Discharge Bankruptcy 7 Withheld

Description

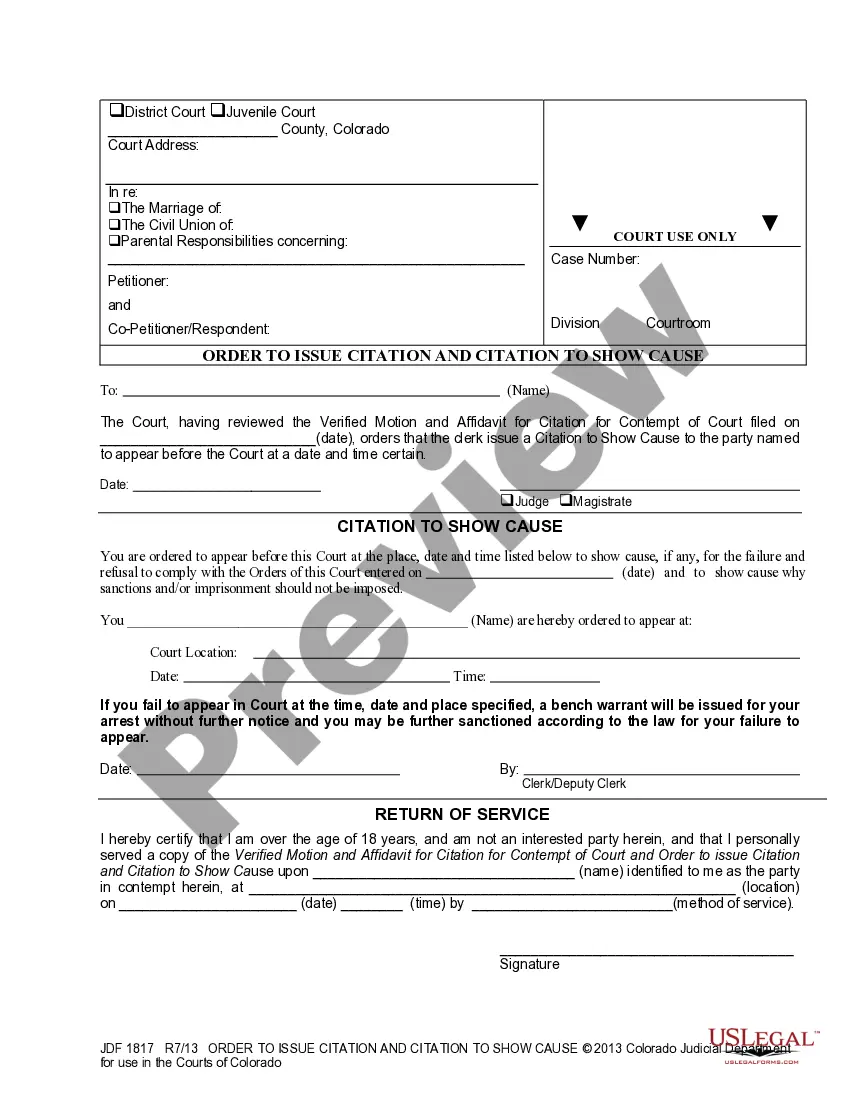

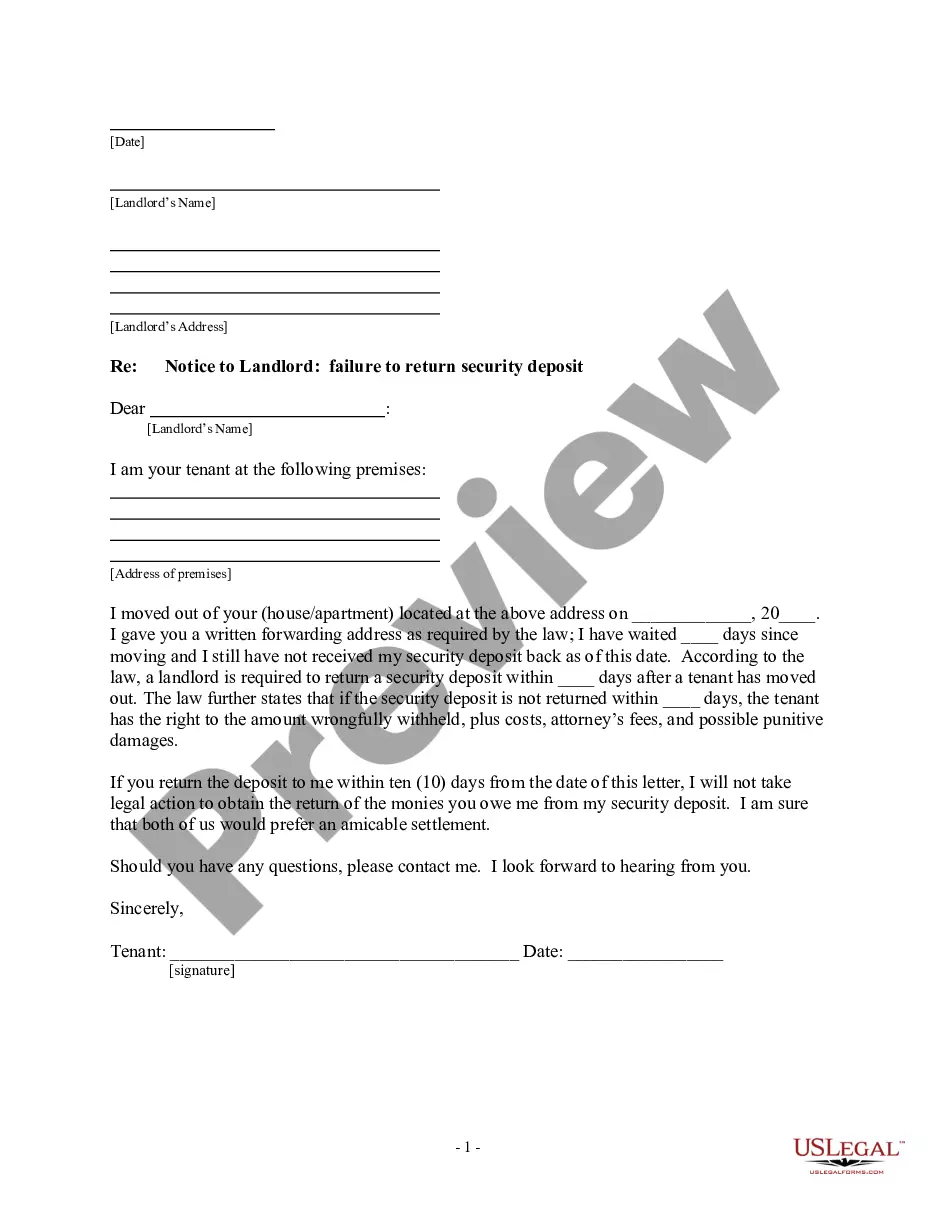

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

The Discharge Bankruptcy 7 Withheld you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Discharge Bankruptcy 7 Withheld will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or review the form description to confirm it suits your requirements. If it does not, use the search option to find the correct one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Select the format you want for your Discharge Bankruptcy 7 Withheld (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers again. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

While it's not possible to remove a legitimate bankruptcy from your credit report, its impact wanes over time until it finally leaves your report after seven to 10 years. In the meantime, you can file a dispute with the credit bureaus if your bankruptcy contains any inaccurate information. How to Remove a Bankruptcy From Your Credit Report | Lexington Law lexingtonlaw.com ? education ? how-to-rem... lexingtonlaw.com ? education ? how-to-rem...

A Chapter 7 bankruptcy may stay on credit reports for up to 10 years from the filing date, while a Chapter 13 bankruptcy generally remains for seven years from the filing date.

No matter how important the card might be, excluding debt is not an option when you file for Chapter 7 bankruptcy. Bankruptcy law requires you to list all of your debt on your bankruptcy petition, without exception. In other words, if you owe a creditor money, the creditor must appear on your petition. Can I Keep a Credit Card In My Chapter 7 Bankruptcy? - Nolo nolo.com ? legal-encyclopedia ? can-i-keep-... nolo.com ? legal-encyclopedia ? can-i-keep-...

You cannot remove a discharged debt from your credit report unless the information listed is incorrect. Even though you repaid the debt, partially or in full, or the lender stopped its collection attempts, the entry will remain on your report for seven years. How Do I Remove Discharged Debt From My Credit Report? - WalletHub wallethub.com ? answers ? how-to-remove-discha... wallethub.com ? answers ? how-to-remove-discha...

While it's not possible to remove a legitimate bankruptcy from your credit report, its impact wanes over time until it finally leaves your report after seven to 10 years. In the meantime, you can file a dispute with the credit bureaus if your bankruptcy contains any inaccurate information.