Motion For Extension Of Time Nunc Pro Tunc

Description

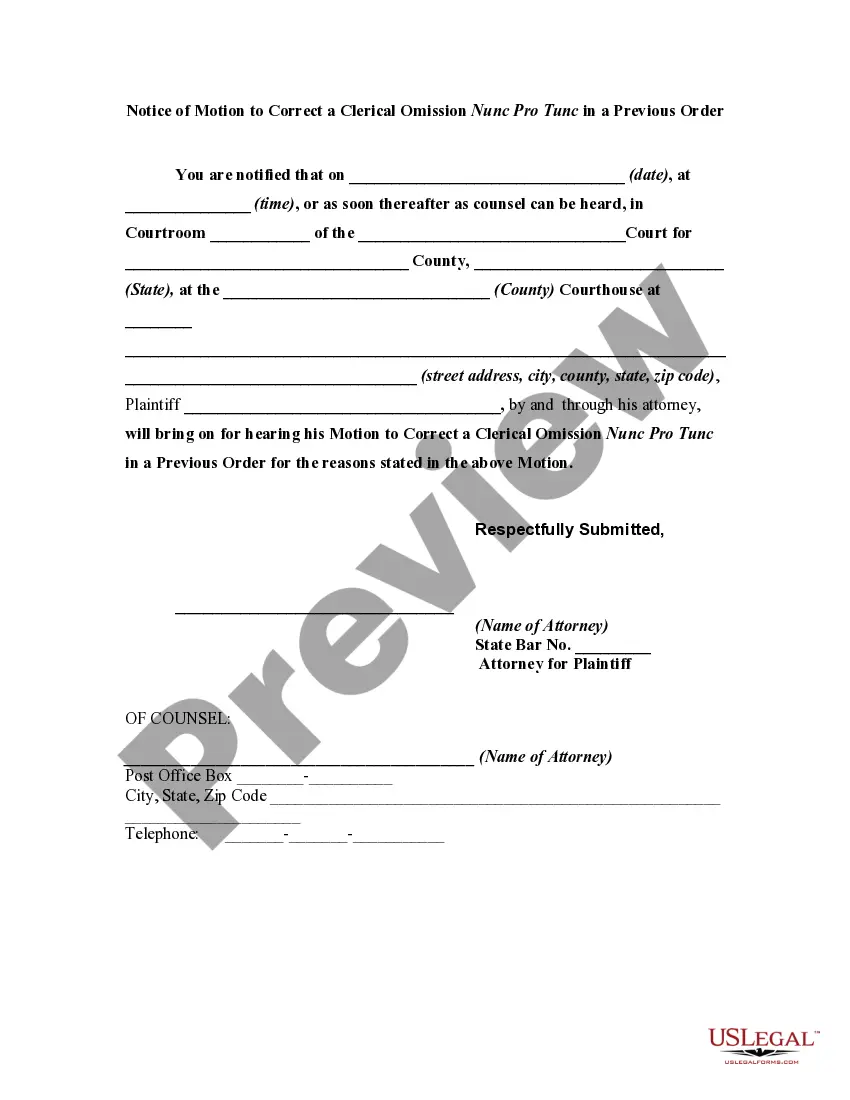

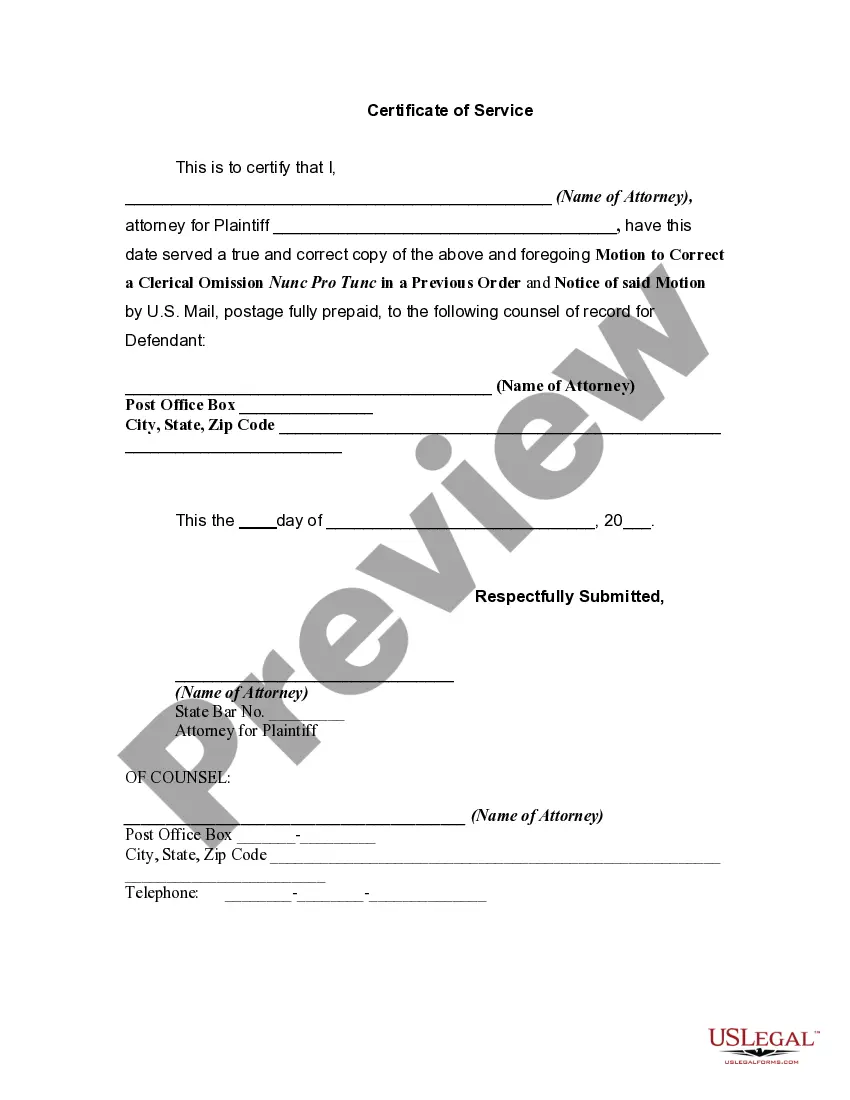

How to fill out Motion To Correct A Clerical Omission Nunc Pro Tunc In A Previous Order?

It’s clear that you cannot become a legal expert right away, nor can you swiftly learn how to prepare a Motion For Extension Of Time Nunc Pro Tunc without having a specialized background.

Drafting legal documents is a lengthy procedure that demands specific training and expertise.

Therefore, why not entrust the drafting of the Motion For Extension Of Time Nunc Pro Tunc to the experts.

You can access your forms again anytime from the My documents section. If you are an existing client, you can simply Log In and retrieve the template from the same section.

Regardless of the nature of your documents—be it financial, legal, or personal—our platform has you supported. Experience US Legal Forms now!

- Utilize the search bar at the top of the page to find the form you need.

- If available, preview it and read the accompanying description to see if Motion For Extension Of Time Nunc Pro Tunc is what you seek.

- If you need a different form, restart your search.

- Create a free account and choose a subscription plan to acquire the template.

- Click Buy now. Once the payment process is complete, you can download the Motion For Extension Of Time Nunc Pro Tunc, fill it out, print it, and submit it to the appropriate individuals or organizations.

Form popularity

FAQ

'Nunc pro tunc' is pronounced as 'nunk proh tungk.' Although it's a Latin term, legal professionals often use it in discussions to address rectifications in court orders. When seeking a Motion for extension of time nunc pro tunc, using the correct terminology can enhance your credibility. Proper pronunciation aids in effective communication with attorneys and judges alike.

'Nunc pro tunc' means acting with retroactive effect. In legal proceedings, it allows a court to recognize the validity of a prior action taken at a later date. When raising a Motion for extension of time nunc pro tunc, understanding this term helps clarify your intentions and objectives. You are essentially requesting the court to acknowledge and rectify past clerical or procedural mistakes.

The document required to form an LLC in Tennessee is called the Articles of Organization. The information required in the formation document varies by state. Tennessee's requirements include: Registered agent.

As long as all existing members of your LLC are in agreement, the process to add a member to a Tennessee LLC is pretty simple. You'll simply amend your LLC operating agreement and issue new membership certificates.

How Do I Amend the Articles of Organization? Determine Whether an Update Is Necessary. ... Obtain Approval for the Update as Required by the LLC's Operating Agreement. ... Complete Appropriate Government Forms to Change the Articles of Organization. ... File Articles of Amendment with the Appropriate State Agency.

It costs $20 to change your LLC name in Tennessee. This is the filing fee for the Articles of Amendment form.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

What are the steps for changing an LLC name in Tennessee? Check if your new LLC name is available. File the Amendment form (and wait for approval) Update the IRS. Update the Tennessee Department of Revenue. Update financial institutions (credit card companies, banks) Update business licenses.

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.

Tennessee LLCs have to file a completed Articles of Amendment to Articles of Organization (LLC) with the Division of Business Services of the Department of State. You can download the form from their website. You can also draft your articles if you do not want to use the form. Filing comes with a $20 fee.