Joint Promissory Note With Collateral Template

Description

How to fill out Complaint Against Makers Of Promissory Note And Personal Guarantors For Joint And Several Liability?

What is the most reliable service to obtain the Joint Promissory Note With Collateral Template and other current iterations of legal documents.

US Legal Forms is the solution! It boasts the largest assortment of legal forms for any scenario.

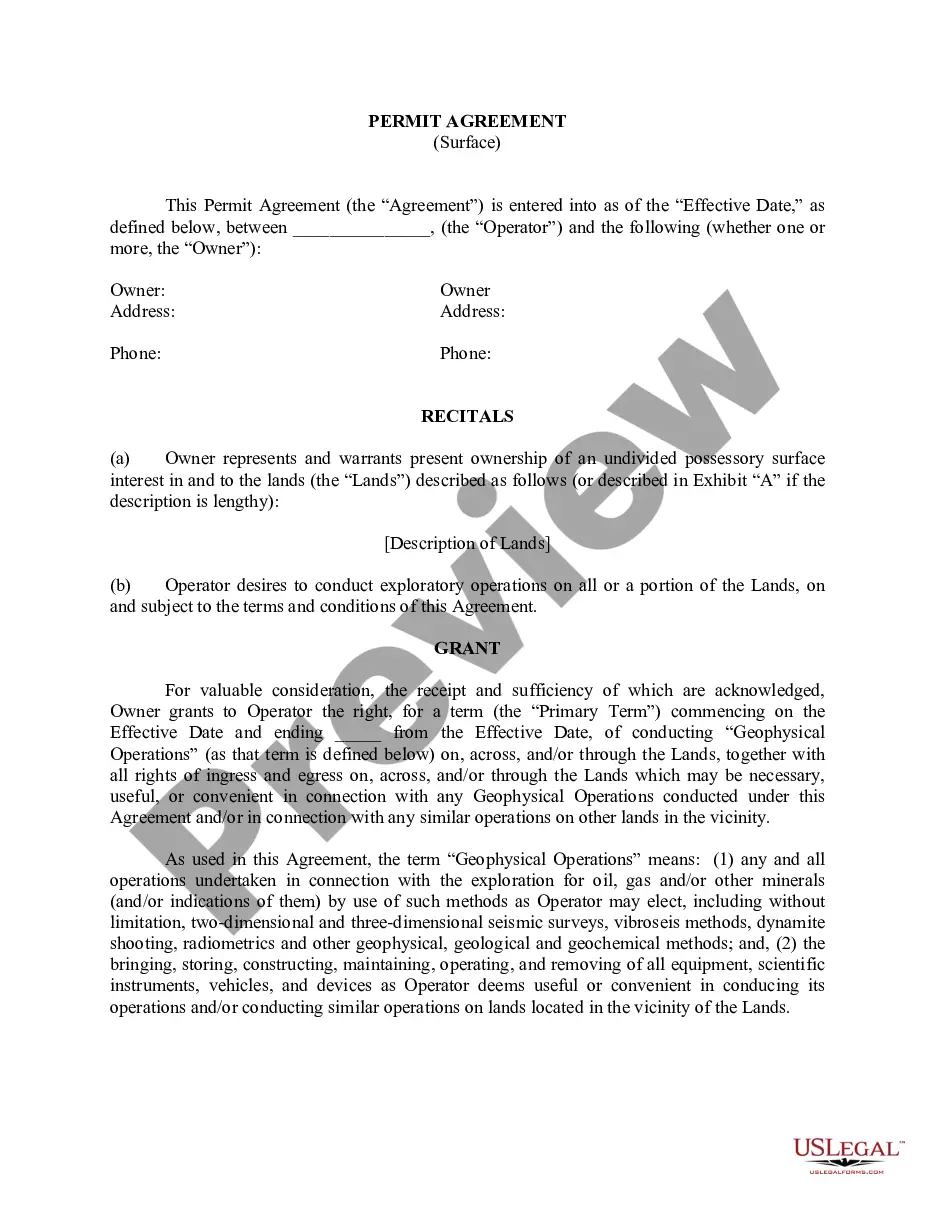

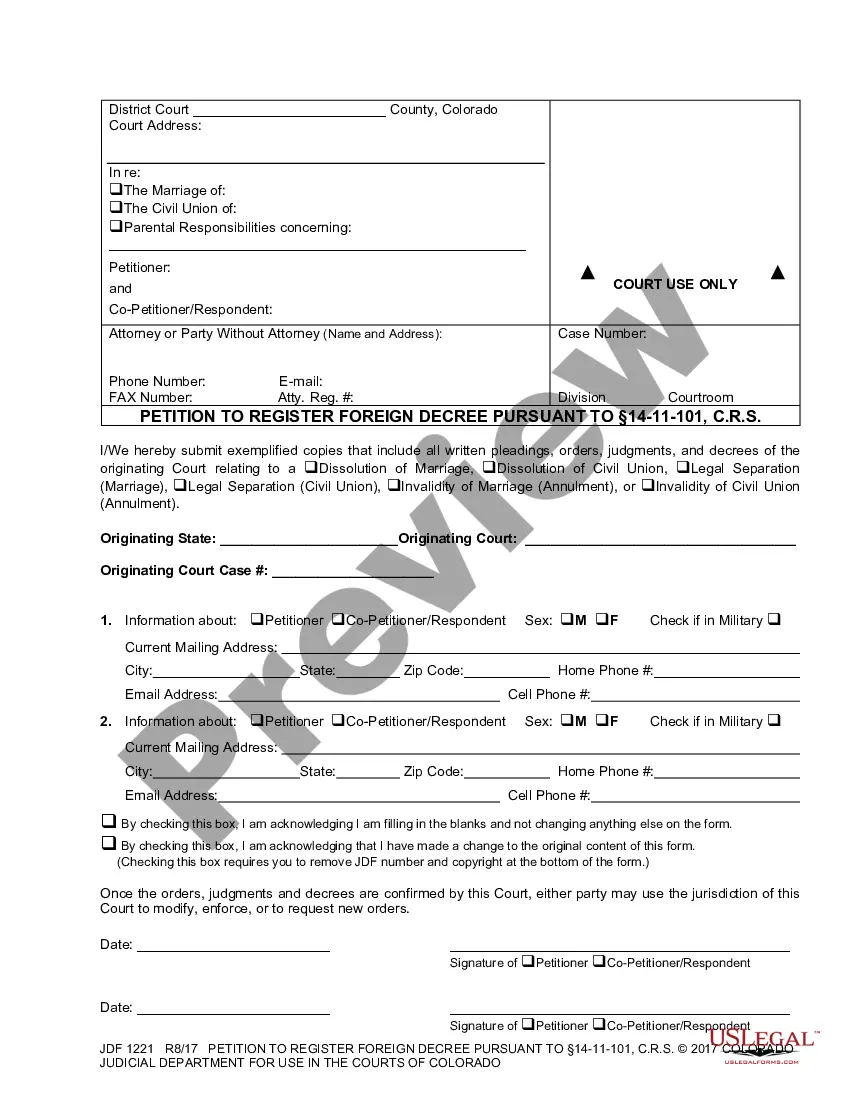

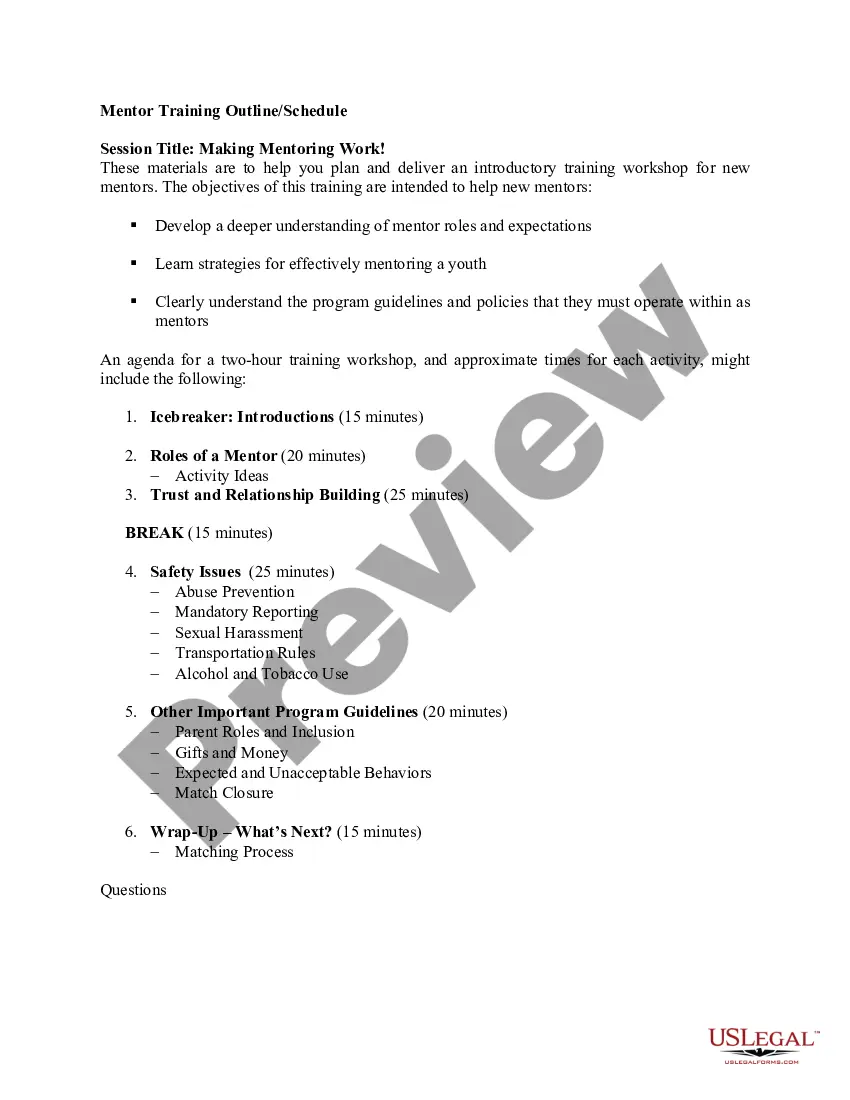

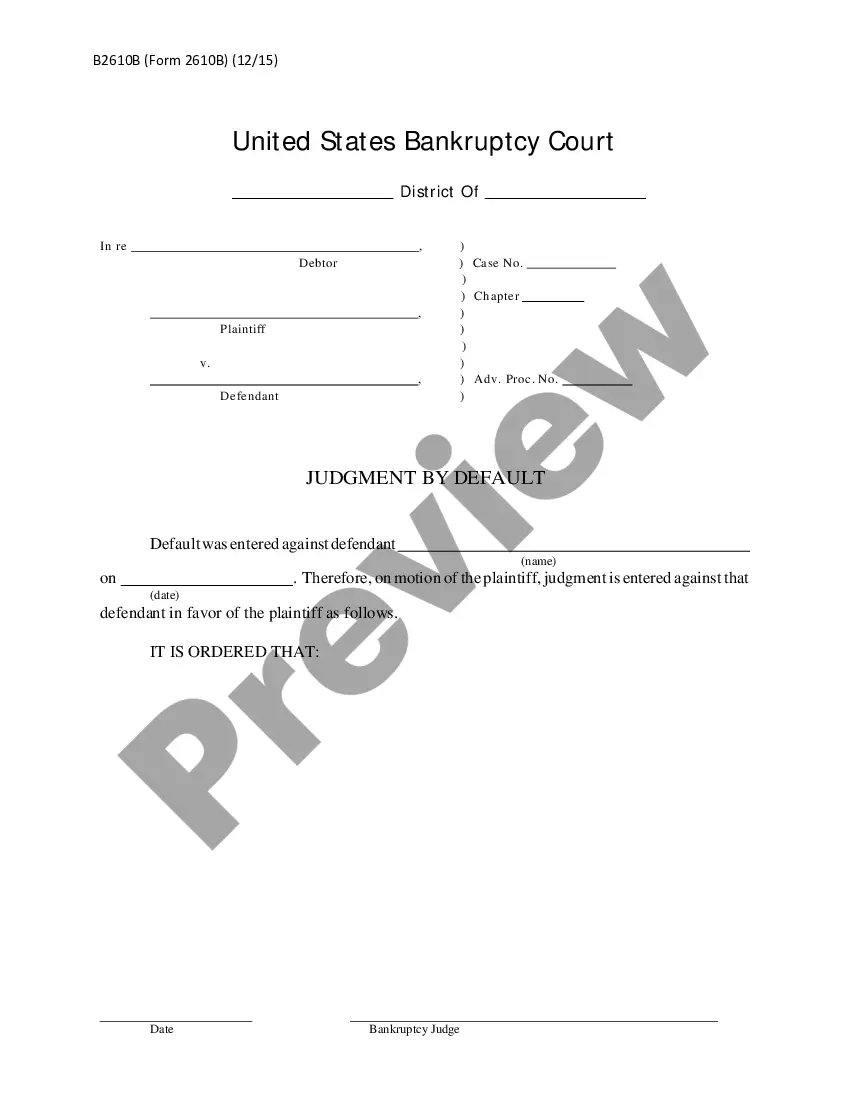

If you don't have an account with our library yet, follow these steps to create one: Form compliance review. Before obtaining any template, ensure it complies with your usage requirements and the regulations of your state or county. Review the form description and utilize the Preview option if available. Alternative document search. If there are any discrepancies, use the search bar in the header to find another template. Click Buy Now to select the correct one. Registering and subscription purchase. Choose the most suitable pricing plan, Log In or register your account, and process your subscription through PayPal or credit card. Acquiring the paperwork. Select the format you prefer to save the Joint Promissory Note With Collateral Template (PDF or DOCX) and click Download to obtain it. US Legal Forms is an outstanding resource for anyone needing to manage legal documents. Premium users can enjoy additional benefits as they can complete and authorize previously saved documents electronically at any time using the integrated PDF editing tool. Try it out today!

- Every document is expertly prepared and verified for adherence to federal and local laws.

- They are organized by category and jurisdiction, making it easy to find what you need.

- Experienced users of the platform simply need to Log In to access the system, confirm their subscription status, and click the Download button next to the Joint Promissory Note With Collateral Template to retrieve it.

- Once saved, the document is accessible for future reference within the My documents section of your account.

Form popularity

FAQ

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.