Complaint Promissory Note With Collateral

Description

How to fill out Complaint For Past Due Promissory Note?

Maneuvering through the red tape of formal documents and templates can be challenging, particularly if one does not engage in such tasks professionally.

Even selecting the correct template for the Complaint Promissory Note With Collateral will be labor-intensive, as it must be accurate to the last detail.

Nevertheless, you will have to spend significantly less time acquiring a suitable template from a resource you can rely on.

Acquire the correct document in a few straightforward steps: Enter the document name in the search bar. Select the appropriate Complaint Promissory Note With Collateral from the results. Review the sample description or open its preview. When the template meets your needs, click Buy Now. Choose your subscription plan. Use your email and create a password to register at US Legal Forms. Select a credit card or PayPal payment option. Download the template document to your device in your preferred format. US Legal Forms can save you considerable time determining whether the form you discovered online meets your requirements. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of locating the correct forms online.

- US Legal Forms serves as a single location where one can obtain the most recent document samples, understand their usage, and download these samples to complete them.

- This is a repository containing over 85K forms applicable in various domains.

- When looking for a Complaint Promissory Note With Collateral, you won’t have to doubt its authenticity as all the forms are validated.

- Having an account at US Legal Forms will guarantee you have all the necessary samples at your fingertips.

- Organize them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by simply clicking Log In on the library website.

- If you still don’t have an account, you can always conduct a new search for the template you require.

Form popularity

FAQ

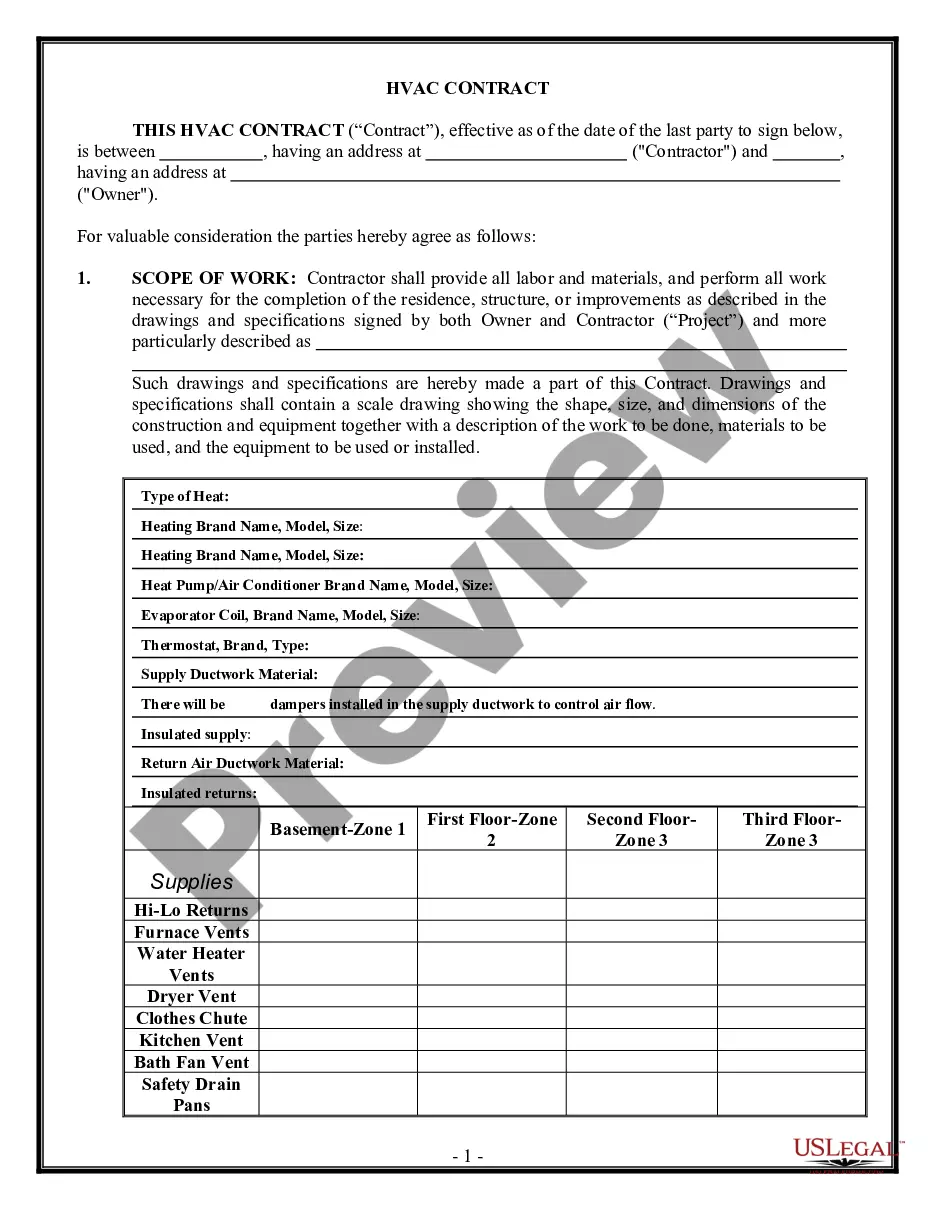

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.