Condo Lien Foreclosure With Real Estate

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

Legal documentation administration can be exasperating, even for experienced experts.

When you are in search of a Condo Lien Foreclosure With Real Estate and lack the time to invest in locating the suitable and current version, the processes can be taxing.

Obtain a wealth of articles, guides, and resources related to your situation and needs.

Save time and energy in locating the documents needed, and use US Legal Forms' sophisticated search and Review tool to identify Condo Lien Foreclosure With Real Estate and access it.

Ensure that the template is recognized in your state or county. Choose Buy Now when you are ready. Select a subscription plan. Locate the format you desire, and Download, complete, eSign, print, and send your documents. Utilize the US Legal Forms online library, supported by 25 years of expertise and reliability. Enhance your daily document management through a seamless and user-friendly procedure today.

- If you possess a membership, sign in to your US Legal Forms account, find the document, and access it.

- Check your My documents section to see the forms you have previously downloaded and manage your files as required.

- If this is your first experience with US Legal Forms, create an account to gain limitless access to all features of the library.

- The following are the actions to take after downloading the desired form.

- Confirm this is the correct document by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to any requirements you may have, from personal to corporate paperwork, all in one location.

- Utilize advanced tools to fill out and manage your Condo Lien Foreclosure With Real Estate.

Form popularity

FAQ

In Louisiana, the foreclosure process begins when a lender files a lawsuit against the borrower. This is typically due to unpaid debts related to property, including condo lien foreclosure with real estate. After the court issues a judgment, the property can be sold at a public auction to satisfy the debt. It's essential to understand each step to protect your rights and possibly avoid foreclosure.

When an HOA places a lien on your property, it signifies that you have unpaid dues or assessments. This action can lead to condo lien foreclosure with real estate if the debt remains unresolved. The lien gives the HOA the right to seek repayment through foreclosure if necessary. It is important to take immediate action to address the lien and consider solutions like working with USLegalForms to navigate the complexities of property liens.

Yes, a property with a lien can be foreclosed, especially in the context of condo lien foreclosure with real estate. When a lien is placed due to unpaid dues or assessments, the homeowner may face foreclosure if the debt remains unpaid. This process allows the lien holder to recover the amount owed by selling the property. Therefore, it is crucial to address any liens promptly to avoid losing your home.

When you foreclose on a condo, the lender takes possession of the property, typically due to missed mortgage payments or unpaid dues. This process involves selling the condo to recover the outstanding debt, which can result in severe financial consequences for the homeowner. Utilizing resources like US Legal Forms can help you navigate the complexities of a condo lien foreclosure with real estate, offering forms and guidance to manage your situation effectively.

The five stages of a foreclosure action include pre-foreclosure, notice of default, auction, post-foreclosure, and eviction. Initially, the lender notifies you of the default, followed by a public auction if the debt remains unpaid. Each stage has specific implications for your condo, particularly in relation to a condo lien foreclosure with real estate, making awareness of these phases vital for homeowners.

When a lien is placed on your condo, it creates a legal claim against your property, which can occur due to unpaid bills or dues. This lien will remain attached to your condo until the debt is settled, limiting your ability to sell or refinance the property. If unresolved, the creditor may pursue a condo lien foreclosure with real estate, which can ultimately lead to the loss of your home.

In Arizona, the foreclosure process typically takes about 90 to 120 days from the time of the initial notice of default. This timeline can vary based on the specific circumstances of the case and whether the homeowner takes action to resolve the issue. Understanding this process is crucial, especially if you are facing a condo lien foreclosure with real estate, as timely intervention can help protect your rights.

If there is a lien on your condo, it means a creditor has a legal claim to your property due to unpaid debts. This situation can complicate the sale or refinancing of your condo, as the lien must be cleared before any transfer of ownership. Additionally, the creditor may initiate a condo lien foreclosure with real estate to recover the owed amount, which can lead to losing your property.

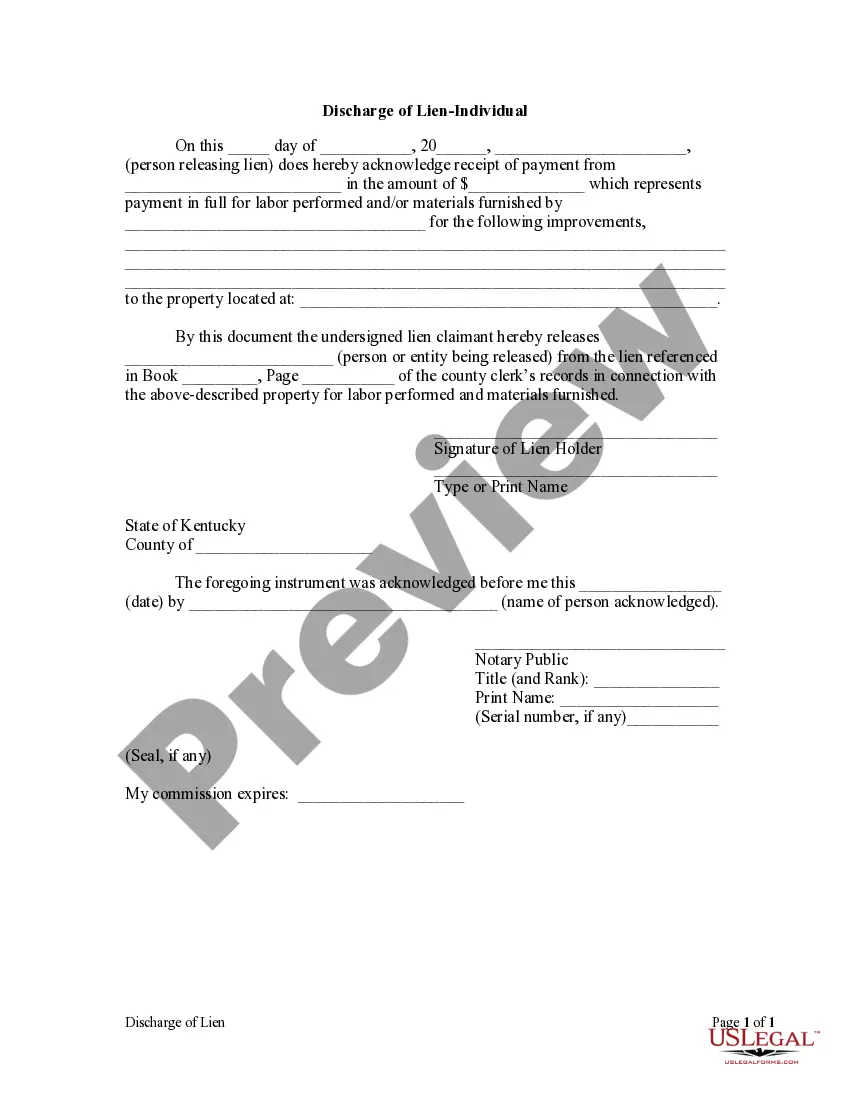

To put a lien on a condo, you will need to create a written document that specifies the amount owed and the reason for the lien. This document should be filed with the appropriate local authority, as it is crucial for the condo lien foreclosure with real estate. It's important to follow your state's regulations regarding notice and timing to ensure your lien is enforceable. Platforms like USLegalForms can provide the necessary templates and instructions to make this process smoother.

In Texas, filing a lien requires specific documentation, including a completed lien form and proof of debt. The process is part of the condo lien foreclosure with real estate, ensuring your claim is legally recognized. You must file these documents with the county clerk's office where the property is located. For assistance with the requirements and forms, consider using USLegalForms for detailed guidance and support.