Motion Stay File Formats Explained

Description

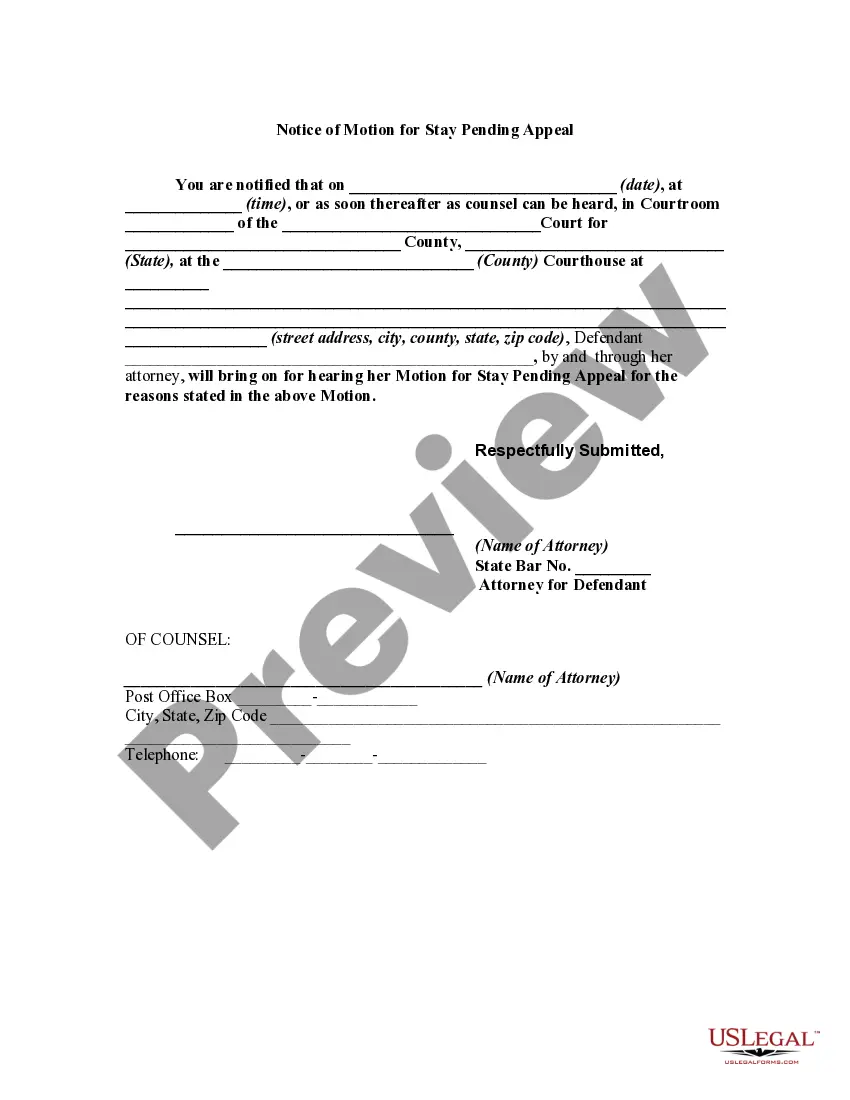

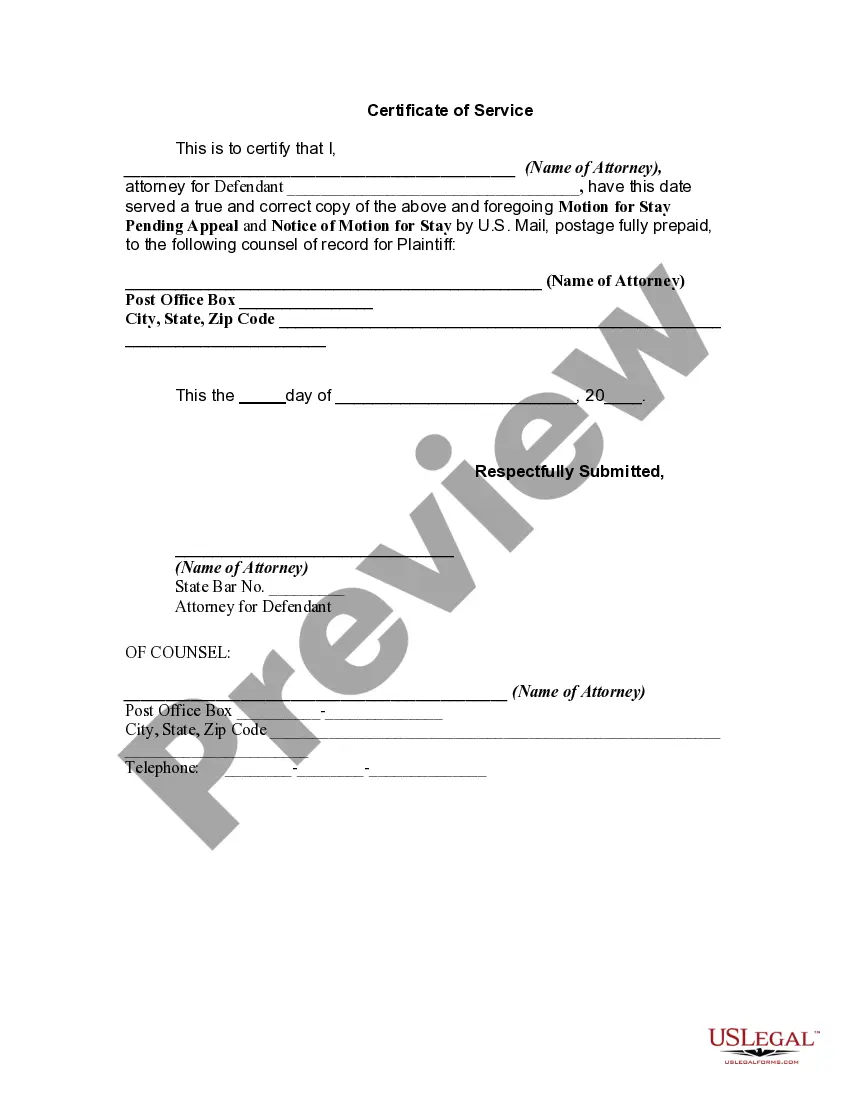

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Regardless of whether it is for corporate objectives or personal issues, everyone must handle legal matters at some stage in their lives.

Completing legal documents requires meticulous focus, beginning with picking the appropriate form example.

With a comprehensive US Legal Forms catalog available, you no longer need to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the ideal template for any situation.

- For example, selecting an incorrect version of the Motion Stay File Formats Explained will result in its rejection upon submission.

- Thus, obtaining a reliable source of legal documents like US Legal Forms is crucial.

- If you need to acquire a Motion Stay File Formats Explained example, adhere to these straightforward steps.

- 1. Access the required sample by using the search bar or browsing through the catalog.

- 2. Review the form’s description to ensure it aligns with your circumstances, state, and county.

- 3. Click on the form’s preview to examine it.

- 4. If it is not the correct form, return to the search tool to find the Motion Stay File Formats Explained example you need.

- 5. Download the template when it satisfies your requirements.

- 6. If you already possess a US Legal Forms profile, click Log in to access previously stored documents in My documents.

- 7. If you do not yet have an account, you can acquire the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: either a credit card or a PayPal account.

- 11. Select the file format you prefer and download the Motion Stay File Formats Explained.

- 12. Once saved, you can fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

To obtain a certificate for a business registered with the Department, visit Maryland Business Express, and select ?Certificate of Status?. The authenticity of Certificates purchased online can be verified here.

If your Maryland corporation was forfeited and you would like to continue to do business, you will need to revive your corporation. File Articles of Revival with the Maryland State Department of Assessments and Taxation (SDAT).

How Do I File Maryland Articles of Incorporation? Create a Maryland Business Express Account. In the portal, select ?Register Your Business? and ?Create Account.? Enter your name, phone number and email, and choose a username and password. ... Answer Questions About Your Company. ... Pay the Fee.

To transfer ownership of a Maryland LLC to someone else, you must first file articles of dissolution or amendment with the Maryland Department of Assessments and Taxation. Additionally, any other specific provisions or requirements in the LLC's operating agreement must be followed.

In Maryland, the necessary paperwork will depend on the business entity type. LLCs have to file the Articles or Certificate of Reinstatement form, while corporations have to submit Articles of Revival. Additionally, you will have to file all your missing returns and pay the corresponding fees.

Yes, you can file the Articles of Amendment by mail to change your Maryland LLC name. Download and complete the Articles of Amendment form and mail to the State Department of Assessments and Taxation. Include a check payable to the State Department of Assessments and Taxation for $100.

To update your Maryland LLC's Articles of Organization, Articles of Amendment must be filed with the Maryland State Department of Assessments and Taxation. Filing Articles of Amendment requires a $100 fee, and can be done by mail or online.

(b) Bylaws shall be adopted, amended or repealed by at least a majority vote of the members voting. If the cooperative has adopted a delegate system, the bylaws may be amended by two-thirds of those delegates present and voting.