Payment Book Template With Payment

Description

How to fill out Receipt For Payments - Template?

Regardless of whether for corporate intentions or for personal affairs, every individual encounters legal situations at some point during their existence.

Filling out legal documents requires careful consideration, starting with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you won’t need to waste time looking for the correct template online. Use the library’s easy navigation to find the suitable form for any event.

- Locate the template you need by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it corresponds to your situation, jurisdiction, and locality.

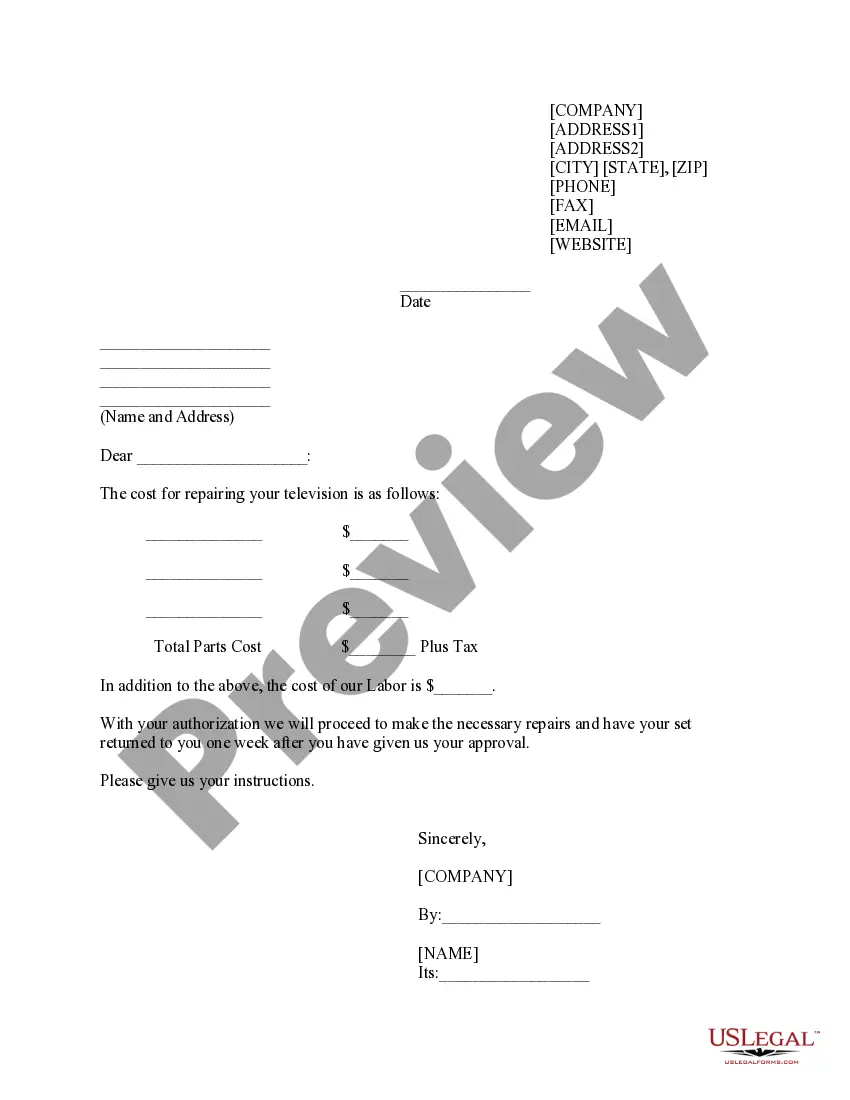

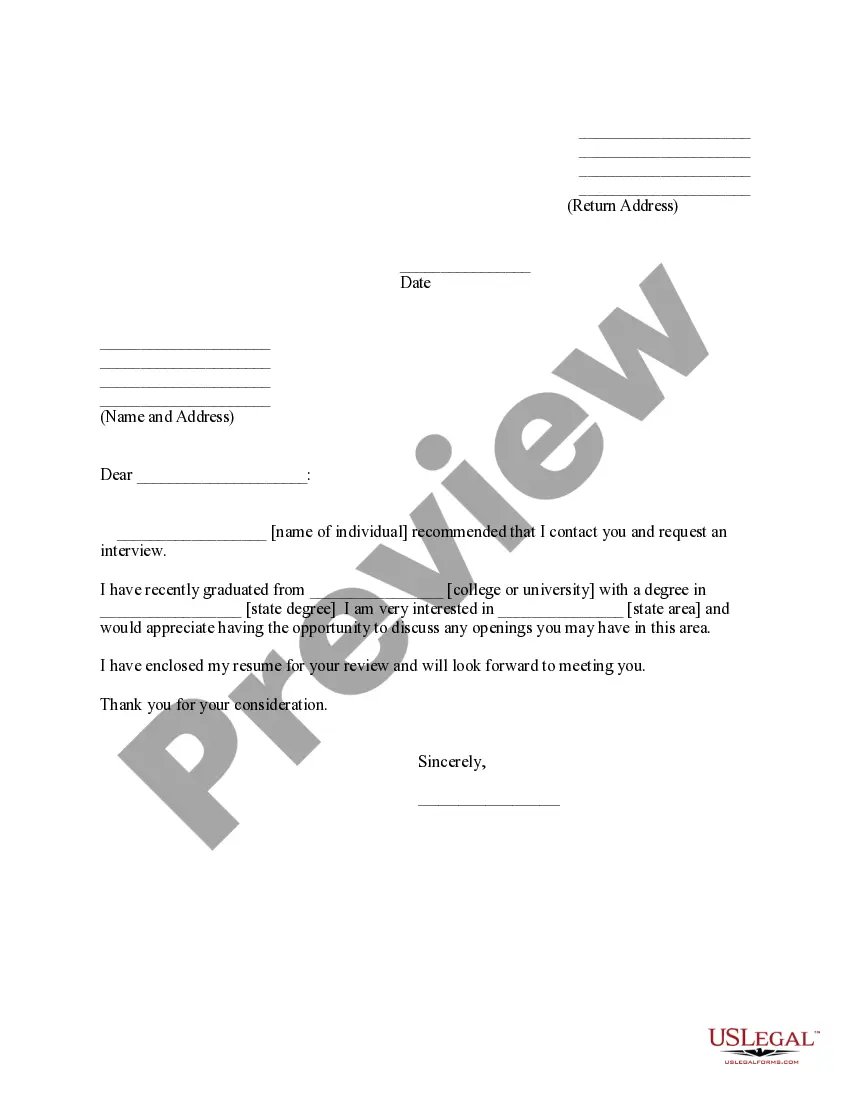

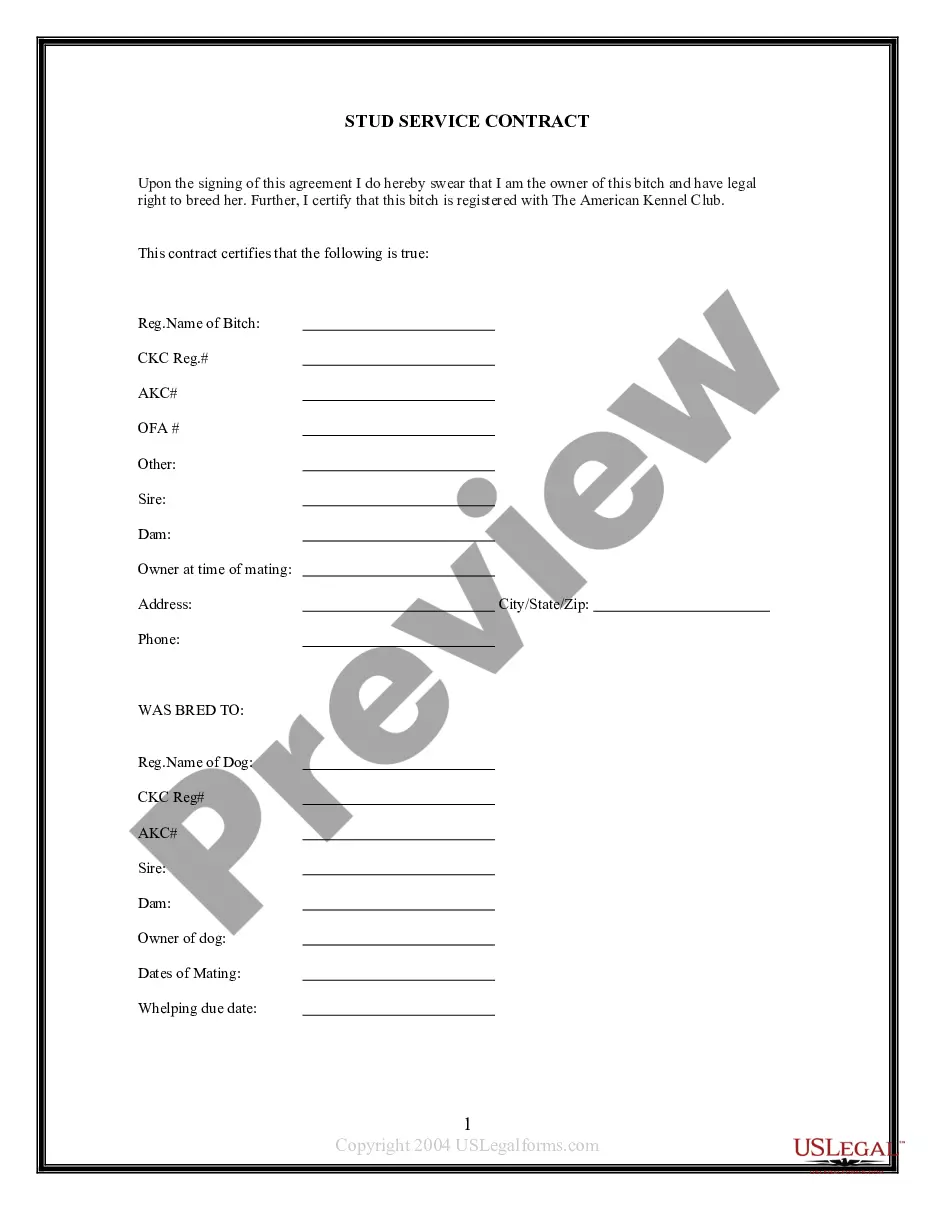

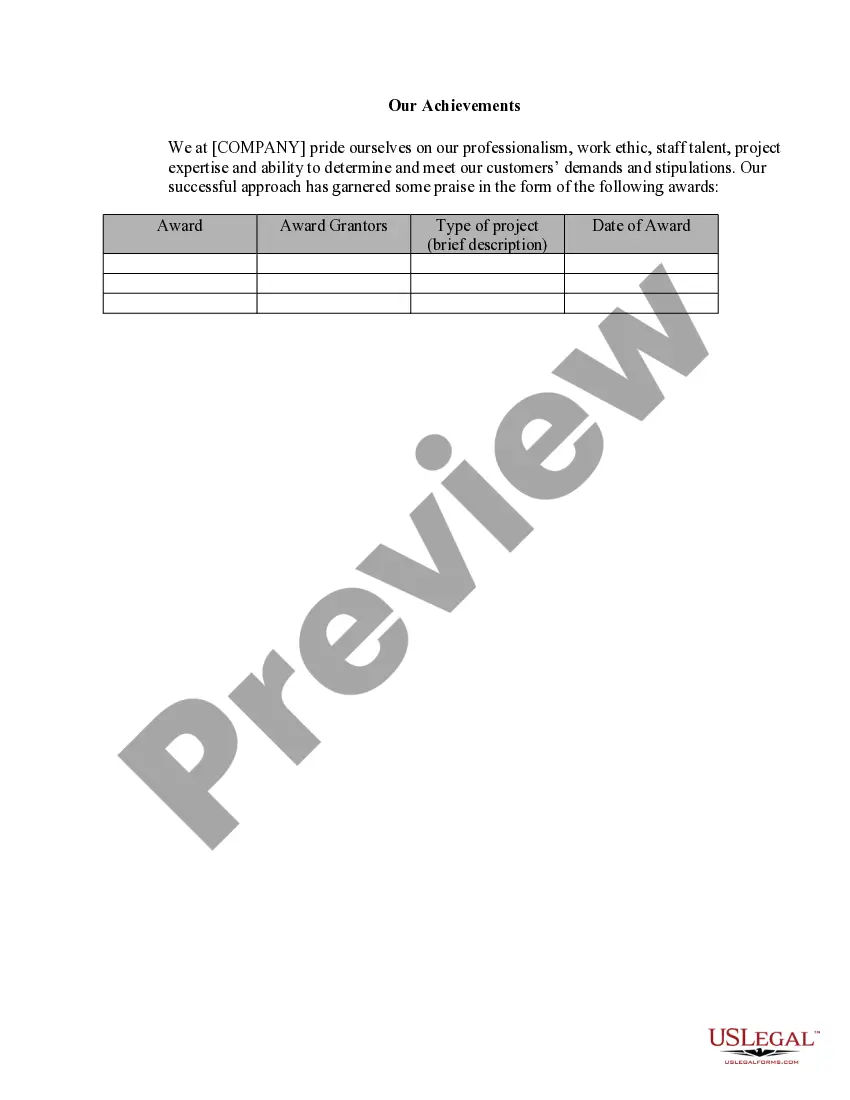

- Click on the form’s preview to scrutinize it.

- If it is not the correct document, return to the search tool to find the Payment Book Template With Payment sample you need.

- Download the template if it fits your requirements.

- If you have a US Legal Forms account, simply click Log in to access saved templates in My documents.

- If you don’t possess an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the registration form for your profile.

- Choose your payment method: you can use a credit card or PayPal.

- Select the document format you prefer and download the Payment Book Template With Payment.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

A revocable trust can be changed at any time by the grantor during their lifetime, as long as they are competent. An irrevocable trust usually can't be changed without a court order or the approval of all the trust's beneficiaries. This makes an irrevocable trust less flexible.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

There are two types of trusts under the jurisdiction of the probate division of the Vermont Superior Court: testamentary and nontestamentary.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

Here's a partial list of assets that may avoid the probate process: Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.