Beneficiary Information With The Request

Description

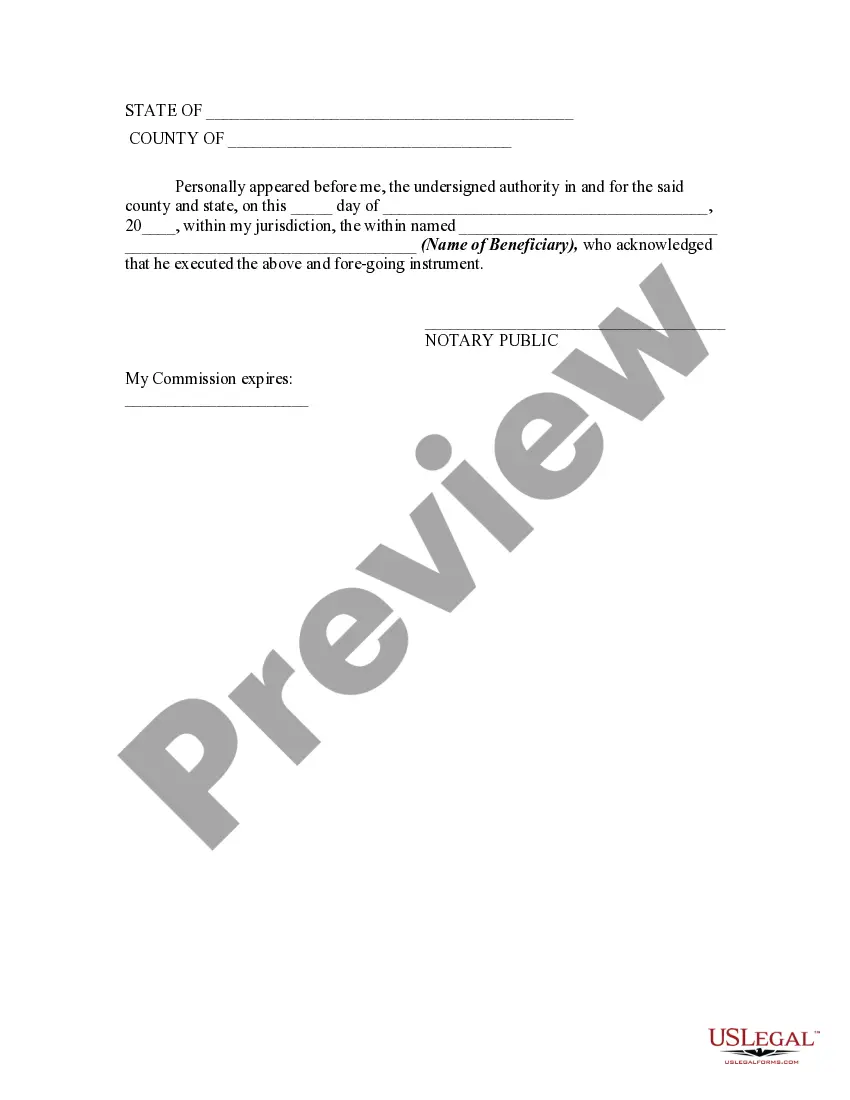

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

- If you’re a returning user, log in to your account, confirm your subscription is current, and select your required form template by clicking the Download button.

- For first-time users, begin by reviewing the form's Preview mode and description to verify its suitability for your needs based on local jurisdiction requirements.

- If you find any discrepancies or need a different document, utilize the Search tab to locate an appropriate template that meets your criteria.

- Proceed to purchase the document by clicking the Buy Now button, followed by selecting a preferred subscription plan and registering for an account for full library access.

- Complete your purchase by providing your payment details via credit card or PayPal to finalize your subscription.

- Once your payment is confirmed, download the form and save it to your device. You can also access it anytime from the My Forms section of your profile.

By following these straightforward steps, you can efficiently access the necessary legal forms tailored to your requirements. US Legal Forms not only offers an extensive selection but also provides users with access to premium experts, ensuring each document is completed accurately and legally compliant.

Start your journey with US Legal Forms today and simplify your legal documentation process.

Form popularity

FAQ

Yes, a spouse can contest a life insurance beneficiary designation under certain circumstances, such as if they were not aware of the policy or if they didn’t consent to the beneficiary choice. In such cases, clear documentation can support the contesting process. Understanding your rights regarding beneficiary information is crucial in these situations.

To find out who is a beneficiary, review the relevant policy documents or financial accounts, as they often contain this information. If necessary, you can also contact the institution that holds the policy or account. For detailed beneficiary information, maintaining organized records is beneficial.

A spouse cannot automatically override the designated beneficiary while the policyholder is alive. However, if the policyholder wishes to change the beneficiary, they can do so at any time. Regularly reviewing and updating your beneficiary information is advisable, especially after major life changes.

Generally, a spouse cannot override a designated beneficiary after the death of the policyholder. The listed beneficiary will receive the benefits as specified in the policy, unless there's evidence of fraud or other issues. It’s important to keep your beneficiary information current to reflect your wishes and avoid conflicts.

Yes, your husband can remove you as his beneficiary, provided he follows the appropriate procedures. He would need to update his beneficiary information formally, often by filling out a new form. Maintaining open communication about beneficiary information can help prevent misunderstandings.

Marriage can impact beneficiary designations, but it doesn't automatically override them. If you marry, your spouse may not automatically become your beneficiary unless you update your beneficiary information. It’s wise to review and, if necessary, modify your beneficiary information after significant life events like marriage.

SF 3102 is a form that individuals use to provide beneficiary information for federal retirement programs. This form ensures that your chosen beneficiaries receive benefits after your passing. It is essential to complete this form correctly to avoid any disputes or confusion regarding beneficiary designation.

Yes, reporting beneficiary income is essential if you receive income from an estate or trust. Failure to report this income may result in fines or penalties. Keeping track of all relevant beneficiary information ensures that you remain compliant with tax regulations and provides a clear overview of your financial obligations.

You can contact the IRS about a deceased person by calling their helpline specifically designed for tax-related inquiries. Be prepared to provide the deceased's Social Security number and any relevant documentation pertaining to their tax situation. This contact ensures that you receive accurate and timely assistance regarding the beneficiary information you need.

Yes, estate income is generally taxable to beneficiaries if it is distributed from the estate after the person's death. Beneficiaries must report their share of any income generated by the estate on their tax returns. Familiarizing yourself with the tax implications of your beneficiary information can help you avoid unpleasant surprises come tax season.