Trustee Distribuidora

Description

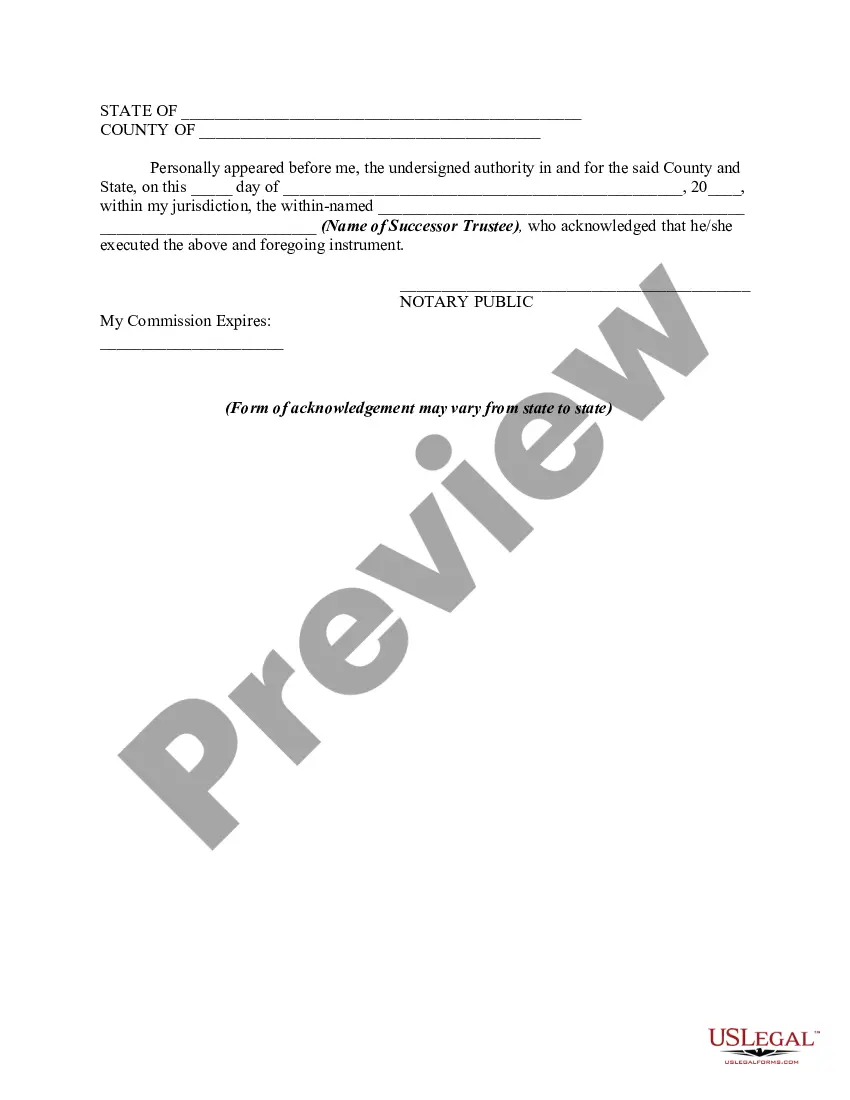

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- For existing users, log in to your account and download your desired form template by clicking the Download button. Ensure your subscription is active; if not, renew it as per your payment plan.

- If you're new, begin by reviewing the Preview mode and form description to confirm that you have selected the appropriate document that meets your local jurisdiction's requirements.

- If you encounter issues, utilize the Search tab to find another template that fits your needs, then proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. A registered account will grant you access to the entire library.

- Complete your transaction by entering your credit card details or linking your PayPal account.

- After successful payment, download your form and save it to your device. You can also access it later through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to draft legal documents rapidly with an extensive online collection of over 85,000 easily fillable and editable forms. This makes it a reliable choice for anyone needing legal assistance.

Get started today to experience the benefits of efficient legal form management!

Form popularity

FAQ

If a trustee fails to follow the trust's instructions, they can face legal repercussions, including being removed from their position or required to compensate the trust for losses. Involving a trustee distribuidora means you have set expectations for how assets should be handled, making it essential for compliance with those guidelines. Consulting with legal experts can provide clarity and help ensure your trust is administered correctly.

A trustee can go to jail if they are found guilty of committing a crime while serving in their role, such as theft or fraud. Legal action against trustees is serious, and the consequences can include imprisonment in addition to civil penalties. It's vital for trustees to comply with all laws and manage trust assets responsibly to avoid such outcomes.

Trustees can be held personally liable if they fail to fulfill their fiduciary duties or act negligently. If a trustee distribuidora mismanages assets or violates the trust terms, they may have to cover any losses incurred by the trust. To mitigate risks, trustees should maintain clear records and act transparently in all transactions.

Yes, a trustee can be held criminally liable if they commit fraud or other criminal acts while managing the trust assets. Criminal liability arises when a trustee engages in illegal activities, such as embezzlement or misappropriation of funds. It's essential for trustees to understand their legal responsibilities, as any breach can lead to serious consequences.

Misconduct of a trustee typically refers to actions that violate their fiduciary duties or the terms of the trust. This can include mismanagement of funds, failing to adhere to the trust's instructions, or acting in their own interest rather than for the beneficiaries. Understanding the responsibilities of a trustee distribuidora can help in identifying and addressing misconduct promptly.

In the context of a trustee distribuidora, the trustee has the duty to manage the assets for the benefit of the beneficiaries. However, the rights of the trustee and the beneficiaries depend on the terms of the trust. Generally, beneficiaries have an equitable interest in the trust assets, while trustees have legal ownership. Clear communication can help prevent disputes over rights.

An example of a trust distribution to beneficiaries might involve a trustee transferring ownership of a family home or vacation property to designated heirs. This can occur once the trust creator has passed away and the distribution terms are met. When a Trustee distribuidora executes such distributions, they ensure that the process aligns with the trust's directives and legal requirements. Properly managing these distributions can provide peace of mind for both the trustee and the beneficiaries.

Writing a trust distribution letter involves providing clear details about the trust and its beneficiaries. Start by outlining the trust’s name, the trustee’s information, and the specific distribution instructions. Ensure you communicate how the Trustee distribuidora will handle the distribution process, including timelines and any required documentation from beneficiaries. A well-crafted letter can help prevent confusion and ensure all parties are on the same page.

One of the biggest mistakes parents make when establishing a trust fund is not clearly defining the terms and conditions for distribution. This lack of clarity can lead to conflicts and misunderstandings among beneficiaries. A Trustee distribuidora should ensure that the trust document outlines how assets will be distributed, who will manage the trust, and under what circumstances distributions occur. Utilizing a platform like US Legal Forms can guide you through creating a comprehensive trust to avoid these pitfalls.

To become a trustee in jail, inmates typically need to meet specific criteria set by the facility, such as good behavior and a minimum security level. Application processes may vary, and interested inmates should inquire with the jail administration. Participating in this role can lead to opportunities for personal growth and development. Understanding the rules and available programs is essential for success.