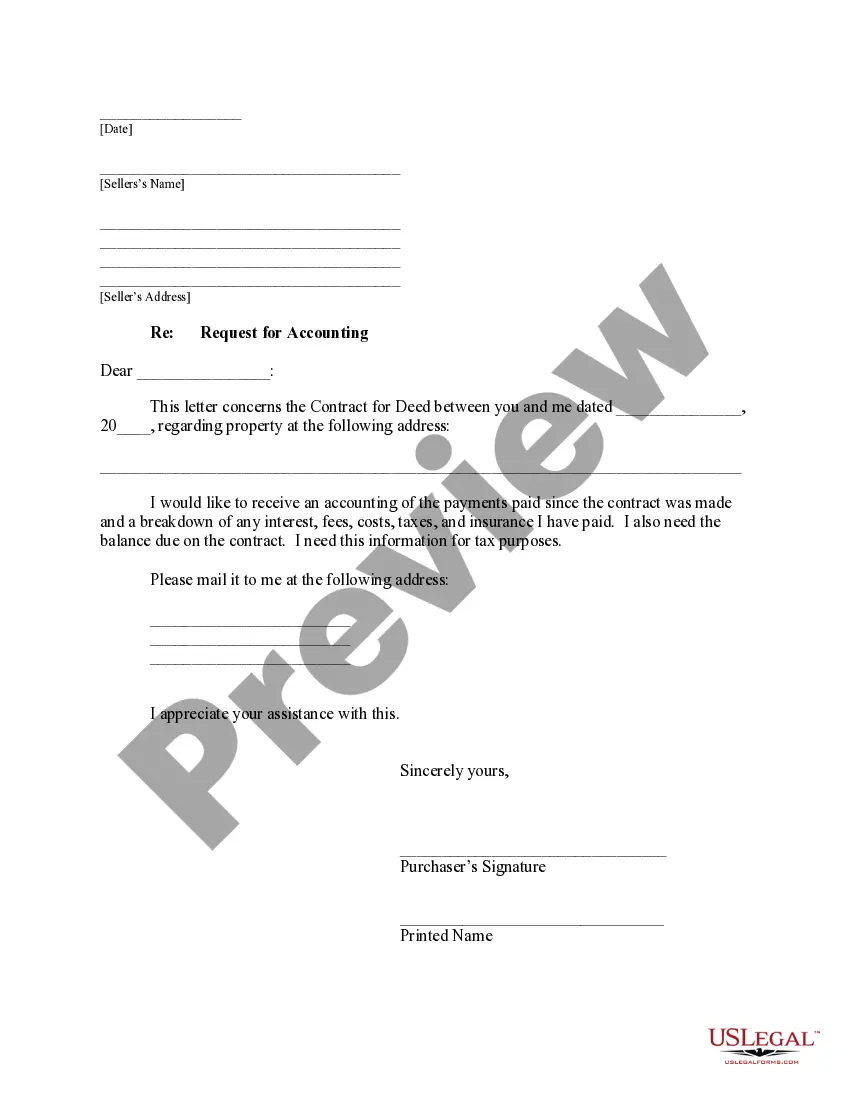

Recibo De Compra Venta Formato

Description

How to fill out Receipt Template For Car Sale?

Engaging with legal documents and protocols can be a lengthy addition to your overall day.

Recibo De Compra Venta Formato and similar forms generally necessitate that you locate them and figure out how to complete them correctly.

Thus, whether you are managing financial, legal, or personal issues, having a comprehensive and efficient online directory of forms readily available will be of significant help.

US Legal Forms is the premier online platform for legal templates, offering more than 85,000 state-specific documents and various resources to help you finalize your paperwork swiftly.

Easily Log In to your account, find Recibo De Compra Venta Formato, and obtain it immediately from the My documents section. You can also access forms you have saved previously.

- Explore the collection of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available at any time for downloading.

- Safeguard your document handling procedures with a top-quality service that enables you to prepare any form in minutes without any additional or concealed costs.

Form popularity

FAQ

Your Nebraska business will most likely need an employer identification number (EIN), casually referred to as a federal tax ID number. It's a 9-digit number that's unique to your business, similar to a social security number. You'll get this number when you register with the federal government.

Form 13, Section B, may be completed and issued by governmental units or organizations that are exempt from paying Nebraska sales and use taxes. See this list in the Nebraska Sales Tax Exemptions Chart. Most nonprofit organizations are not exempt from paying sales and use tax.

To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

Register for a Federal identification number at the Internal Revenue Service (IRS) at 800?829?4933 or their website. A company that has no employees and simply provides a service may not need to register. See "Sales Tax on Services" and Regulation 1?082, Labor Charges.

How much is a Nebraska Business License? Nebraska doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

How much does it cost to get an EIN? Applying for an EIN for your Nebraska LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.