Motion Stay File Format Is Incorrect

Description

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Legal administration can be exasperating, even for the most adept experts.

When you are concerned about a Motion Stay File Format being Incorrect and lack the opportunity to invest time in locating the accurate and current version, the processes can be taxing.

US Legal Forms addresses all needs you might possess, from personal to corporate documents, all centralized in one platform.

Utilize sophisticated tools to complete and manage your Motion Stay File Format Is Incorrect.

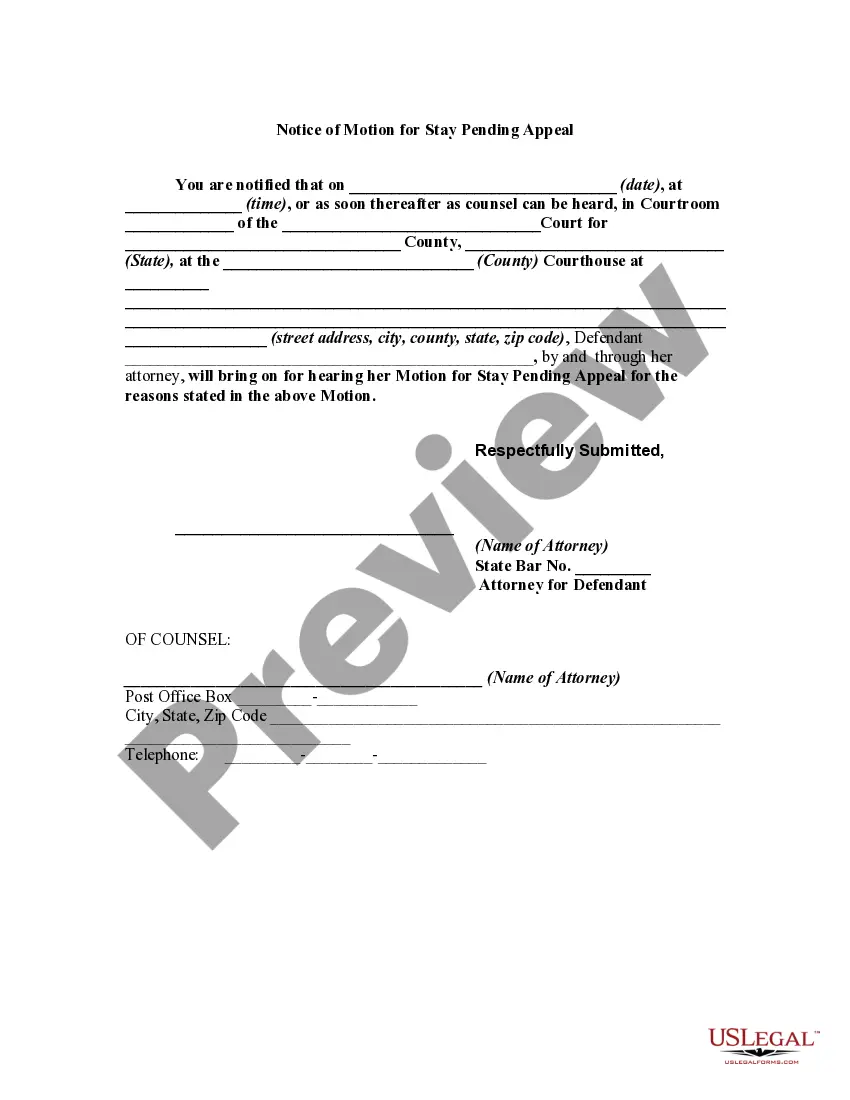

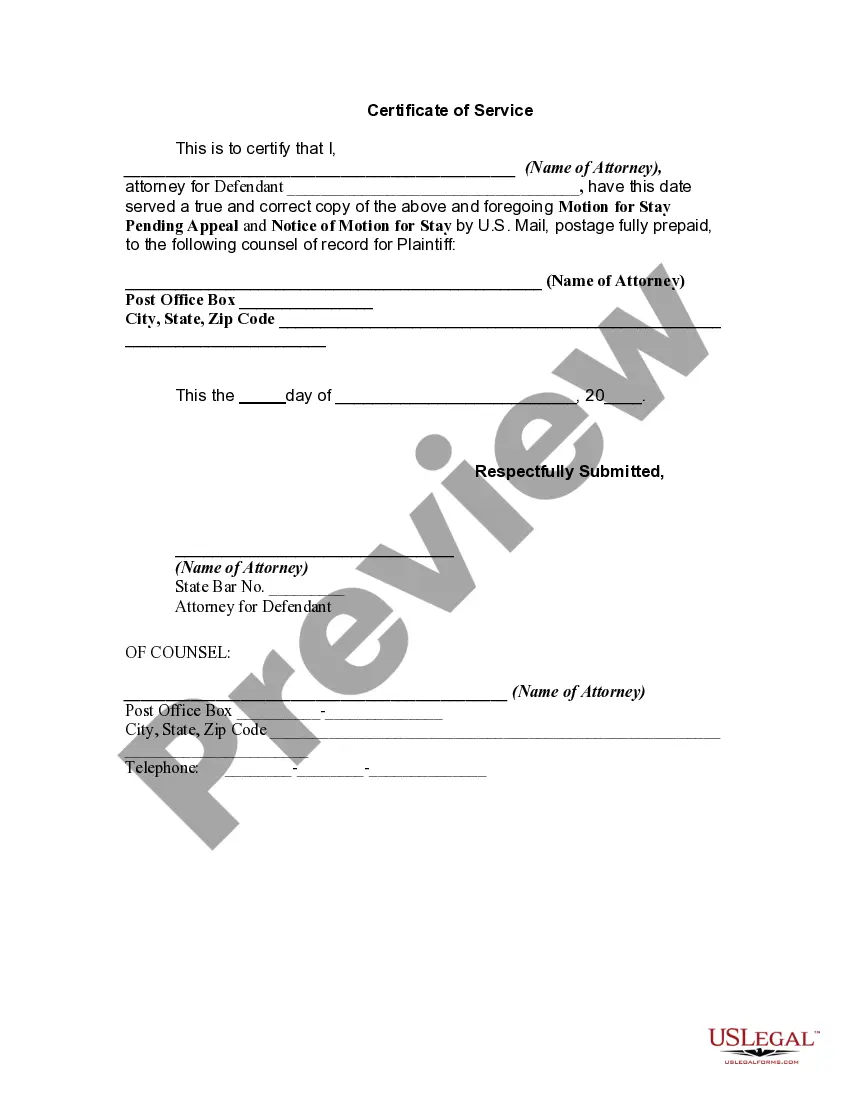

Here are the steps to follow after accessing the desired form: Confirm that this is the correct form by previewing it and examining its details.

- Tap into a valuable repository of articles, guides, and resources relevant to your case and needs.

- Save time and effort searching for the documents you require, employing US Legal Forms’ advanced search and Preview feature to find Motion Stay File Format Is Incorrect and acquire it.

- For existing subscribers, Log Into your US Legal Forms account, locate the form, and download it.

- Check your My documents tab to view the documents you have previously downloaded and to manage your folders accordingly.

- If it’s your first time using US Legal Forms, create a free account to access unlimited benefits from the library.

- A comprehensive online form directory may be transformative for anyone aiming to navigate these scenarios effectively.

- US Legal Forms is a frontrunner in internet legal forms, offering more than 85,000 state-specific legal documents available to you at any moment.

- With US Legal Forms, you can access a variety of state- or county-specific legal and organizational documents.

Form popularity

FAQ

Rule 12 addresses various pretrial motions in criminal cases, ensuring that both sides have adequate time to prepare. This rule often deals with motions to suppress evidence or dismiss charges. If the motion stay file format is incorrect, it can hinder your ability to rely on Rule 12 effectively. Understanding this rule can help you navigate the legal system more efficiently, so you may want to explore resources on uslegalforms to ensure you comply with all procedural requirements.

Form 511 is used by an Electing PTE to file an income tax return for a specific tax year or period and to remit Electing PTE tax paid with respect to all members' distributive or pro rata shares of income.

Sole proprietorships or general partnerships require no legal entry formalities except compliance with state and local licensing and taxation requirements.

In Maryland, the necessary paperwork will depend on the business entity type. LLCs have to file the Articles or Certificate of Reinstatement form, while corporations have to submit Articles of Revival. Additionally, you will have to file all your missing returns and pay the corresponding fees.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

Sole proprietorships are subject to pass-through taxation, meaning the business owner reports income or loss from their business on their personal tax return, but the business itself is not taxed separately. A sole proprietor will submit a Schedule C with their personal 1040 tax return on an annual basis.

A sole proprietor without employees and who doesn't file any excise or pension plan tax returns doesn't need an EIN (but can get one). In this instance, the sole proprietor uses his or her social security number (instead of an EIN) as the taxpayer identification number.

Sole proprietors typically do not receive a 1099 form. A 1099 form is a tax form that the Internal Revenue Service (IRS) uses to record payments received by someone other than an employer throughout the year.

Sole proprietors file personal income tax returns using Form 1040 and report their business income on Schedule C. Individuals must determine their taxable income by subtracting expenses from total income.