Civil Appeal Process In Kenya

Description

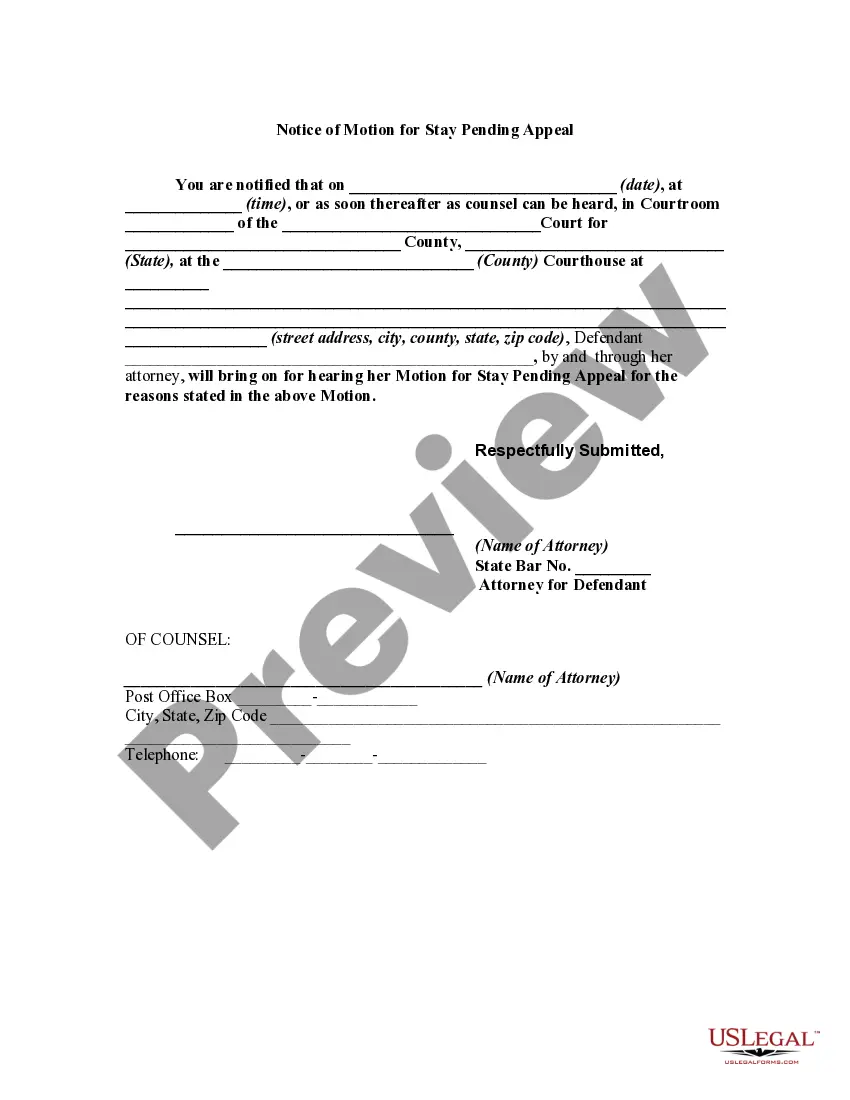

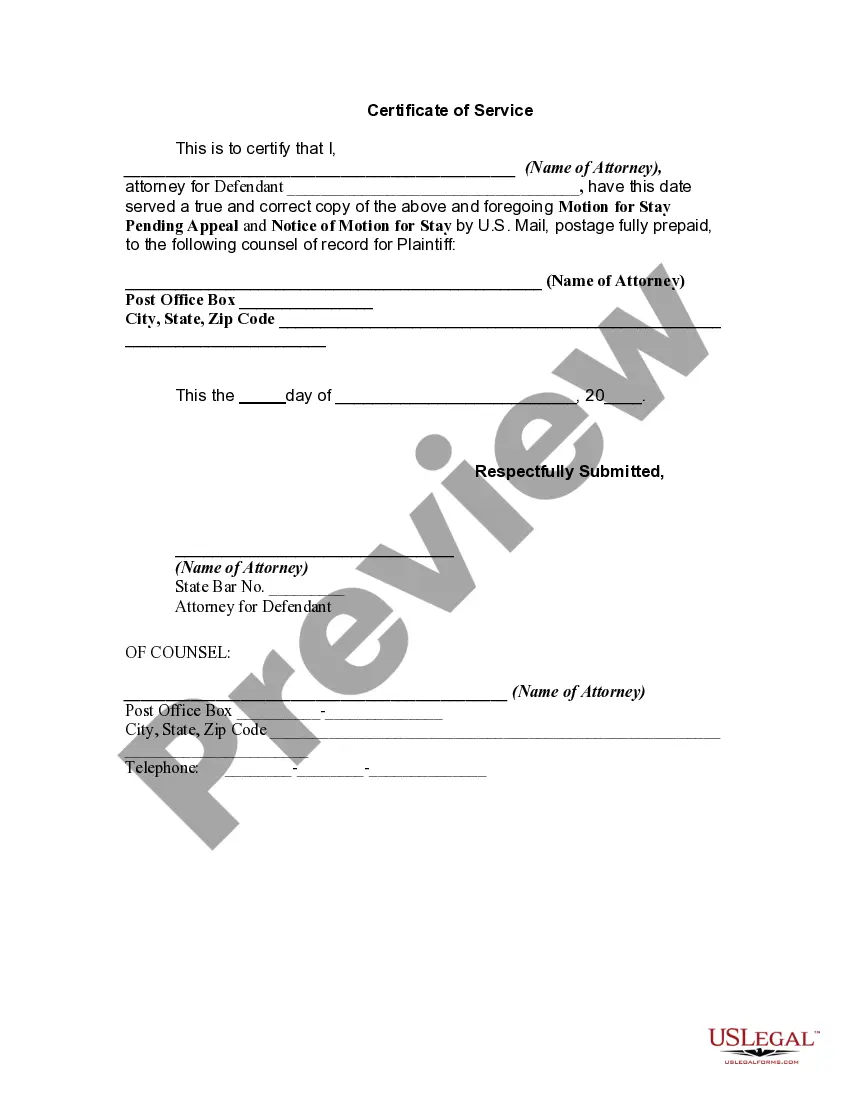

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Managing legal documents can be perplexing, even for seasoned professionals.

If you're interested in a Civil Appeal Process in Kenya and lack the time to search for the correct and updated version, the procedures can become overwhelming.

US Legal Forms addresses all requirements you may have, from personal to corporate papers, in one convenient place.

Utilize advanced tools to complete and manage your Civil Appeal Process in Kenya.

Here are the steps to follow after accessing the desired form: Validate it is the correct form by previewing it and examining its details.

- Access a valuable resource hub of articles, guides, and materials pertinent to your circumstances and requirements.

- Save time and effort searching for the documents you need, and utilize US Legal Forms’ sophisticated search and Review feature to find the Civil Appeal Process in Kenya.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously saved and manage your folders appropriately.

- If it’s your first experience with US Legal Forms, create an account and gain unlimited access to all benefits of the platform.

- A robust online form library can significantly benefit anyone who wishes to navigate these circumstances successfully.

- US Legal Forms stands as a frontrunner in online legal documents, offering over 85,000 state-specific legal templates available whenever needed.

- With US Legal Forms, you can access state- or county-specific legal and organizational documents.

Form popularity

FAQ

South Carolina requires foreign business owners to obtain a Certificate of Existence (sometimes called a Certificate of Good Standing) from your home jurisdiction. A Certificate of Existence shows your company has paid all taxes and required fees and is generally fit to do business.

To reinstate your South Carolina corporation you need to file Application for Reinstatement of a Corporation Dissolved by Administrative Action along with Tax Compliance Certificate from the South Carolina Department of Revenue with South Carolina Secretary of State, and pay any fees, missing annual reports and ...

Most states require businesses to file an annual (or other periodic) report with the Secretary of State. For the State of South Carolina, LLCs are not required to file an annual report every year. If your LLC has elected to be taxed as an S Corp however, you'll have to file form SC 1120S to the Department of Revenue.

To register a foreign corporation in South Carolina, you must file a South Carolina Application for Certificate of Authority with the South Carolina Secretary of State, Business Filings Division. You can submit this document by mail, in person, or online.

How to Reinstate a South Carolina LLC a completed South Carolina Application for Reinstatement by a Limited Liability Company Following Administrative Dissolution. a Certificate of Tax Compliance from the South Carolina Department of Revenue. a $25 reinstatement fee.

To register a foreign LLC in South Carolina, you'll need to file an Application for Certificate of Authority with the South Carolina Secretary of State and pay a $110 fee ($125 if filing online).

Steps to Filing South Carolina Foreign LLC Online After approval of your application, you will receive a Certified copy of your Business Registration from the Secretary of State office. The Cost of registration is $110 (non-refundable).

Starting an LLC in South Carolina will include the following steps: #1: Register Your South Carolina LLC Company Name. #2: Select a Registered Agent. #3: File Articles of Organization With the State. #4: Secure a Federal Employer Identification Number. #5: Formalize an Operating Agreement.