Trustee Securitizadora

Description

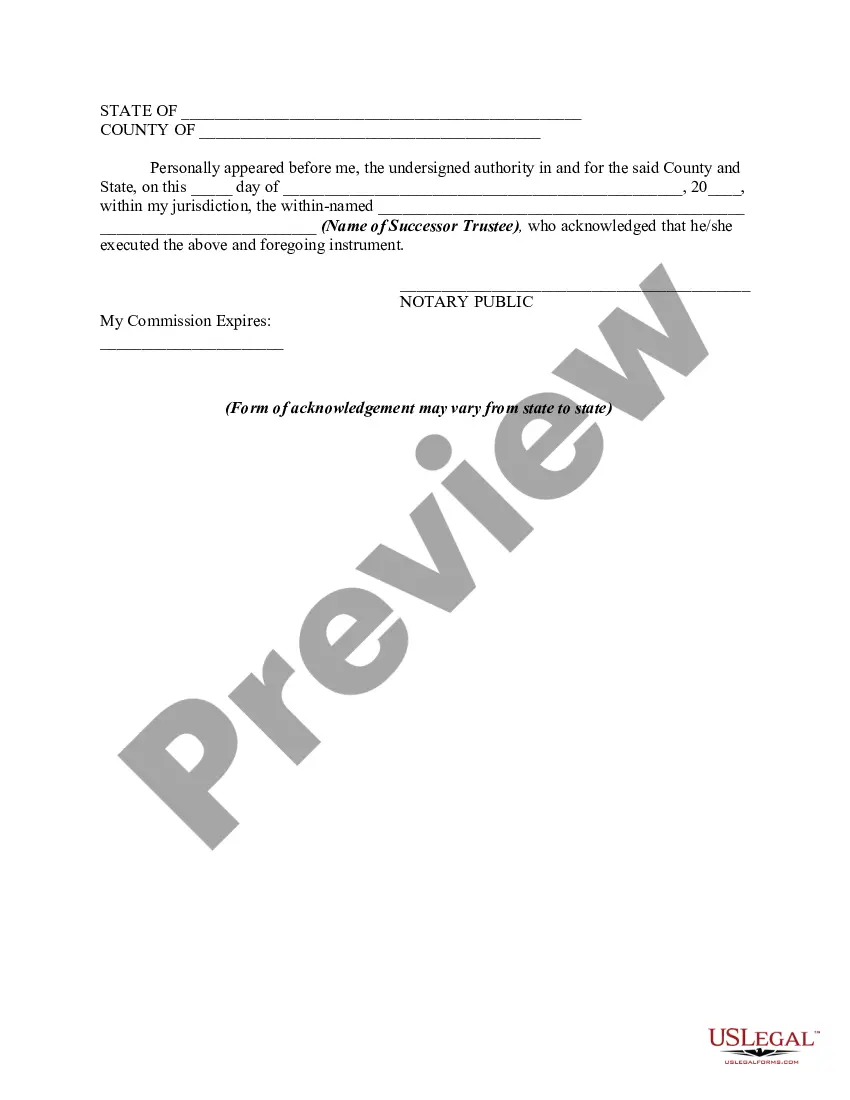

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- If you're a returning user, log into your account to access and download your required form template. Verify that your subscription is active; renew if necessary.

- For first-time users, start by browsing the Preview mode to read the form descriptions and confirm you've selected the one that meets your needs according to your jurisdiction.

- If the selected template doesn’t fit your requirements, use the Search tab above to explore other forms until you find the right one.

- After identifying the correct document, click on 'Buy Now' and choose your preferred subscription plan. Registration is required to access the library.

- Complete your purchase by entering your credit card or using PayPal for payment.

- Once purchased, download your form to your device. Access it anytime through the My Forms section of your profile.

US Legal Forms empowers users with more forms and extensive resources than competitors, all at an affordable cost. Their online library helps facilitate quick document execution, ensuring legal compliance.

Don't delay in securing the legal forms you need through US Legal Forms. Start your experience today for a hassle-free legal documentation process!

Form popularity

FAQ

Yes, trustees usually must file tax returns for the trust's income. This requirement often means completing Form 1041 and recording any distributions made to beneficiaries. Proper filing is crucial for avoiding tax penalties and ensuring compliance with IRS regulations. Trust platforms like trustee securitizadora can help organize and streamline this necessary reporting.

Yes, a successor trustee is also required to file Form 56 upon their appointment. This step formally informs the IRS of the change and clarifies the new trustee’s role. This ensures that the trust continues to operate smoothly under the correct legal authority. Using trustee securitizadora can make this transition more manageable.

Failing to file Form 56 can lead to problems with the IRS, including penalties and complications in managing the trust's tax obligations. Without this form, the IRS may not recognize your authority to act, potentially causing delays in financial matters. It's crucial to file Form 56 to maintain proper communication and clear any potential issues. Utilizing trustee securitizadora can help ensure compliance with these requirements.

Form 56 must be filed by fiduciaries, like trustees, who are responsible for managing the finances of another party. This includes trustees of irrevocable or revocable trusts. Filing this form ensures that the IRS knows who is acting on behalf of the estate or trust. With platforms like trustee securitizadora, understanding and managing your filing obligations becomes easier.

Typically, a trust grantor or beneficiaries with legal standing can override the trustee's decisions. This power often depends on the specific terms of the trust agreement. Additionally, courts may intervene if there are disputes or concerns about the trustee's actions. Engaging with a trustee securitizadora can provide clarity on these matters and help navigate complex situations.

Yes, a trustee is generally required to file Form 56 to notify the IRS of their appointment. This form notifies the IRS that you are acting on behalf of the trust, allowing them to recognize your authority. Filing Form 56 keeps your tax matters in order and ensures communication is clear with the IRS. Using the trustee securitizadora service streamlines this filing process.

To report trustee income, you typically need to include any income earned during the trust administration on the tax return. The income should be listed on IRS Form 1041, which is specifically for estates and trusts. Remember, the trustee is responsible for ensuring proper reporting, so keeping accurate records is essential. The trustee securitizadora platform can help simplify this process with its comprehensive financial tools.

Certifying a trust involves creating a written document that verifies the existence and terms of the trust, typically for purposes such as asset management or property transactions. This certification helps establish the authority of the trustee and ensures that they can act on behalf of the trust. You can streamline this process with USLegalForms, which offers templates tailored for certification that comply with the trustee securitizadora requirements.

The trustee plays a crucial role in securitization by managing and administering the assets that are securitized. They ensure all transactions comply with legal obligations while protecting the interests of the beneficiaries. By understanding this role within the context of trustee securitizadora, individuals can appreciate how the trustee acts as a mediator between the trust's assets and those who benefit from them.

One significant mistake parents often make is failing to fund the trust promptly after its creation. This oversight can lead to complications for beneficiaries who rely on the trust for support and management of assets. To prevent this, consider using USLegalForms during the setup phase, which provides clear guidance on how to properly fund your trust, ensuring it operates effectively within the trustee securitizadora system.