Trust Revocation Form California

Description

How to fill out Consent To Revocation Of Trust By Beneficiary?

Handling legal paperwork and operations can be a lengthy addition to the day.

Trust Revocation Form California and similar forms usually require you to search for them and find your way to fill them out accurately.

Consequently, if you are managing financial, legal, or personal issues, having a thorough and accessible online library of forms available will greatly assist.

US Legal Forms is the leading online source for legal templates, featuring over 85,000 state-specific documents and a variety of tools to facilitate quick completion of your forms.

Is this your first time utilizing US Legal Forms? Register and create an account in a few minutes, and you’ll gain access to the form library and Trust Revocation Form California. Then, follow the instructions outlined below to complete your form.

- Browse the collection of pertinent documents available to you with a simple click.

- US Legal Forms provides state- and county-specific documents available for download at any time.

- Safeguard your document management tasks using a premium service that lets you prepare any form within minutes with no additional or hidden charges.

- Simply Log In to your account, locate Trust Revocation Form California, and download it instantly in the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

If the trust is revocable, the person who set up the trust or grantor, has the right to remove the house from their trust by executing a deed conveying the property from the trust back to the grantor.

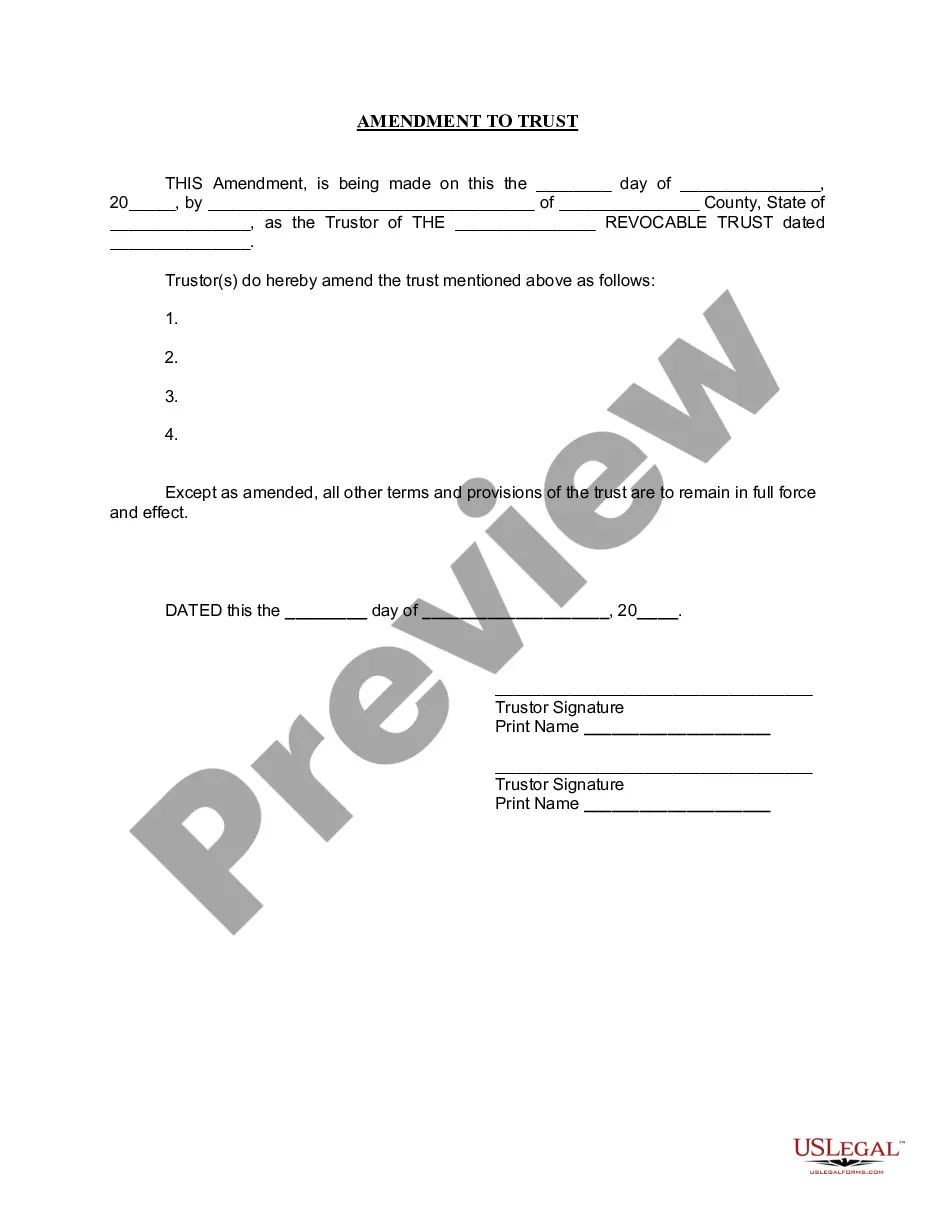

(a) A trust that is revocable by the settlor may be revoked in whole or in part by any of the following methods: (1) By compliance with any method of revocation provided in the trust instrument. (2) By a writing (other than a will) signed by the settlor and delivered to the trustee during the lifetime of the settlor.

The idea here is that you present a formal document that irrevocably states your wish to dissolve the trust. From there, you should have the document signed by the grantor, notarized, and potentially filed in court.

The first step to revoking a living trust is to remove the assets from the trust. This involves retitling the assets back into your name. Next, you will need to fill out a formal revocation form stating your desire to terminate the trust. The revocation form will then need to be signed and notarized.

The two most common ways to terminate and/or modify an irrevocable trust is to 1) argue that there has been a change of circumstances not anticipated by the settlors at the time they created the trust (for example changes in tax law, and 2) argue that all beneficiaries consent to the proposed termination and or ...