Trustee Acceptance Form For A Trust

Description

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- If you are a returning user, log in to your account and verify your subscription status. If your subscription has expired, renew it based on your chosen payment plan.

- For first-time users, start by browsing the extensive form collection available. Look for the Trustee acceptance form and review its description to ensure it meets your legal needs and local requirements.

- Should you need a different template, utilize the Search tab to find the correct document that aligns with your requirements.

- Once you've identified the correct form, click on the Buy Now button to select your preferred subscription plan, and create an account to access the library.

- Complete the purchase by entering your payment information, whether it be credit card details or a PayPal account.

- Download your form directly to your device and access it anytime via the My documents section of your account.

US Legal Forms offers a myriad of advantages, including access to a robust collection of over 85,000 legal forms. This extensive library ensures you find exactly what you need efficiently.

With access to premium expert support, you can have peace of mind knowing that your documents are completed accurately and legally sound. Start your hassle-free paperwork journey today!

Form popularity

FAQ

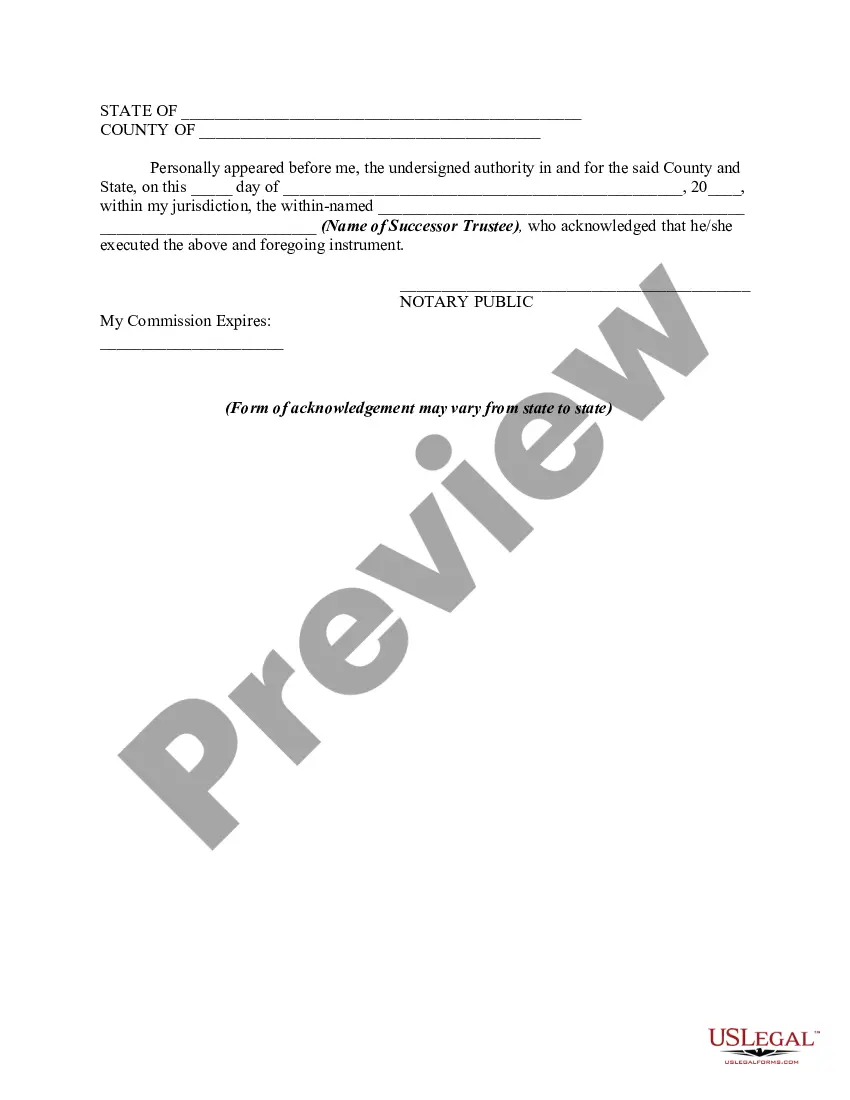

An acceptance of successor trusteeship is a formal agreement in which the successor trustee acknowledges their appointment and agrees to assume their responsibilities. This document is vital for protecting the interests of the trust and its beneficiaries. By completing a Trustee acceptance form for a trust, the successor trustee can ensure they are legally recognized and prepared to manage the trust effectively.

The first task a successor trustee should undertake is to review the trust document in detail. Understanding its terms and conditions is crucial for effective administration. Following this, completing a Trustee acceptance form for a trust is important to officially accept the role and signify a commitment to manage the trust according to the specified directives.

A successor trustee refers to a person or entity designated to take over the responsibilities of the original trustee when the need arises. This situation typically occurs if the original trustee is unable to fulfill their duties due to incapacity, passing, or resignation. Utilizing a Trustee acceptance form for a trust helps the successor trustee officially confirm their role and obligations, ensuring a seamless transition in the trust's management.

Acceptance to serve as a trustee is a formal acknowledgment by an individual agreeing to assume the responsibilities of managing a trust. This is an essential step as it signifies the individual's commitment to uphold the terms set forth in the trust document. To make this process smoother, you can utilize a Trustee acceptance form for a trust to ensure all legal requirements are met.

When choosing a trustee, it is essential to select someone who is trustworthy, responsible, and knowledgeable about financial matters. The ideal candidate often possesses a clear understanding of the responsibilities associated with the trustee acceptance form for a trust. Additionally, consider appointing someone who can remain impartial and ensure that the wishes outlined in the trust are executed effectively. This choice can significantly impact the management and distribution of the trust's assets, so take time to evaluate potential trustees carefully.

To accept a trusteeship, you need to sign the trustee acceptance form for a trust and notify the other involved parties, such as beneficiaries. This formal acknowledgment brings clarity and establishes that you are now responsible for managing the trust. Be sure to review the trust documentation thoroughly to understand your duties before accepting.

Deciding whether to agree to be a trustee should be a careful consideration of your ability and willingness to take on this responsibility. If you feel confident in managing finances and have a good understanding of the trust, it could be a rewarding experience. Utilizing a trustee acceptance form for a trust can help ensure you are fully informed before making your decision.

Yes, there can be downsides to being a trustee, including potential liability for mismanagement of the trust assets. Additionally, there may be personal time commitment and emotional challenges, especially if family matters are involved. It’s crucial to weigh these factors and complete a trustee acceptance form for a trust only if you feel prepared.

A letter of wishes for a trustee is an informal document that outlines the trust creator's desires regarding the management of trust assets. While not legally binding, it provides guidance to the trustee on fulfilling their responsibilities according to the creator's intent. Always pair this with a detailed trustee acceptance form for a trust to balance both guidance and legal requirements.

Acceptance of trust as an executor refers to your agreement to act on behalf of an estate after someone passes away. This involves managing the will's provisions and settling debts and taxes. Use a trustee acceptance form for a trust to clarify your acceptance and responsibilities in this role.