Payment Book Template With Spine

Description

How to fill out Receipt For Payments - Template?

It’s clear that you cannot transform into a legal expert instantly, nor is it feasible to swiftly create a Payment Book Template With Spine without possessing a distinct assortment of abilities.

Assembling legal documents is a lengthy undertaking that demands specific training and expertise. So why not entrust the assembly of the Payment Book Template With Spine to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can find everything from court papers to templates for internal business communications. We recognize the significance of compliance and adherence to federal and state regulations.

Click Buy now. Once the payment is completed, you can receive the Payment Book Template With Spine, fill it out, print it, and send or mail it to the indispensable individuals or organizations.

You can revisit your documents from the My documents section at any time. If you are an existing client, you can easily Log In and find and download the template from the same section.

- Start with our website and acquire the document you need in just minutes.

- Locate the form you require using the search bar positioned at the upper part of the page.

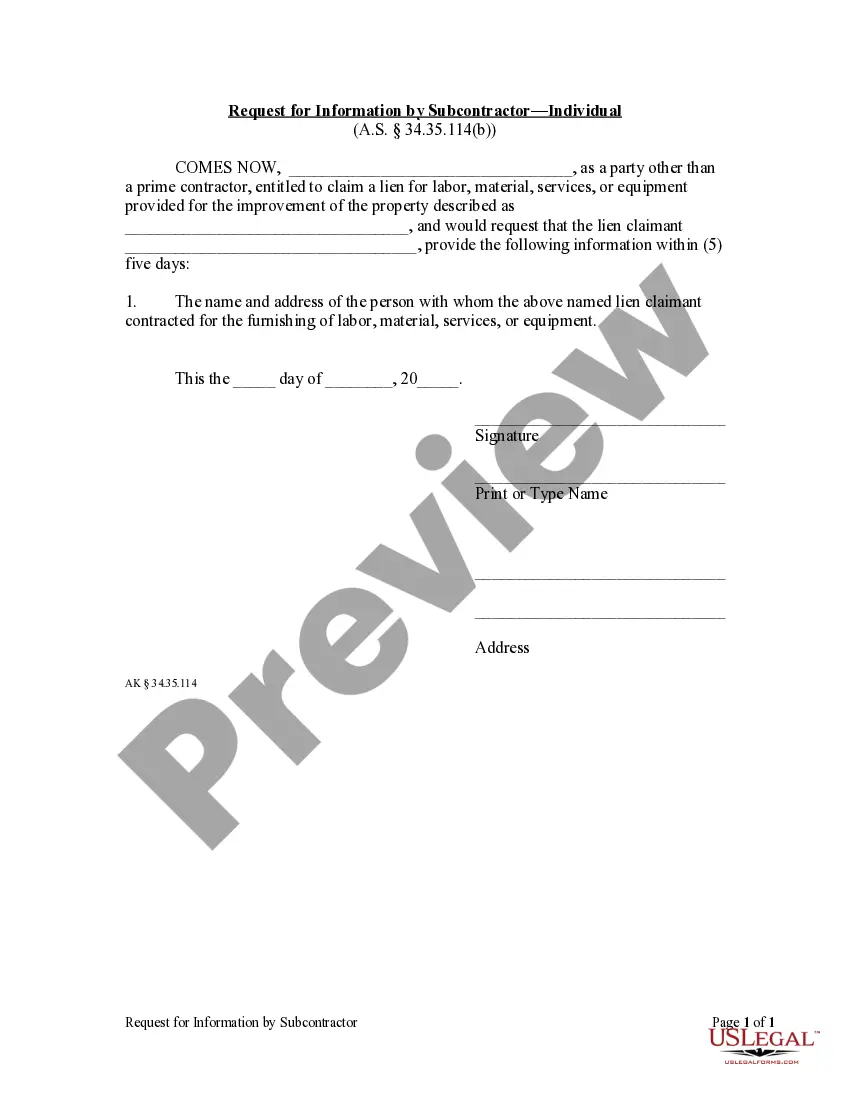

- Review it (if this option is available) and examine the accompanying description to determine if Payment Book Template With Spine is what you are looking for.

- If you need a different document, restart your search.

- Create a free account and select a subscription plan to purchase the form.

Form popularity

FAQ

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

Form 8879 is used for Form 1040, U.S. Individual Income Tax Return; Form 8879-PE, IRS efile Signature Authorization for Form 1065; Form 8879-C, IRS efile Signature Authorization for Form 1120;and Form 8879-S, IRS efile Signature Authorization for Form 1120S.

You do not need to register for an account to file an appeal. If you wish to mail your appeal, you should include the Taxpayer Appeal Form (TAX-610) that came with your NOA and include supporting documentation that outlines why you are appealing.

Recipients of Social Security benefits may be exempt from Vermont tax on part or all of their benefits. If you had Social Security benefits that were taxable in the current tax year as shown on your federal Form 1040, U.S. Individual Income Tax Return, then you may qualify for a Vermont exemption.

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone ? 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time ? except Alaska and Hawaii which are Pacific time.

Employers should work with these employees to make sure that the correct amount of Vermont income tax is withheld, and completing the W-4VT will help. Each employee will need to complete a W-4VT, Employee's Withholding Allowance Certificate in order to calculate their Vermont Income Tax Withholding.

Convenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.

No, Post Offices do not have tax forms available for customers. However, you can view, download, and print specific tax forms and publications at the "Forms, Instructions & Publications" page of the IRS website.