Example Of Motion For Continuance Form Indiana

Description

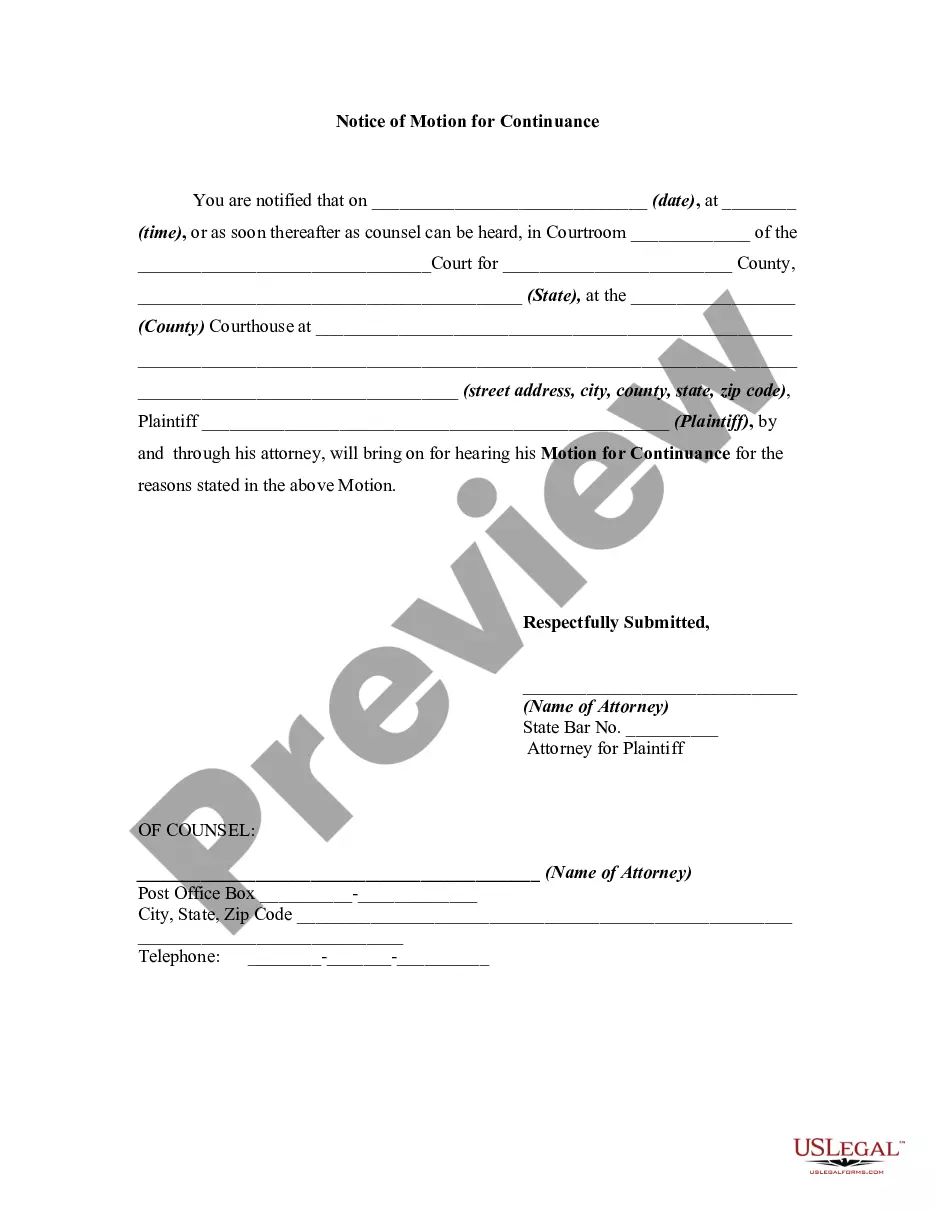

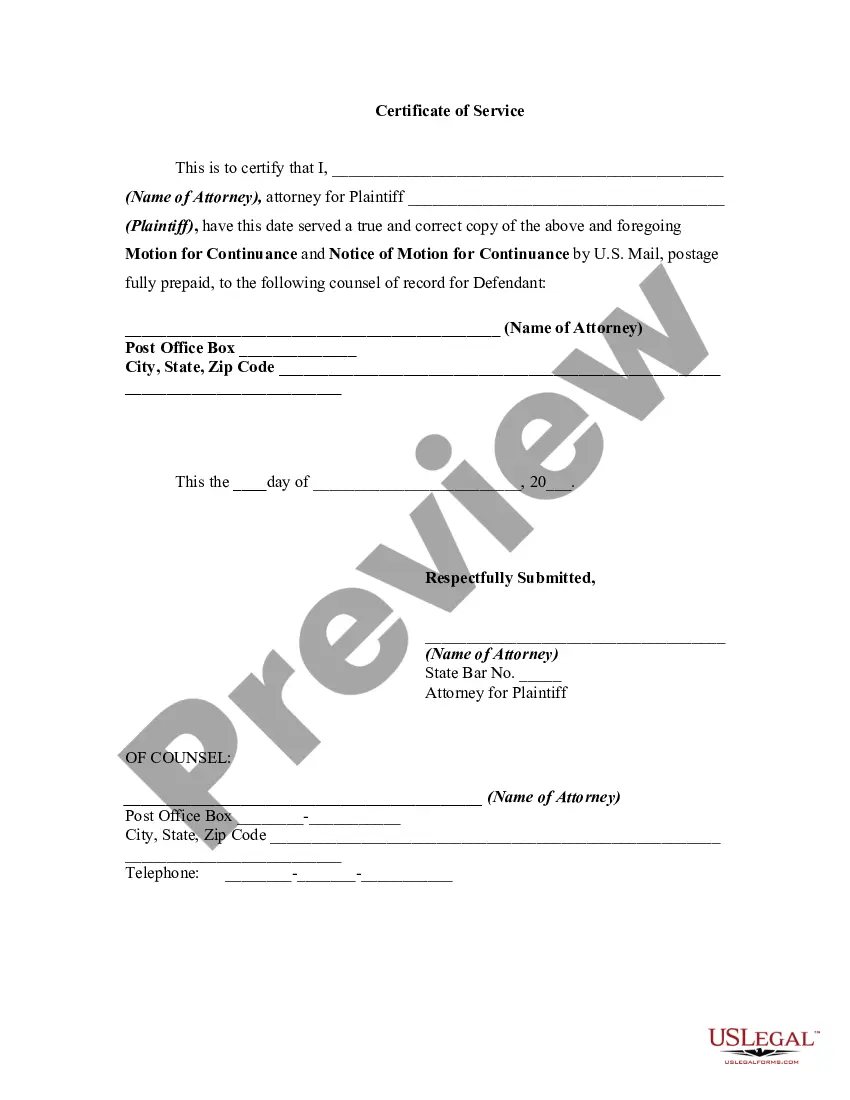

How to fill out Generic Motion For Continuance And Notice Of Motion?

Securing a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Acquiring the appropriate legal documents requires carefulness and meticulousness, which emphasizes the importance of obtaining samples of Example Of Motion For Continuance Form Indiana exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the complications associated with your legal paperwork. Explore the comprehensive US Legal Forms catalog to discover legal templates, assess their suitability for your situation, and download them instantly.

- Utilize the catalog navigation or search feature to find your template.

- Access the form’s details to verify its compliance with the requirements of your state and region.

- View the form preview, if available, to confirm that it is the form you are interested in.

- If the Example Of Motion For Continuance Form Indiana does not meet your requirements, continue searching for the appropriate template.

- Once you are certain about the form’s relevancy, download it.

- If you are a registered user, click Log in to authenticate and retrieve your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the pricing plan that aligns with your needs.

- Follow through with the registration process to complete your purchase.

- Conclude your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading the Example Of Motion For Continuance Form Indiana.

- After obtaining the form on your device, you can edit it using the editor or print and complete it manually.

Form popularity

FAQ

State income tax rates range from 5.35% to 9.85%, and the state's sales tax rate is 6.875%. Minnesota offers a number of tax deductions and credits that can reduce your state taxes, including a child care credit and a student loan credit.

You can get Minnesota tax forms either by mail or in person. To get forms by mail, call 651-296-3781 or 1-800-652-9094 to have forms mailed to you. You can pick up forms at our St. Paul office. Our office hours are a.m. to p.m., Monday - Friday. Minnesota Department of Revenue. 600 N. Robert St. St.

Convenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

You can now file Income Tax Return forms conveniently online. Check out the easy steps to download ITR forms in PDF from the official website of the Income Tax department: Log in to the official website of .incometaxindia.gov.in.

FSA-156EZ Abbreviated 156 Farm Record Form.

EFile These Minnesota State Tax Forms Prepare and e-file these state forms for current tax year in conjunction with your federal and state income tax return. As you proceed through the tax interview on efile.com, the application will select the correct state forms for you. You can also choose tax forms individually.

The signing of this form gives FSA representatives. authorization to enter and inspect crops/commodities and land uses on the above identified land. A signature date (the date the producer signs the FSA-578) will also be captured. A. CERTIFIER'S SIGNATURE.

Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs. Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, for the applicable program year.