Trustee Acceptance Form For A Bank

Description

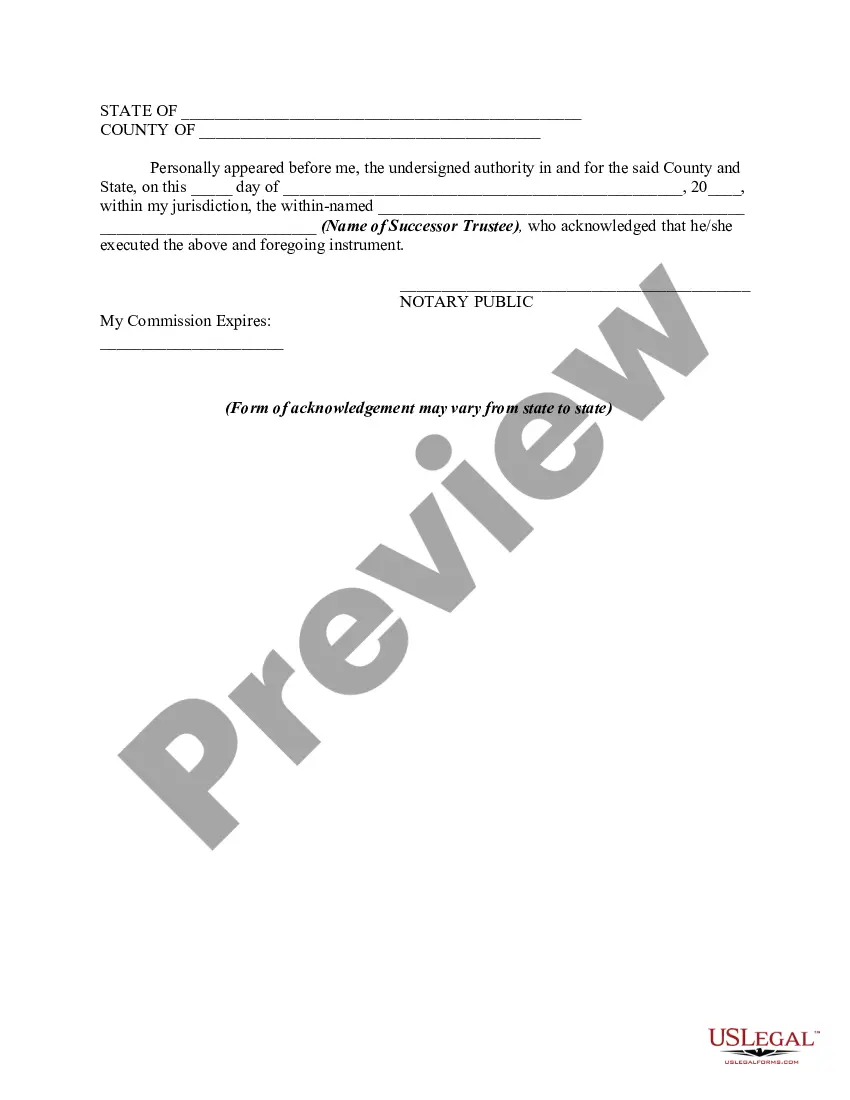

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- Log in to your US Legal Forms account if you've used the service before, ensuring your subscription remains active. If your subscription is expired, renew it based on your plan.

- For first-time users, start by browsing the extensive library to find the Trustee Acceptance Form. Review the preview mode and form description to ensure it meets your needs.

- If you need a different template, utilize the search bar to find the appropriate form that aligns with your local jurisdiction requirements.

- Once you find the correct document, proceed by clicking the 'Buy Now' button and select your preferred subscription plan. You'll need to create an account to access various resources.

- Complete your purchase by providing your credit card or PayPal information. Ensure all details are valid for a successful transaction.

- After completing your purchase, download the form directly onto your device. You can also access it anytime from the 'My Forms' section in your profile.

Following these steps will ensure you obtain the necessary Trustee Acceptance Form efficiently.

Explore the vast resources and expert assistance available at US Legal Forms today to ensure your legal documents are accurate and effective!

Form popularity

FAQ

A trustee cannot engage in self-dealing or use trust assets for personal gain. They must also avoid any actions that may conflict with their fiduciary duty. Importantly, a trustee must not take steps without the consent of the beneficiaries or neglect their responsibilities. For proper guidance in your duties, consider using a trustee acceptance form for a bank, which can help clarify expectations and protect all parties involved.

The acceptance of trust as an executor refers to the agreement by an executor to undertake the responsibilities of managing and distributing an estate according to a will. This acceptance often involves submitting a formal document, sometimes referred to as a trustee acceptance form for a bank, to financial institutions. By doing so, the executor confirms their role and authority, allowing them to access and manage estate assets. Understanding this process is essential for fulfilling your duties effectively and legally.

To obtain a trustee letter, you generally need to request it from the trust creator or settlor, who may draft the letter themselves or use a legal service. Additionally, ensure that the trust document clearly outlines the powers of the trustee. You can also consider using platforms like uslegalforms, which offer templates and guidance for creating a trustee acceptance form for a bank. This simplifies the process, ensuring you gather all necessary information efficiently.

A trustee letter is a document that confirms the authority of a trustee to act on behalf of a trust. This letter typically includes information about the trust, the identities of the trustees, and their specific powers. Having a trustee letter is crucial when dealing with financial institutions, as it often serves as part of the trustee acceptance form for a bank. By providing this documentation, you ensure that the bank recognizes the trustee's authority to manage trust assets.

Choosing a bank as a trustee can provide security and professionalism in managing your trust. Banks have the expertise to navigate financial complexities and ensure that assets are managed properly over time. Utilizing a trustee acceptance form for a bank can help structure this relationship in a clear and organized manner.

A letter of acceptance as a trustee is a formal document used to accept the responsibilities associated with being a trustee. It highlights your willingness to manage the trust's assets effectively and in line with its stipulations. Incorporating the trustee acceptance form for a bank ensures compliance with banking requirements.

A letter of acceptance of trustee is a written declaration by an individual acknowledging their new role as trustee of a trust. This letter outlines the trustee's duties and legal obligations. Utilizing a trustee acceptance form for a bank can help clarify these responsibilities for all parties involved.

To accept being a trustee, you should carefully review the terms of the trust and formally communicate your acceptance, often through a written letter. It is vital to fill out the trustee acceptance form for a bank, especially if managing assets in financial institutions is involved. Being informed will help you fulfill the role effectively.

A trustee confirmation letter is a document that verifies a trustee's appointment and acceptance of their role. This letter serves as an official record and is often necessary for financial institutions. It may refer to the trustee acceptance form for a bank to affirm acceptance of fiduciary duties.

A letter of acceptance explanation provides details about a trustee's acknowledgment of their responsibilities and duties. This document often outlines the terms under which the trustee agrees to act. Using a trustee acceptance form for a bank can ensure that all parties involved understand their roles and obligations.