Revocation Receipt Trustee For Trust

Description

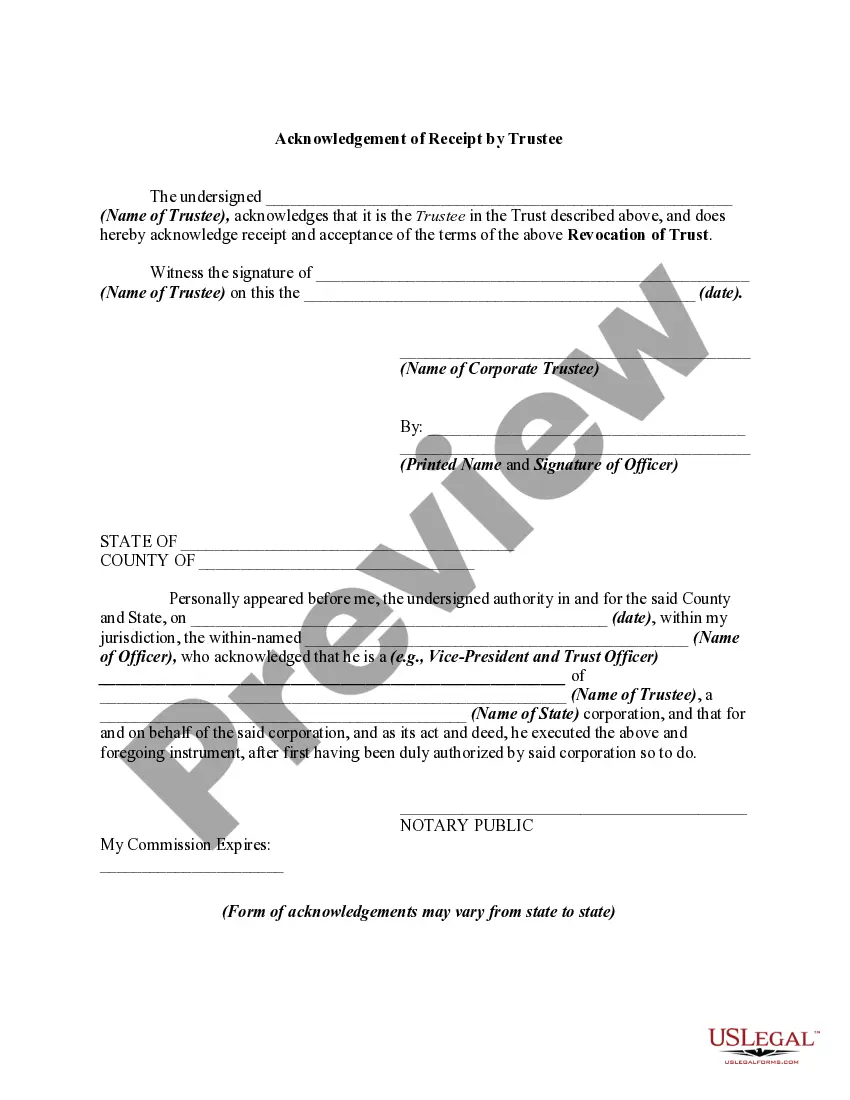

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

- If you're a returning user, log in to your account and locate the necessary form template. Ensure your subscription is active; renew if necessary.

- For first-time users, begin by checking the Preview mode and form description to confirm the template meets your legal requirements.

- Should you need an alternative, use the Search tab to find other suitable forms, ensuring they align with your jurisdiction.

- Purchase the selected document by clicking the Buy Now button and choosing your subscription plan; account registration is required for full access.

- Complete your payment using your credit card or PayPal to finalize the subscription.

- Download your revocation receipt trustee form and keep it on your device, accessible anytime via the My Forms section.

In conclusion, US Legal Forms empowers users to handle their legal documentation needs with ease and confidence. By following these steps, you can secure your revocation receipt trustee for trust swiftly and accurately.

Start your journey with US Legal Forms today to experience the benefits of hassle-free legal documentation!

Form popularity

FAQ

Yes, a nursing home can potentially access the assets within a revocable trust to cover care costs. Since these assets remain part of your estate, they are not exempt from being used for medical expenses. To protect your assets, consider speaking with an estate planning expert who can guide you on how to structure your trust efficiently. Utilizing a revocation receipt trustee for trust can also aid in the proper documentation and management of your trust assets.

Revocation of trust refers to the process of formally canceling a revocable trust. This allows you, as the trustee, to take back control of the assets and reallocate them as desired. It's essential to follow the appropriate legal procedures to ensure a valid revocation. Using a revocation receipt trustee for trust can help streamline documentation and record-keeping during this process.

Choosing between a revocable trust and an irrevocable trust depends on your goals. A revocable trust offers flexibility and control, allowing you to make changes as needed. However, an irrevocable trust often provides better protection against creditors and may reduce estate taxes. The right choice hinges on your specific circumstances and needs.

A revocable trust can be easily altered or revoked, which is beneficial, but this flexibility also creates some disadvantages. The trust's assets are included in your estate for tax purposes, potentially leading to higher estate taxes. Additionally, creditors can reach these assets, unlike in some irrevocable trusts. Thus, you should consider your financial situation carefully.

Removing a trustee from a trust can be accomplished through a few different methods. First, you may need to check the trust document for specific provisions regarding the removal process. If no clear steps are outlined, a legal process may be necessary, often requiring a court's involvement to ensure the interests of the beneficiaries are protected. Using a revocation receipt trustee for trust can help facilitate this process, ensuring the necessary changes are documented and legitimate.

To write a revocable trust, start by outlining your assets and determining how you want to manage them during your lifetime. Create a revocation receipt trustee for trust as part of your document, to allow modifications whenever necessary. Clearly name your trustee, beneficiaries, and outline any specific terms you wish to include. US Legal Forms offers user-friendly resources to help you craft a legally sound revocable trust tailored to your needs.

Yes, in California, a revocation of trust typically must be notarized to be effective. Having a notary public sign your revocation receipt trustee for trust adds a layer of legal validity. This step ensures that the document meets state requirements and protects your rights. For more straightforward handling of these documents, consider using US Legal Forms for accurate templates that comply with California laws.

To remove someone from a revocable trust, you will need to execute a revocation receipt trustee for trust. This document formally announces the removal and must be signed by you, the trustmaker. Additionally, you should notify the trustee and any beneficiaries involved to keep everyone informed about the changes. Using a reliable platform like US Legal Forms can simplify this process with templates that guide you effectively.

A trustee revokes a trust by following the instructions outlined in the trust document. This often involves creating a written declaration of revocation, signed in accordance with state laws. This declaration should indicate clearly that the trust is no longer in effect. Using a revocation receipt trustee for trust can assist in documenting this essential process to avoid future confusion.

A revocation clause typically states that a specific trust is nullified. For instance, the clause might read, 'This trust is hereby revoked in its entirety.' It is important to include detailed instructions regarding what happens to the trust’s assets after revocation. Implementing a revocation receipt trustee for trust can document this process effectively.