Insurance Appeal Letter For Wegovy

Description

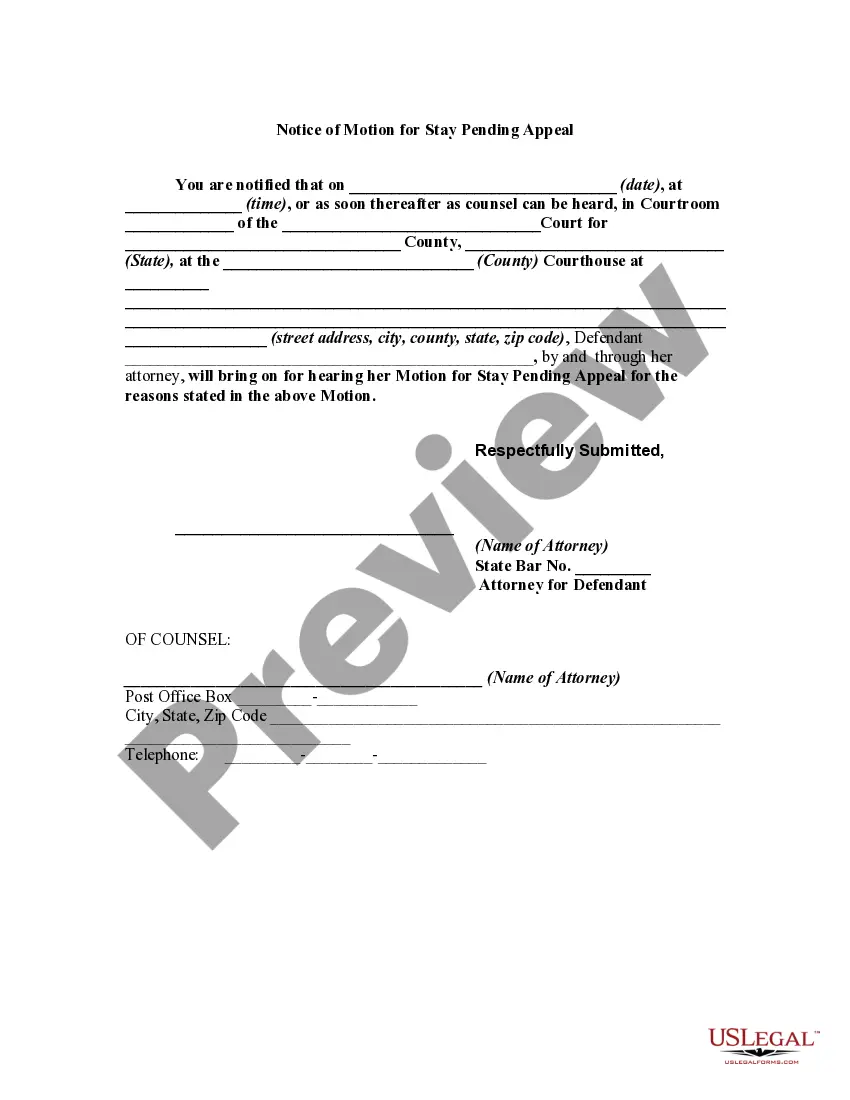

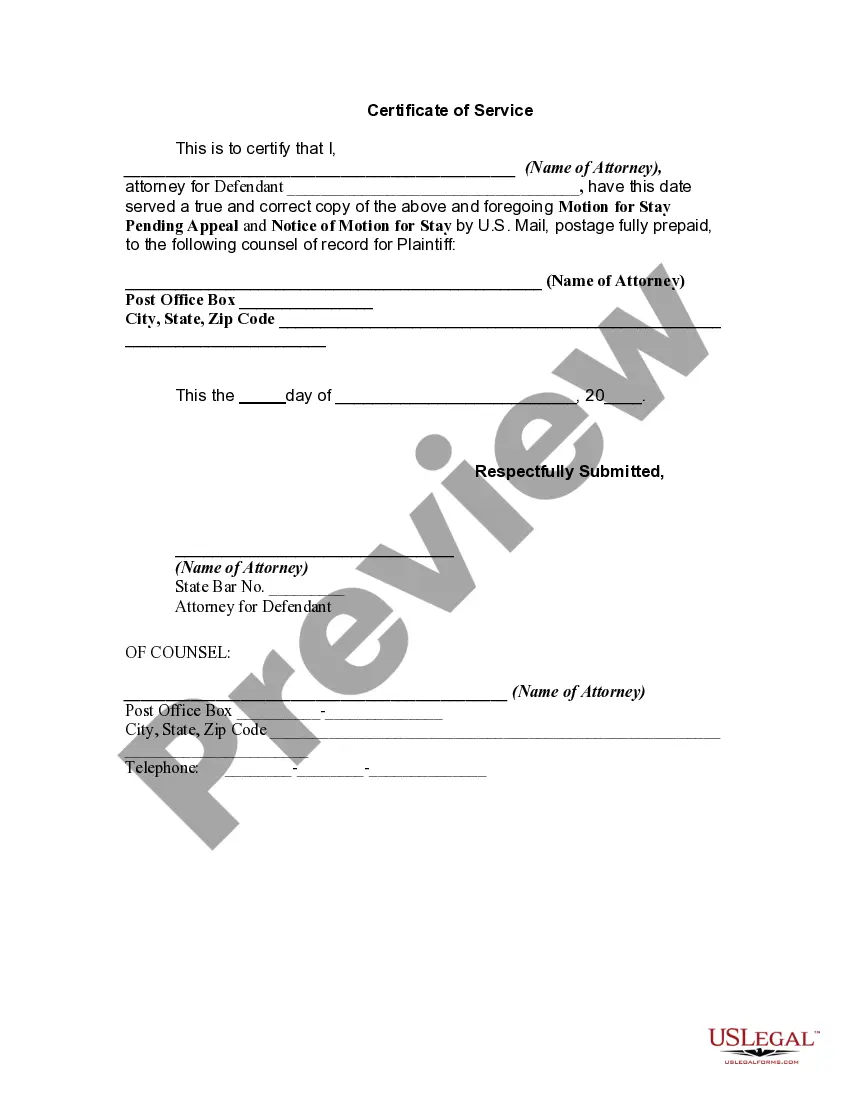

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Engaging with legal documents and processes can be a lengthy addition to your day.

Insurance Appeal Letter For Wegovy and similar forms often necessitate that you locate them and grasp how to fill them out properly.

For this reason, whether managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms readily available will be significantly beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms and a variety of tools to assist you in completing your documents with ease.

Is this your first experience using US Legal Forms? Create and set up your account in just a few minutes to gain access to the form library and Insurance Appeal Letter For Wegovy. Then, follow the instructions provided below to complete your form.

- Explore the library of applicable documents accessible at a single click.

- US Legal Forms gives you state- and county-specific forms that you can download anytime.

- Enhance your document management with exceptional support that enables you to prepare any form in minutes without incurring additional or concealed fees.

- Just Log In to your account, search for Insurance Appeal Letter For Wegovy, and download it immediately from the My documents section.

- You can also view forms you have previously downloaded.

Form popularity

FAQ

Appeal the decision: If your insurance denies coverage for Ozempic, you have the right to appeal the decision. This involves submitting a formal request for reconsideration, providing any necessary supporting documents and evidence of medical necessity.

To be eligible you must have a BMI of 30 or higher or a BMI of 27 or higher with at least one weight-related medical condition, such as high blood pressure or type 2 diabetes. Your doctor will also evaluate your overall health and medical history to determine whether Wegovy is safe and appropriate.

How do I pay for Ozempic if insurance doesn't cover it? If a person does not have insurance, they may be eligible for Novo Nordisk's Patient Assistance Program. If they meet the criteria, they will receive free medication.

How to write an appeal letter to insurance company appeals departments Step 1: Gather Relevant Information. ... Step 2: Organize Your Information. ... Step 3: Write a Polite and Professional Letter. ... Step 4: Include Supporting Documentation. ... Step 5: Explain the Error or Omission. ... Step 6: Request a Review. ... Step 7: Conclude the Letter.

To handle a Mounjaro health insurance denial, you should start with the appeal process recommended by your insurance company. But before doing so, you need to determine whether your insurance plan is an ERISA or non-ERISA plan. If your health insurance is sponsored by your employer, it is likely an ERISA plan.