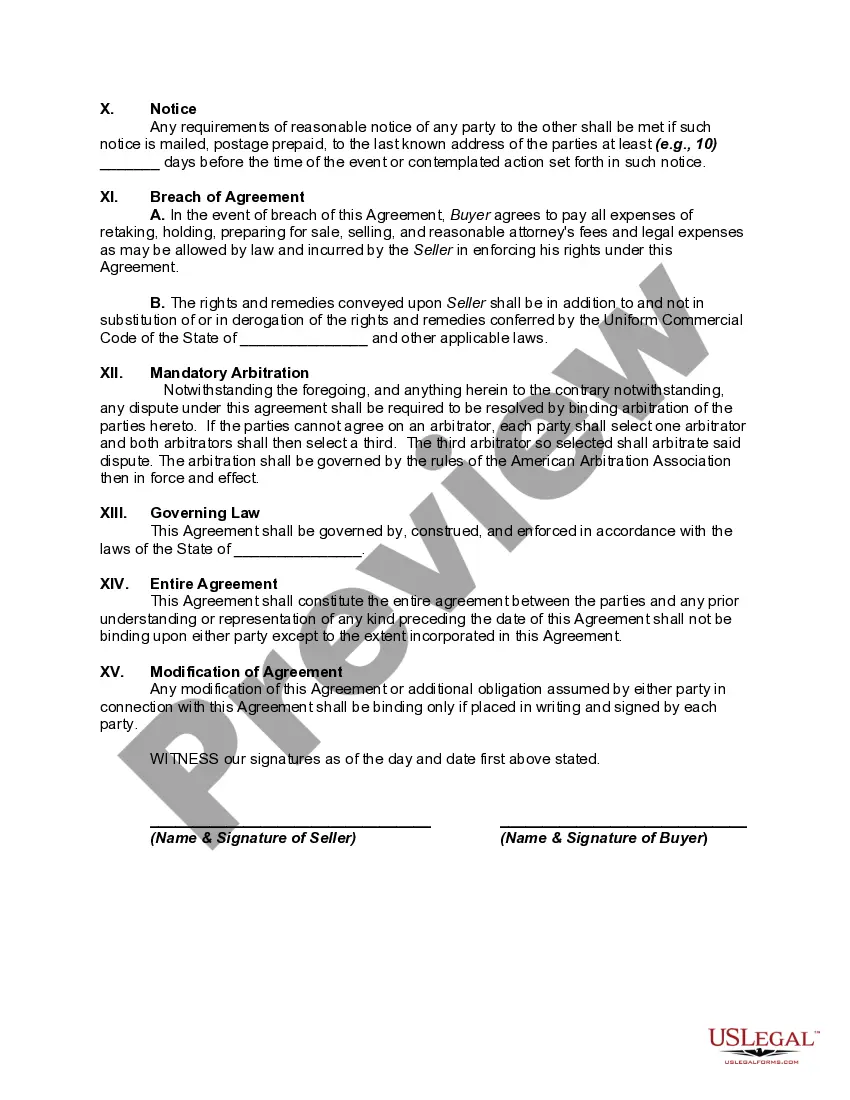

How to fill out Contract Or Agreement For The Sale Of A Puppy Or Dog?

The Akc Puppy Contract With Breeders you see on this page is a reusable formal template drafted by professional lawyers in line with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Akc Puppy Contract With Breeders will take you only a few simple steps:

- Look for the document you need and check it. Look through the sample you searched and preview it or check the form description to ensure it fits your needs. If it does not, use the search bar to get the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Akc Puppy Contract With Breeders (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers again. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.

Steps for Making a Financial Power of Attorney in Connecticut Create the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Land Records Office.

Use LGL-001, Power of Attorney, to authorize one or more individuals to represent you before DRS. This authorization allows your representative(s) to receive and inspect confidential tax information and to act on your behalf in matters before DRS.

CT Title 19 Application is used to apply for Connecticut Medicaid health care coverage. This application allows Connecticut residents to apply for medical assistance. It also provides information about the eligibility requirements, how to apply and other important information about Medicaid in Connecticut.

A Connecticut limited power of attorney form is a legal document that gives an agent the ability to represent the principal to complete a task. The form becomes void once the assignment has been completed, at the expiration date of the document, or at any other time designated by the principal.

You may also call the Centralized Services Unit at 860-263-2750. All requests for files must include the name of the case and docket number. Docket numbers may be available on-line at .jud.ct.gov by utilizing the case look-up function. Files should be available within one or two business days.

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.