Statement Social Security Sample For Deceased Person

Description

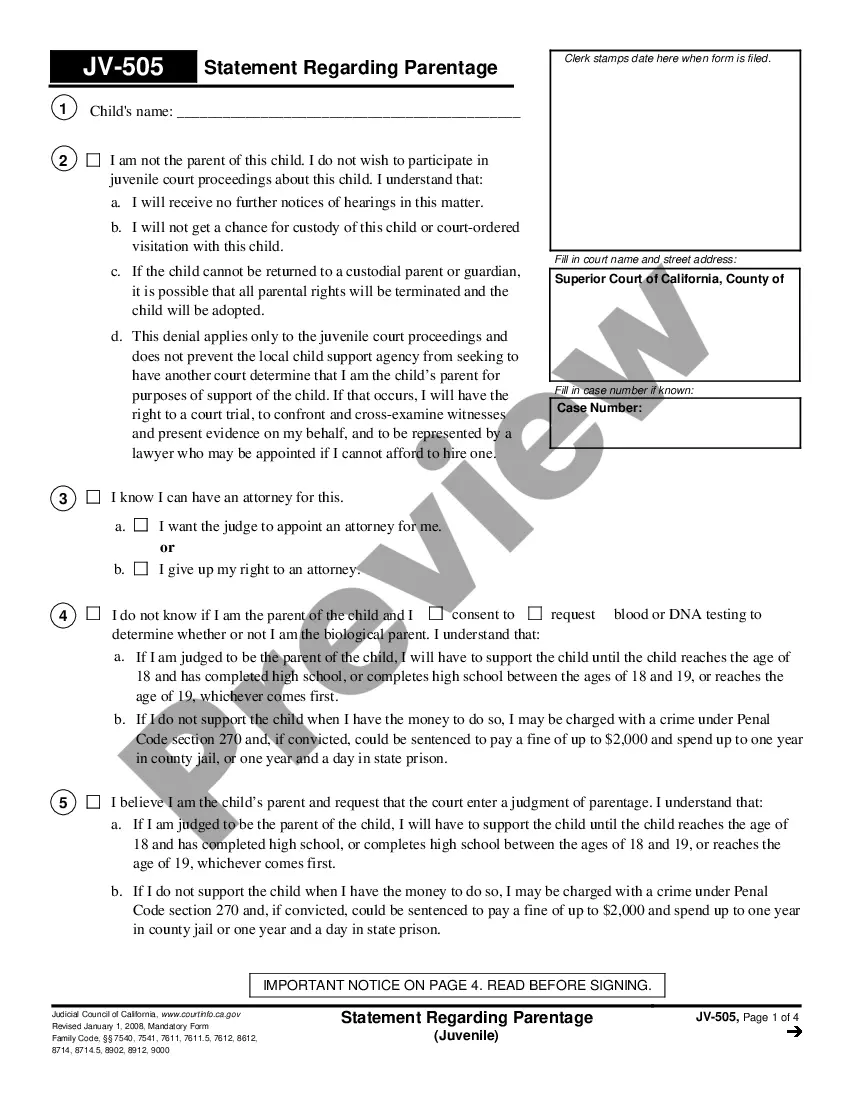

How to fill out Letter Or Statement To Social Security Administration In Order To Establish Claimant's Date Of Eligibility For Benefits?

Managing legal documents and processes can be a lengthy addition to your day.

Statement Social Security Sample For Deceased Individual and similar forms usually necessitate searching for them and figuring out how to fill them out correctly.

For this reason, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific documents and a variety of resources to assist you in completing your paperwork swiftly.

Is it your first time using US Legal Forms? Sign up and establish your account in just a few minutes, and you'll have access to the forms directory and Statement Social Security Sample For Deceased Individual. Then, follow the steps below to complete your document: Ensure you have located the correct form using the Review option and examining the form details. Choose Buy Now when ready, and select the subscription plan that best fits your needs. Click Download, then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience helping users manage their legal documents. Obtain the form you require today and streamline any process effortlessly.

- Explore the collection of pertinent documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific documents available for download at any time.

- Safeguard your document management processes with a high-quality service that enables you to create any form in minutes without additional or concealed fees.

- Simply Log In to your account, locate Statement Social Security Sample For Deceased Individual and obtain it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

You can get a Social Security statement for a deceased parent by calling Social Security at 1-800-772-1213 or by visiting the local Social Security office.

How to Fill Out Social Security Form SSA-1724-F4? First, fill in the information about the deceased. ... Enter your name (applicant's) and indicate your relationship with the above person. Now, type your name, address, and SSN, and answer a few questions about the payments the deceased should have received.

Form SSA-8 | Information You Need To Apply For Lump Sum Death Benefit. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

Widow or widower, age 60 or older, but under full retirement age, gets between 71% and 99% of the worker's basic benefit amount. Widow or widower, any age, with a child younger than age 16, gets 75% of the worker's benefit amount. Child gets 75% of the worker's benefit amount.

Your Social Security number and the deceased worker's Social Security number. A death certificate. (Generally, the funeral director provides a statement that can be used for this purpose.) Proof of the deceased worker's earnings for the previous year (W-2 forms or self-employment tax return).