Discharged Bankruptcy Chapter 13 Withdrawn

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

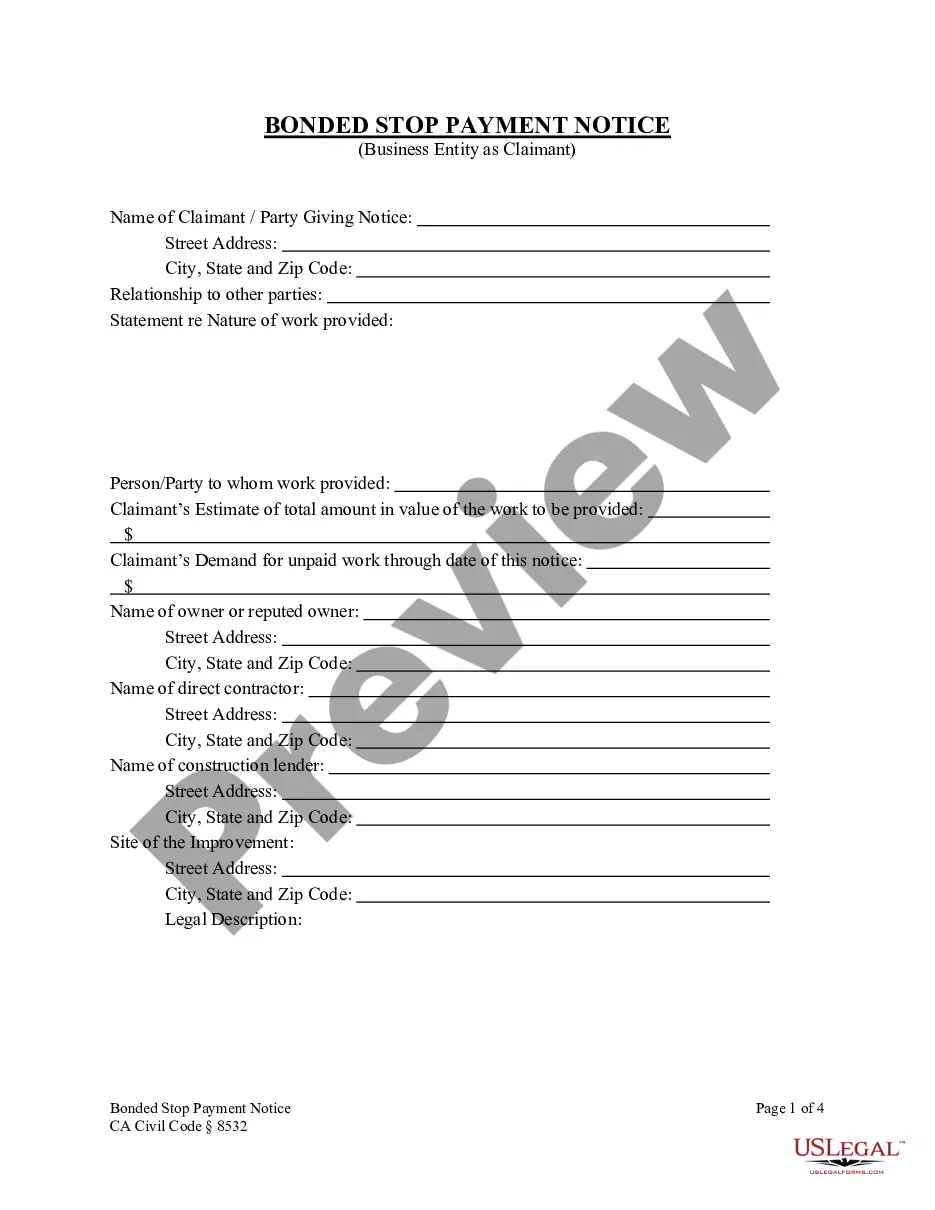

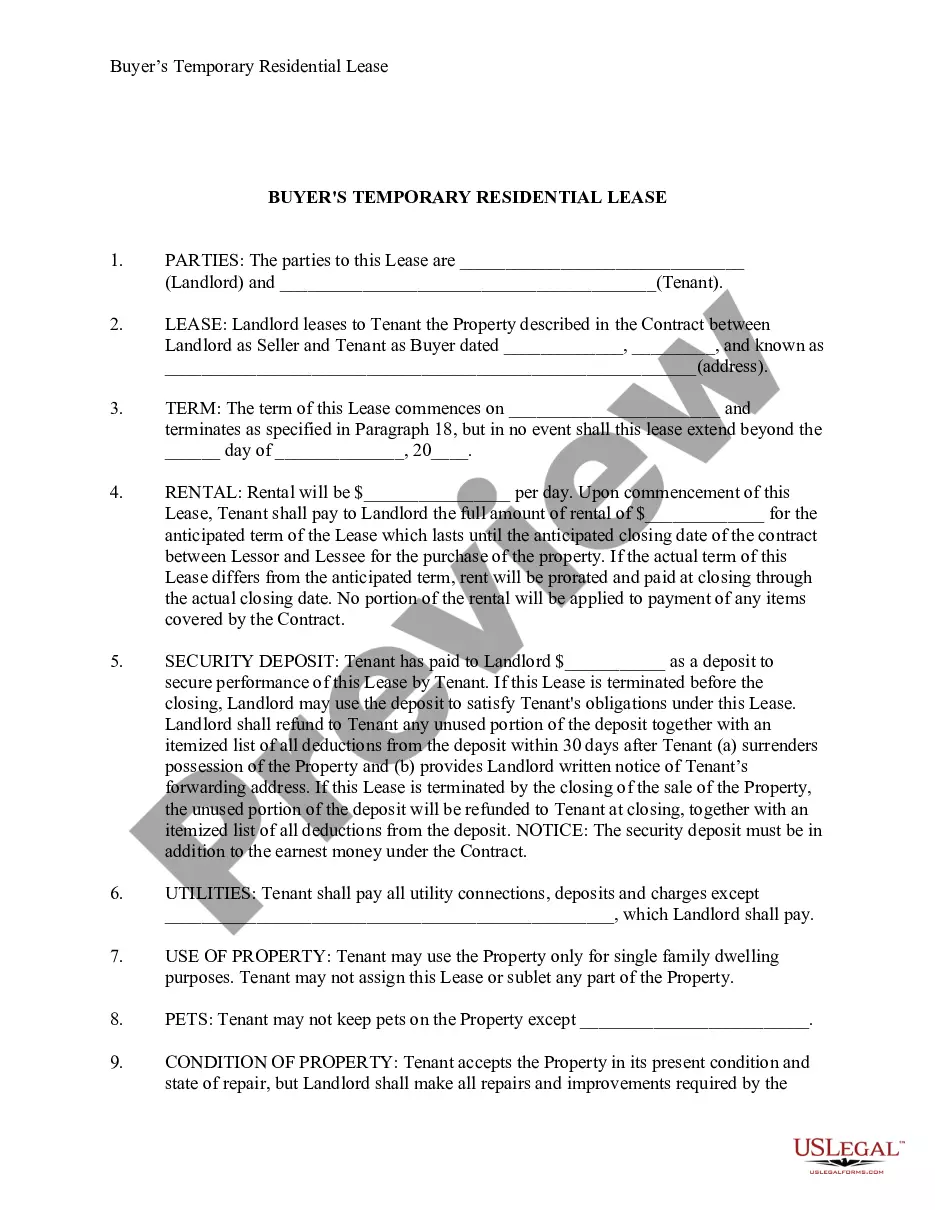

Managing legal documents and procedures can be a lengthy addition to your day.

Discharged Bankruptcy Chapter 13 Withdrawn and similar forms typically necessitate that you search for them and understand how you can fill them out correctly.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and accessible online catalog of forms at your disposal will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and various tools to assist you in completing your documents effortlessly.

- Browse the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms that can be downloaded at any time.

- Enhance your document management processes with top-tier support that allows you to prepare any form within minutes without any additional or concealed fees.

- Simply Log In to your account, find Discharged Bankruptcy Chapter 13 Withdrawn and download it instantly from the My documents tab.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

In Chapter 7 bankruptcy, a party in interest can request that a debt discharge be revoked if they can show that the debtor: Obtained the debt discharge fraudulently, and that the fraud was only discovered after the debt discharge was granted.

Typically, a request to revoke the debtor's discharge must be filed within one year of the discharge or, in some cases, before the date that the case is closed. The court will decide whether such allegations are true and, if so, whether to revoke the discharge.

A Chapter 7 bankruptcy case can be reopened after discharge and case closure under certain circumstances. Bankruptcy Code Section 350(b) authorizes the bankruptcy court to reopen a case for various reasons including to ?administer assets, to relief to the debtor, or for other cause.? Fed.

You must also keep in mind that once a bankruptcy case is filed, whether Chapter 7 or Chapter 13, it cannot be completely reversed and will appear on a credit report for 7 to 10 years whether or not the case is actually completed.

Typically, a request to revoke the debtor's discharge must be filed within one year of the discharge or, in some cases, before the date that the case is closed. The court will decide whether such allegations are true and, if so, whether to revoke the discharge.