Acceptance Letter For Trustee

Description

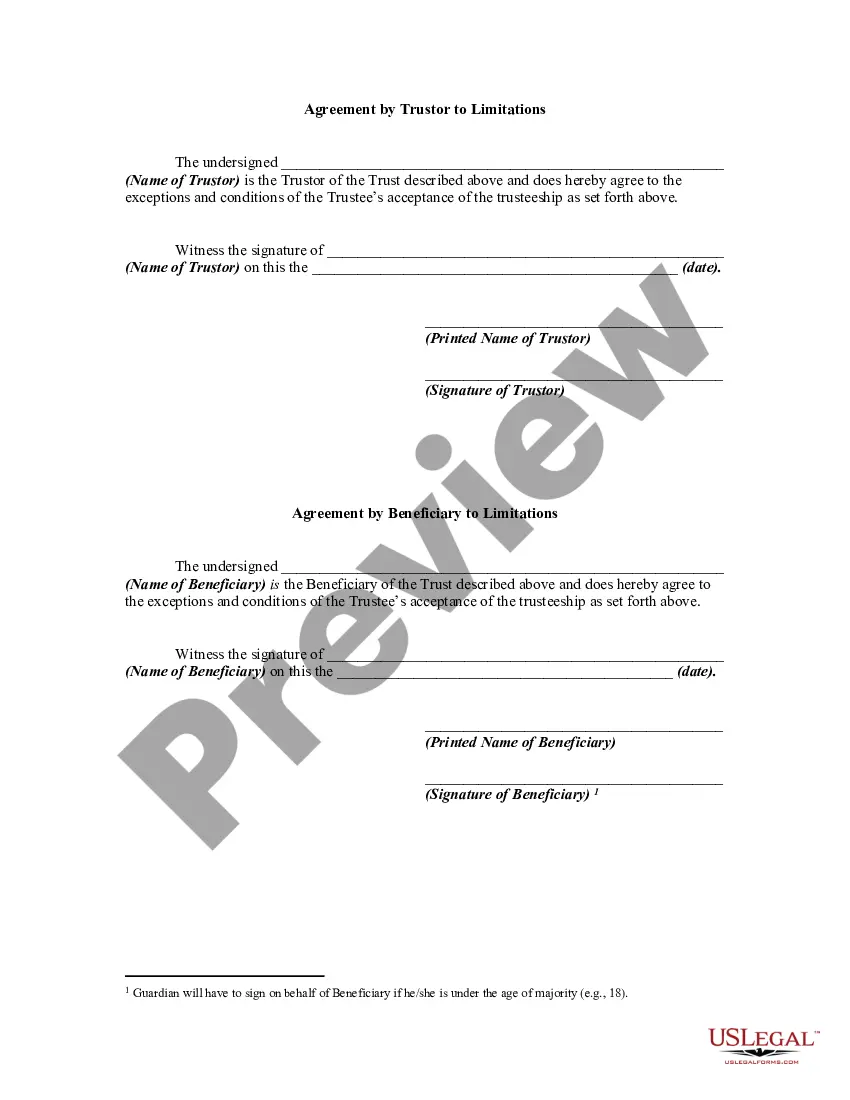

How to fill out Acceptance Of Appointment By Trustee With Limitations?

Legal document administration can be overwhelming, even for seasoned professionals.

When you are looking for an Acceptance Letter For Trustee and lack the time to invest in locating the correct and current version, the process can be burdensome.

US Legal Forms accommodates every need you may have, ranging from personal to business documents, all consolidated in one location.

Utilize cutting-edge tools to finalize and manage your Acceptance Letter For Trustee.

Here are the steps to follow after accessing the form you require: Validate that this is the correct form by previewing it and reviewing its details.

- Access a valuable repository of articles, tutorials, and guides pertinent to your situation and requirements.

- Save time and effort in locating the documents you need, and make use of US Legal Forms’ enhanced search and Review tool to find and obtain your Acceptance Letter For Trustee.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Visit the My documents section to review the documents you have previously saved and manage your folders as desired.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the advantages offered by the library.

- A powerful web form library could be a significant advantage for anyone aiming to navigate these situations efficiently.

- US Legal Forms stands as a frontrunner in online legal forms, offering over 85,000 state-specific legal documents at your convenience.

- With US Legal Forms, you can access legal and business forms specific to your state or county.

Form popularity

FAQ

An employee is paid by the hour, week or month. An independent contractor is usually paid by the job or on a straight commission. An employee's business and travel expenses are generally paid by an employer. This shows that the employee is subject to regulation and control.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

As explained above, the 20-Factor Test provides criteria for assessing how much control and independence a worker has in their relationship with a hiring company. The general goal is to understand whether a business has the right to direct and control a worker's actions.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...

In 2019, the IRS found that this test was too complicated and difficult to apply consistently and revealed a new way of classifying workers in their Employer's Supplemental Tax Guide (2020). Essentially, the IRS compressed the 20-factor test into what we now know as the three-pronged test or the common law test.