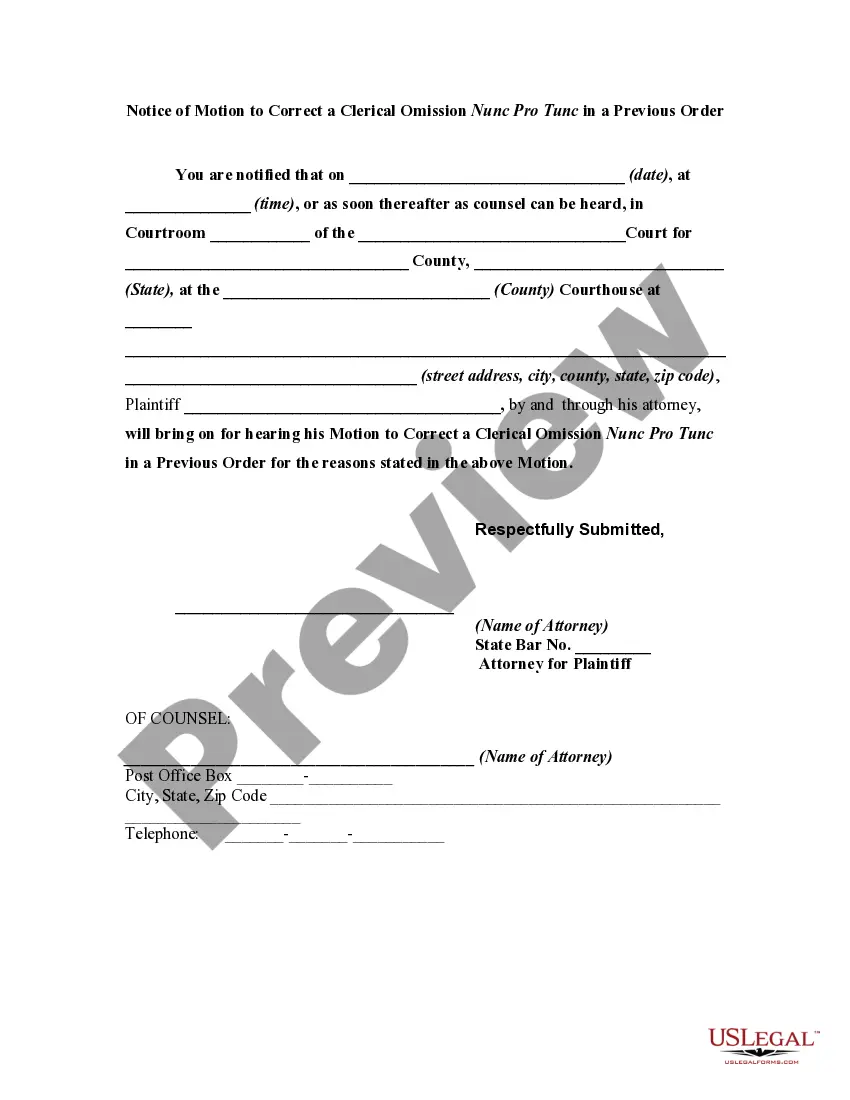

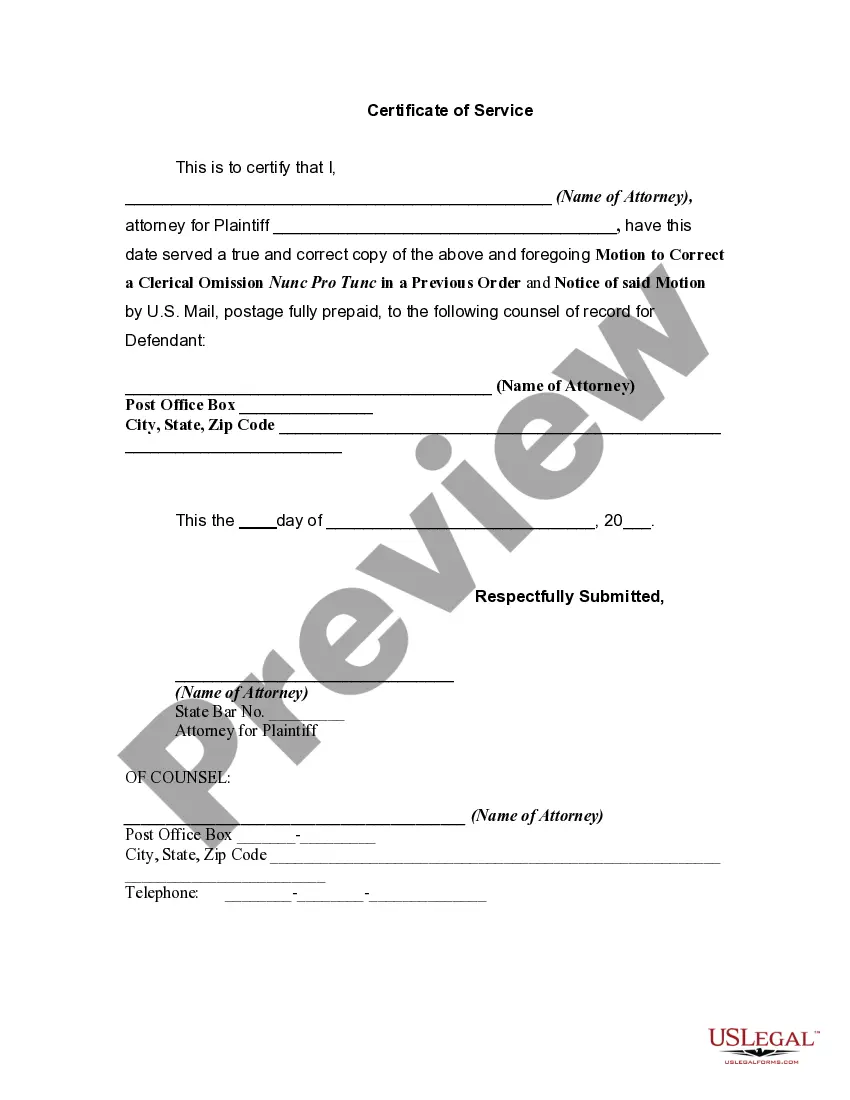

Motion Nunc Pro Tunc Within 30 Days

Description

How to fill out Motion To Correct A Clerical Omission Nunc Pro Tunc In A Previous Order?

Handling legal documents and processes can be a lengthy addition to the day.

Motion Nunc Pro Tunc Within 30 Days and similar forms frequently require you to find them and maneuver through the steps to fill them out accurately.

Thus, if you are managing financial, legal, or personal issues, having a thorough and functional online database of forms readily available will be very beneficial.

US Legal Forms is the leading online resource for legal documents, boasting over 85,000 state-specific forms and a variety of resources that assist you in completing your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create your account in a few minutes, and you'll gain access to the form catalog and Motion Nunc Pro Tunc Within 30 Days. After that, follow the steps below to complete your form.

- Explore the directory of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management tasks with a high-quality service that enables you to prepare any form in a matter of minutes without additional or concealed charges.

- Just Log In to your account, find Motion Nunc Pro Tunc Within 30 Days, and download it immediately from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

In plain English, 'nunc dimittis' can be understood as 'now let go'. However, in the world of legal terminology, this phrase is often less significant compared to the significance of a 'Motion nunc pro tunc within 30 days'. This legal motion allows you to request that a court retroactively correct an order, providing important flexibility in legal procedures. To better navigate such motions, consider exploring resources available on the US Legal Forms platform.

You pronounce 'nunc pro tunc' as 'nunk proh tunck'. While it may sound complex, breaking it down helps. It's important to become familiar with the term, especially when discussing legal procedures like a Motion nunc pro tunc within 30 days. Understanding how to articulate the phrase can assist in communicating effectively with legal professionals.

The Tennessee version of Article 9 is found in Chapter 9 of Title 47, Tennessee Code Annotated. Basically, the Chapter (Article) 9 framework involves the filing of documents to provide notice of liens on personal property and fixtures. Not all UCC Article 9 records are filed with the Register.

Our online search ( ) displays summary information about a financing statement (debtors, secured parties, dates). Information Requests (UCC11) can now be submitted online and as soon as payment is complete, you are able to retrieve a . pdf file of the images.

Ing to the Secretary of State's Office, ?the Uniform Commercial Code (UCC) is a comprehensive set of laws governing sales and other commercial transactions.

A UCC financing statement is effective for a period of five (5) years. A financing statement lapses or terminates at the end of the five-year period. A continuation statement can be filed to extend the lapse date if it is filed within six (6) months before the security interest expires.

By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing. This means that if the debtor defaults on the loan, the creditor can potentially receive the personal property of the debtor that was put up as collateral.

A UCC financing statement is valid until it lapses. How much is the filing fee to file a UCC1? The filing fee is fifteen dollars ($15.00) per debtor.

1 financing statement is a legal form that a creditor files to give notice that it has the right to take possession of and sell certain assets belonging to the debtor for the repayment of a specific debt.?