Trust Agreement Form

Description

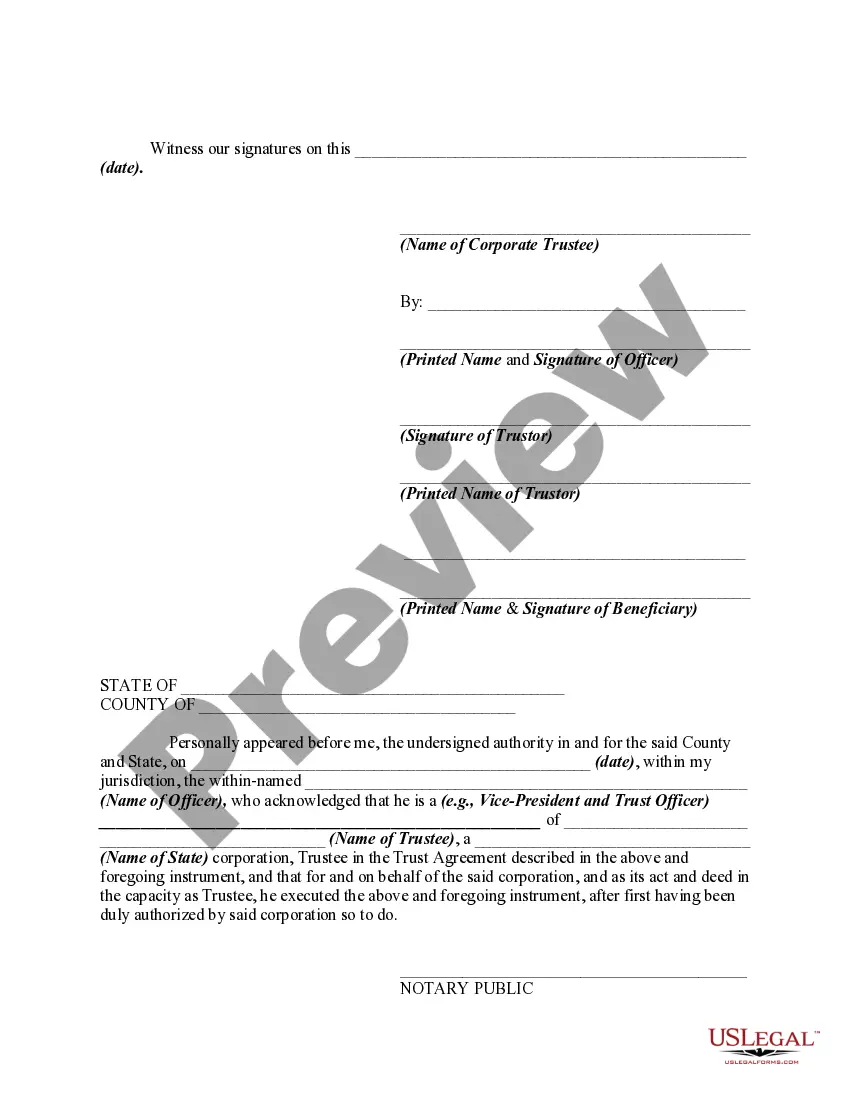

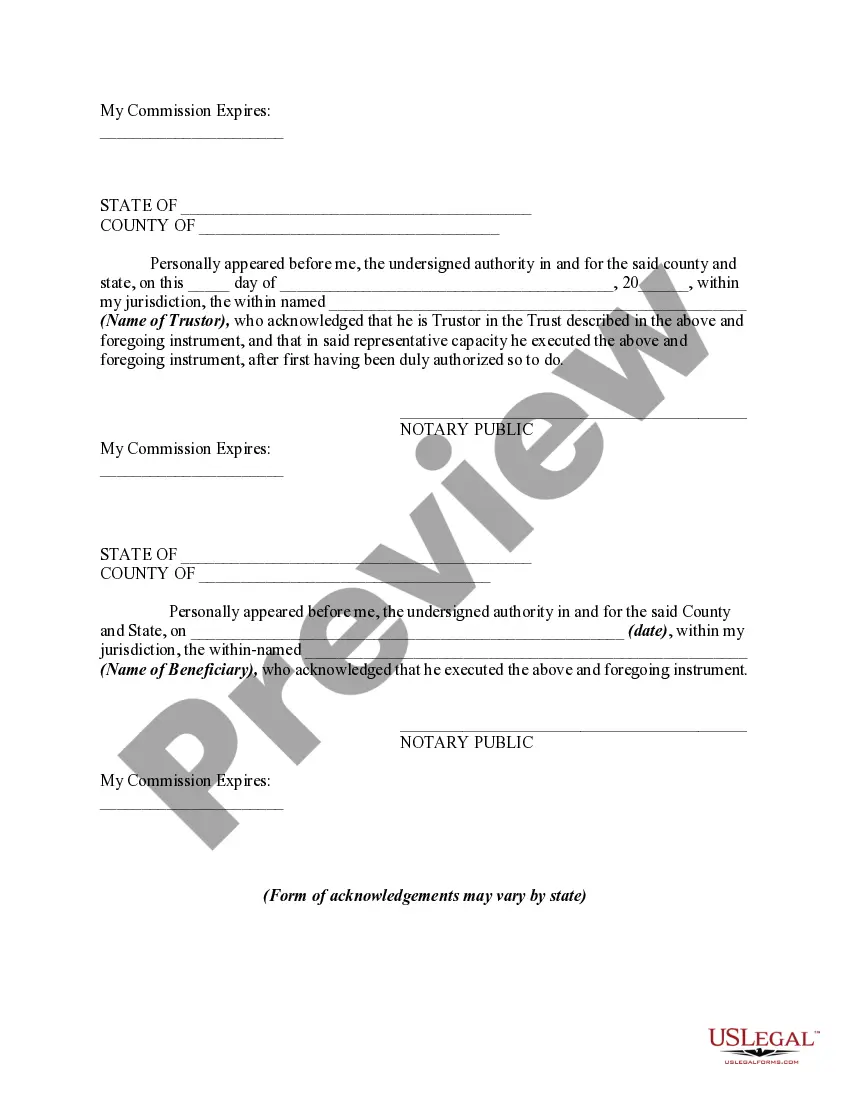

How to fill out Agreement To Renew Trust Agreement?

There's no longer a requirement to spend hours looking for legal documents to adhere to your local state laws.

US Legal Forms has consolidated all of them in one location and enhanced their availability.

Our website offers more than 85,000 templates for various business and personal legal situations categorized by state and purpose.

Utilize the Search bar above to find another sample if the previous one did not meet your needs. Click Buy Now next to the template name when you identify the correct one. Select the most suitable pricing plan and create an account or Log In. Complete your subscription payment with a credit card or via PayPal to proceed. Choose the file format for your Trust Agreement Form and download it to your device. Print your form to fill it in by hand or upload the sample if you prefer to use an online editor. Preparing official documentation under federal and state laws and regulations is fast and straightforward with our library. Experience US Legal Forms today to maintain your documentation in order!

- All forms are properly drafted and verified for legitimacy, so you can trust in acquiring an up-to-date Trust Agreement Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents anytime by accessing the My documents tab in your profile.

- If you have not interacted with our platform before, the process will involve a few more steps to complete.

- Here's how new users can locate the Trust Agreement Form within our catalog.

- Review the page content thoroughly to verify it includes the sample you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

A trust agreement is an estate planning document that allows you to transfer ownership of your assets to a third party. In this case, your legal role is trustor, while the other party's role is trustee.

There are three basic characteristics that define a simple trust: The trust must annually distribute to the beneficiaries any income it earns on trust assets. The trust cannot distribute the principal of the trust. The trust cannot make distributions to charitable organizations.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Here are five things you should do before writing a living trust:Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own.Find the Paperwork for Your Assets.Choose Beneficiaries.Choose a Successor Trustee.Choose a Guardian for Your Minor Children.