Amendment Trust Agreement With Withdrawal

Description

How to fill out Amendment To Trust Agreement In Order To Add Property From Inter Vivos Trust And Consent Of Trustee?

There's no longer a requirement to squander hours searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our website offers over 85k templates for any business and personal legal matters compiled by state and area of utilization.

Preparing formal documents in accordance with federal and state regulations is quick and straightforward with our library. Experience US Legal Forms today to maintain your documentation in order!

- All forms are properly drafted and confirmed for legality, ensuring you receive an up-to-date Amendment Trust Agreement With Withdrawal.

- If you are acquainted with our service and already possess an account, you must verify your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents at any time by opening the My documents tab in your profile.

- If you've never utilized our service previously, the process will require a few additional steps to finish.

- Here's how new users can locate the Amendment Trust Agreement With Withdrawal in our library.

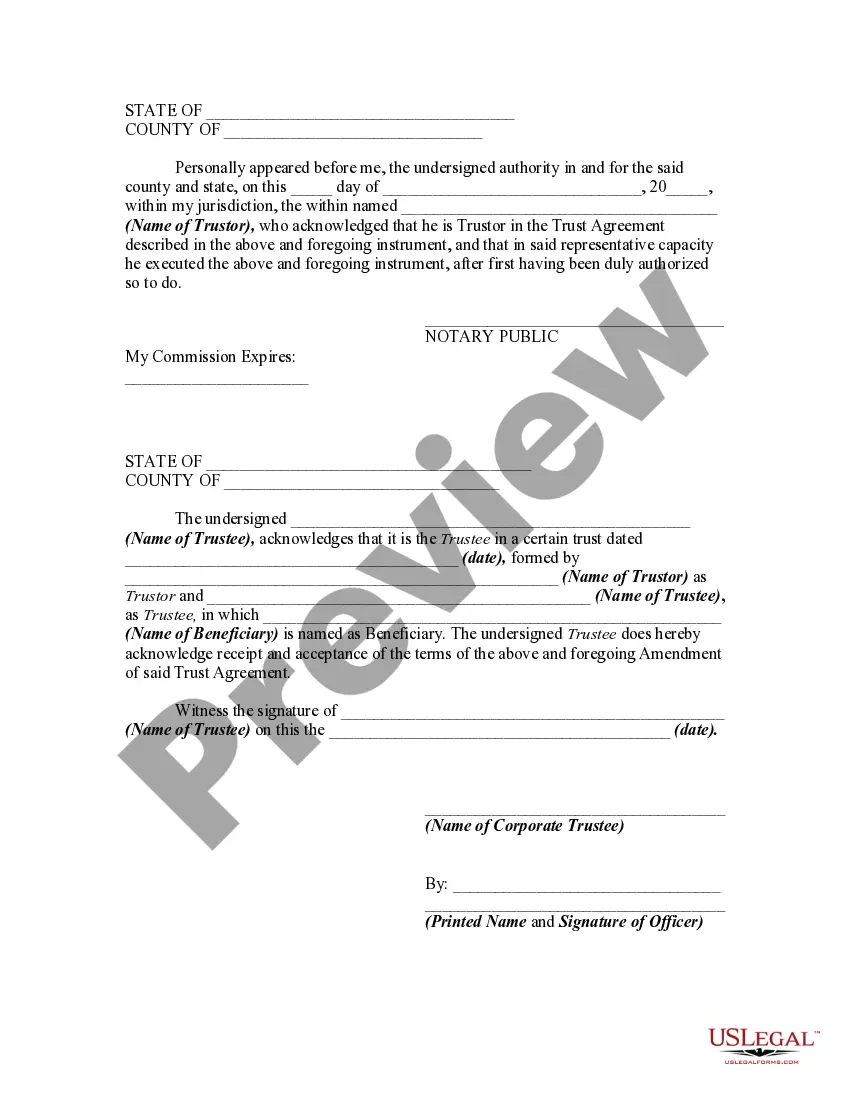

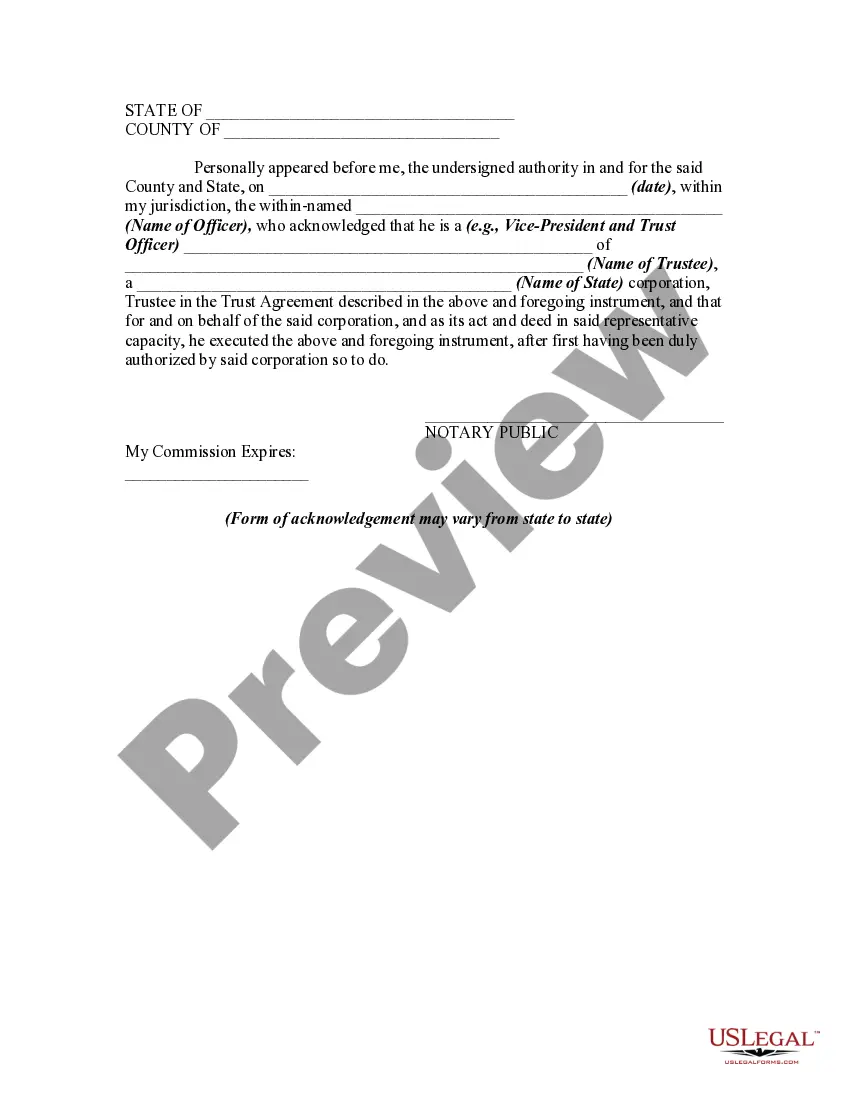

- Read the page content attentively to ensure it contains the example you require.

- Use the form description and preview options if available.

Form popularity

FAQ

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Shares of Class A Common Stock represented by Trust Interests may be withdrawn from the Voting Trust only (a) upon written notice by a Beneficiary to the Trustee (a Class A Notice of Withdrawal) or (b) in connection with an Ineligibility Withdrawal or a Selling Withdrawal (each as defined below).

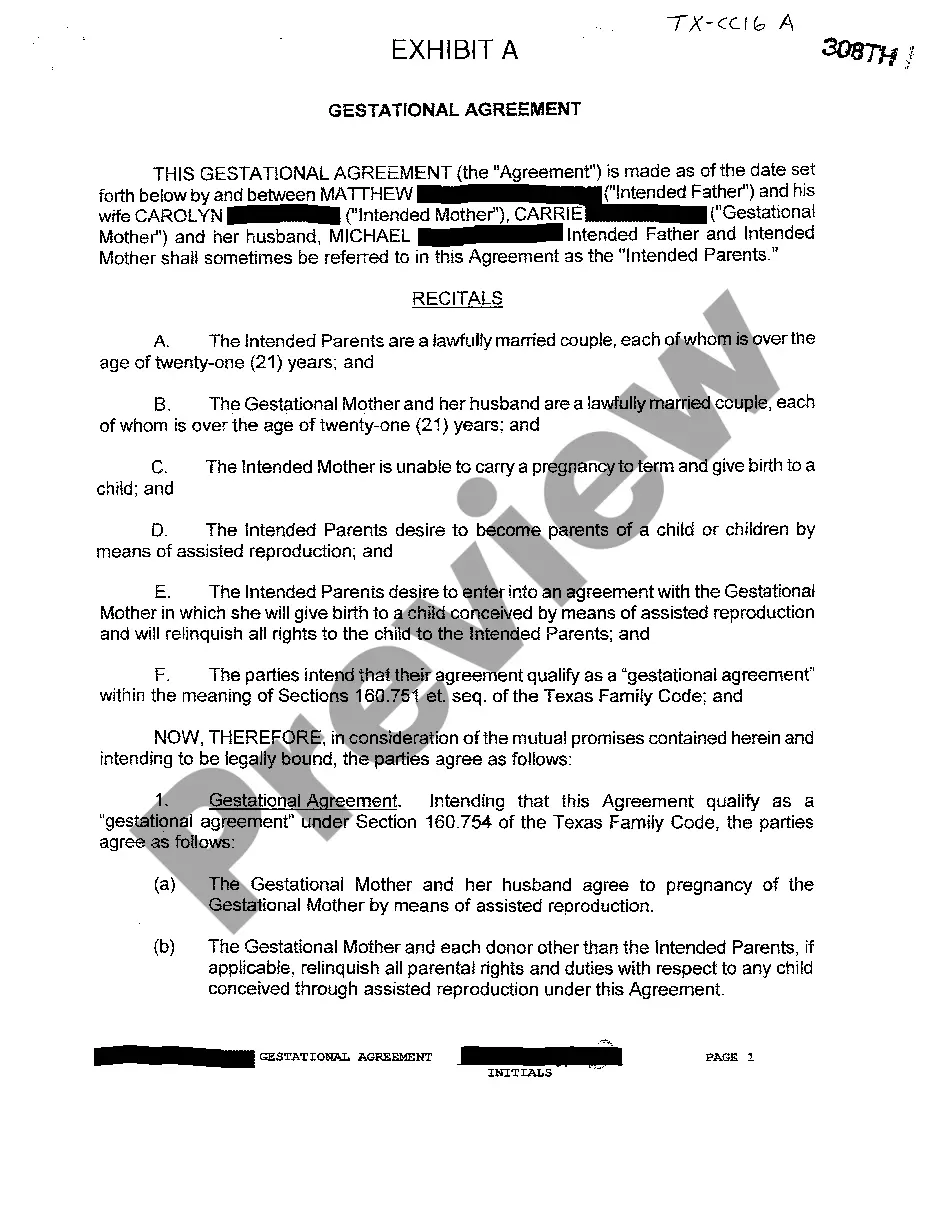

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as amending the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

A trust amendment is a legal document that is used to change specific provisions of a revocable living trust. Examples of changes to specific provisions of a trust includes changing the successor trustee, updating the beneficiaries, or changing specific bequests of the trust property.

The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.