How Can A Trust Be Dissolved

Description

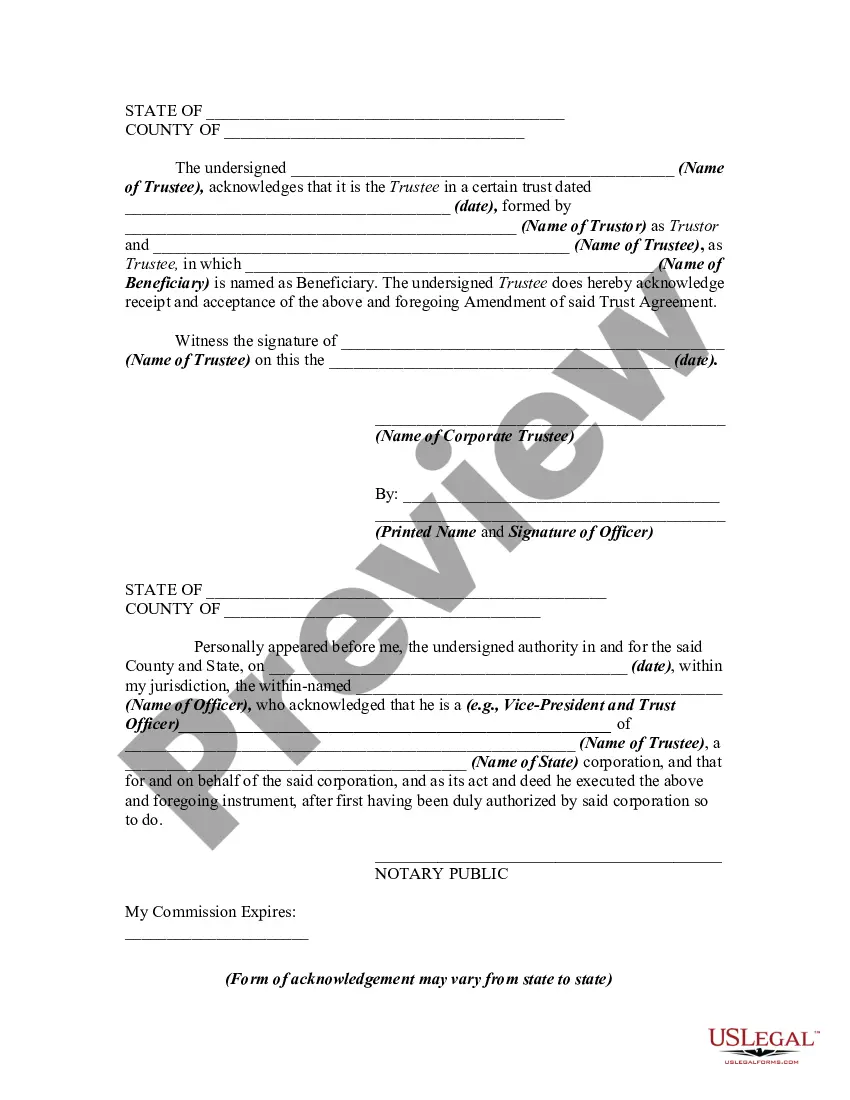

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

- Log into your US Legal Forms account and ensure your subscription is active.

- Review the library for trust dissolution forms that meet your specific requirements and comply with local laws.

- Utilize the Search feature to find any additional templates you may need if the initial one does not fit your needs.

- Select the form you require and click on the 'Buy Now' button to choose a subscription plan suited to your needs.

- Complete your purchase with your payment information, either through credit card or PayPal.

- Download the necessary forms to your device, and access them anytime through the 'My Forms' section in your profile.

By utilizing US Legal Forms, you empower yourself with access to a vast library of over 85,000 legal forms, ensuring that you have what you need to handle the dissolution of a trust. This service not only provides extensive resources but also connects users with premium experts for assistance, enabling you to create legally sound documents with ease.

Take control of your legal needs today and start using US Legal Forms for your trust dissolution and more!

Form popularity

FAQ

The difficulty of dissolving a trust largely depends on its terms and type. For many, understanding how a trust can be dissolved is essential, especially in the case of irrevocable trusts. This process often involves navigating legal complexities which might require expert advice. Utilizing services from platforms like US Legal Forms can simplify the journey, providing the necessary support and documentation to effectively dissolve the trust.

The time required to dissolve a trust varies widely based on factors such as the type of trust and the specific circumstances involved. In cases of revocable trusts, the process can often be completed quickly, sometimes within weeks. On the other hand, dissolving an irrevocable trust can take longer, typically requiring a legal review and possibly court approval to ensure that all parties are informed. For a clearer timeline, consider consulting with resources like US Legal Forms.

Breaking a trust is not necessarily a straightforward process, but it can be achieved depending on the circumstances. To understand how a trust can be dissolved, you must first examine the terms set forth in the trust document itself. If the trust is revocable, the process is generally simpler, and the grantor can dissolve it at any time. However, for irrevocable trusts, legal assistance may be required to navigate the complexities involved.

A trust can be considered void if it contains illegal provisions, is created with fraudulent intent, or if the creator did not have the mental capacity required to establish a valid trust. Moreover, an absence of essential elements, like beneficiaries or a valid purpose, can also render a trust void. Knowing what makes a trust void can illuminate your options on how a trust can be dissolved properly.

A trust may be deemed invalid for several reasons, including lack of proper documentation, failure to meet the requirements of the law, or if the creator of the trust lacked capacity at the time of creation. Additionally, if the trust's purpose becomes impossible or illegal, it can also be declared invalid. Understanding these factors is essential when considering how a trust can be dissolved or challenged.

The 5 year rule for trusts often refers to taxation of assets held in a trust when distributions are made. Generally, it means that if a trust terminates or assets are distributed within five years of the establishment of the trust, there may be adverse tax consequences. Understanding this rule is crucial for effective estate planning. Explore how a trust can be dissolved while minimizing tax impact by leveraging resources from US Legal Forms.

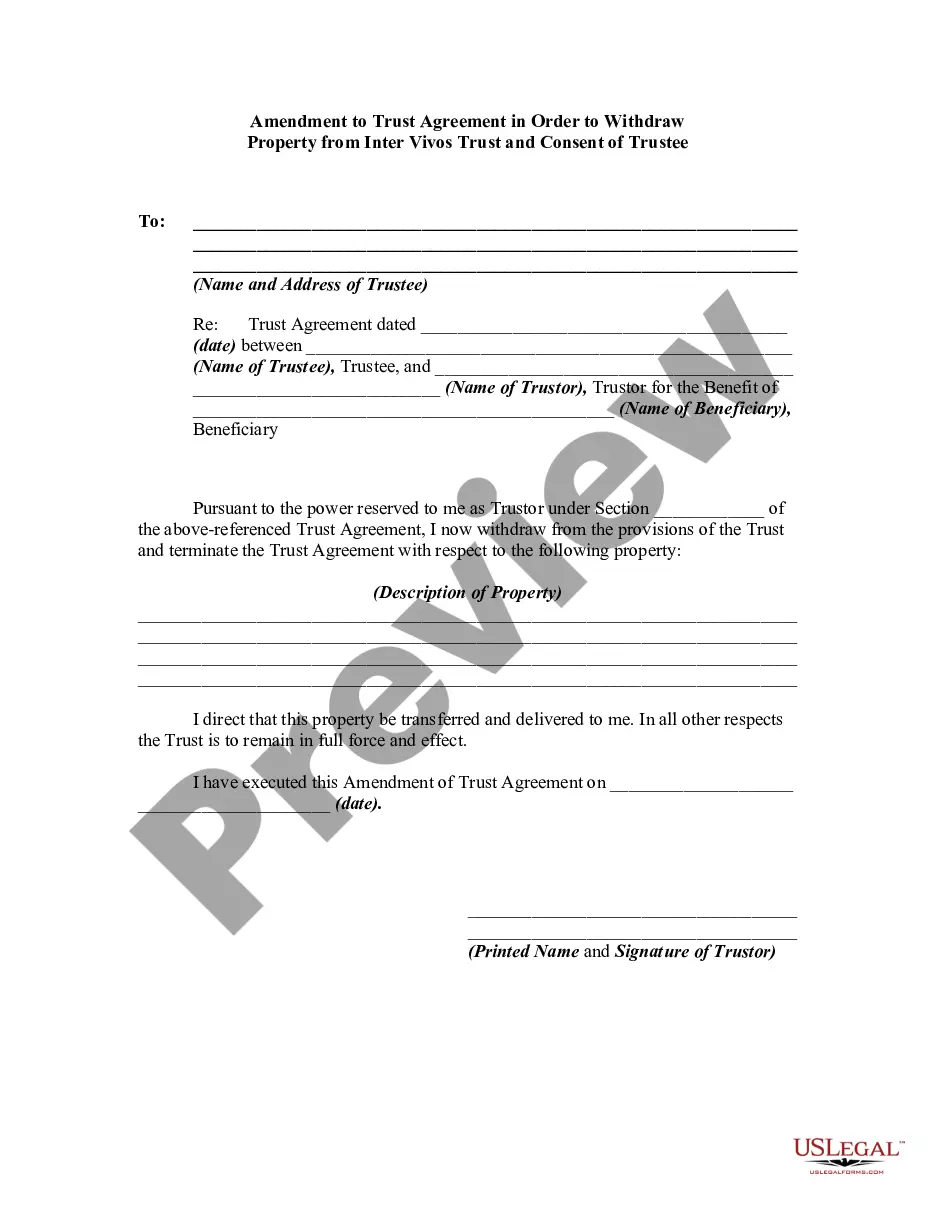

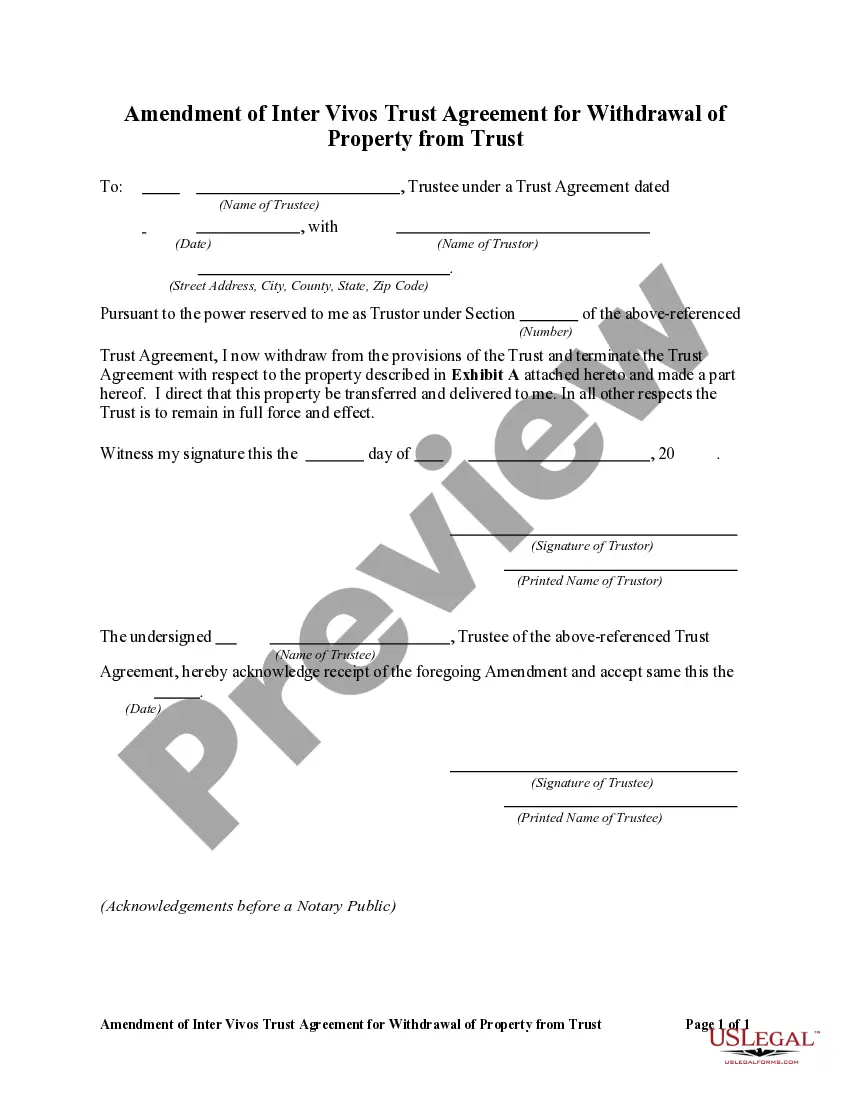

To dissolve a trust, you typically need to follow specific legal procedures, which may include getting consent from all beneficiaries or proving that the trust's purpose has been fulfilled. Depending on your state, you may need to file certain documents in court. It's essential to consult with legal experts to ensure you adhere to your state’s regulations on how a trust can be dissolved effectively and smoothly.

When you terminate a trust, the assets within it must be distributed according to the trust's terms or as required by law. This action can result in various tax implications, including potential capital gains taxes. It is crucial to understand how terminating the trust affects the beneficiaries and the overall estate plan. Therefore, knowing how a trust can be dissolved is vital to avoid unexpected issues down the line.

To understand how a trust can be dissolved, you should follow a clear process. Start by reviewing the trust document, as it typically outlines the steps required for dissolution. Next, notify beneficiaries and settle any outstanding obligations or debts. Lastly, transfer the remaining assets to the appropriate parties, ensuring compliance with state laws. For assistance, consider using US Legal Forms, which provides resources that simplify the process.

When considering how a trust can be dissolved, it's important to understand the tax implications. The trust may incur capital gains taxes if it sells assets, which becomes taxable income for the beneficiaries. Additionally, any income generated before the dissolution must be reported on tax returns. Consulting a tax professional is advisable to navigate these complexities effectively.