Amend Complete Repair é Bom

Description

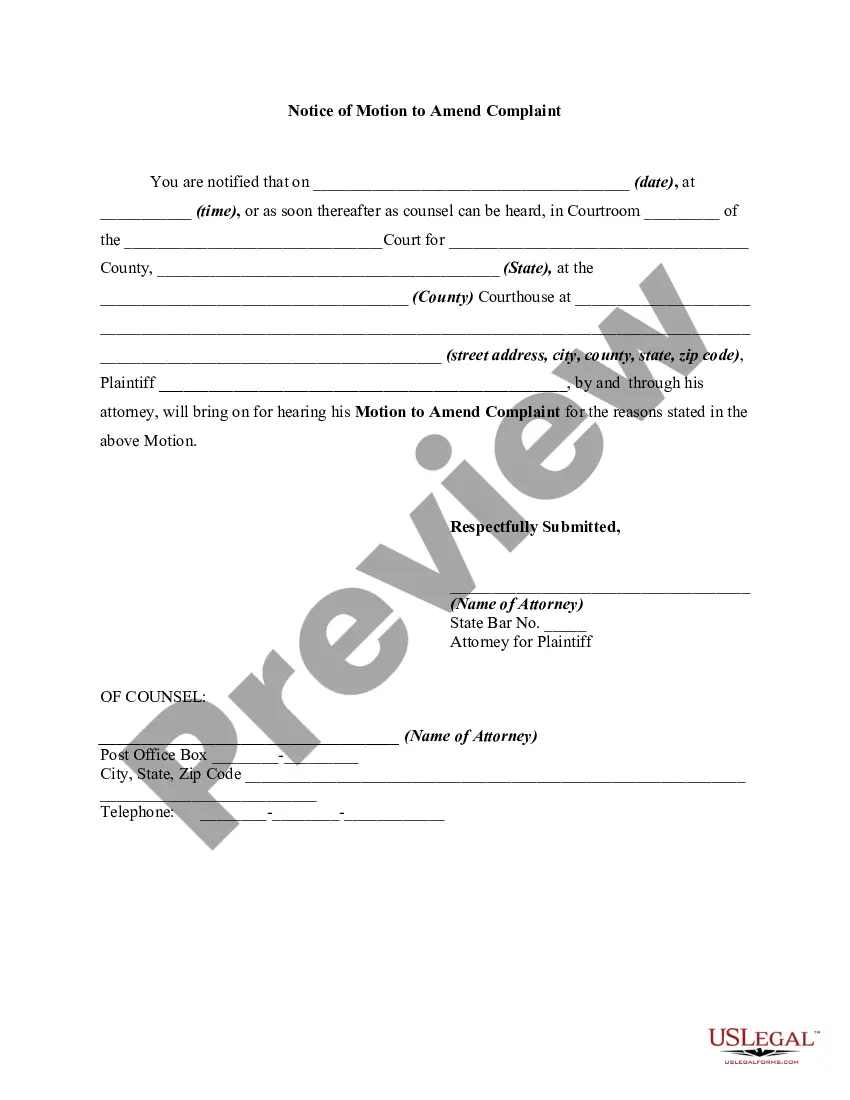

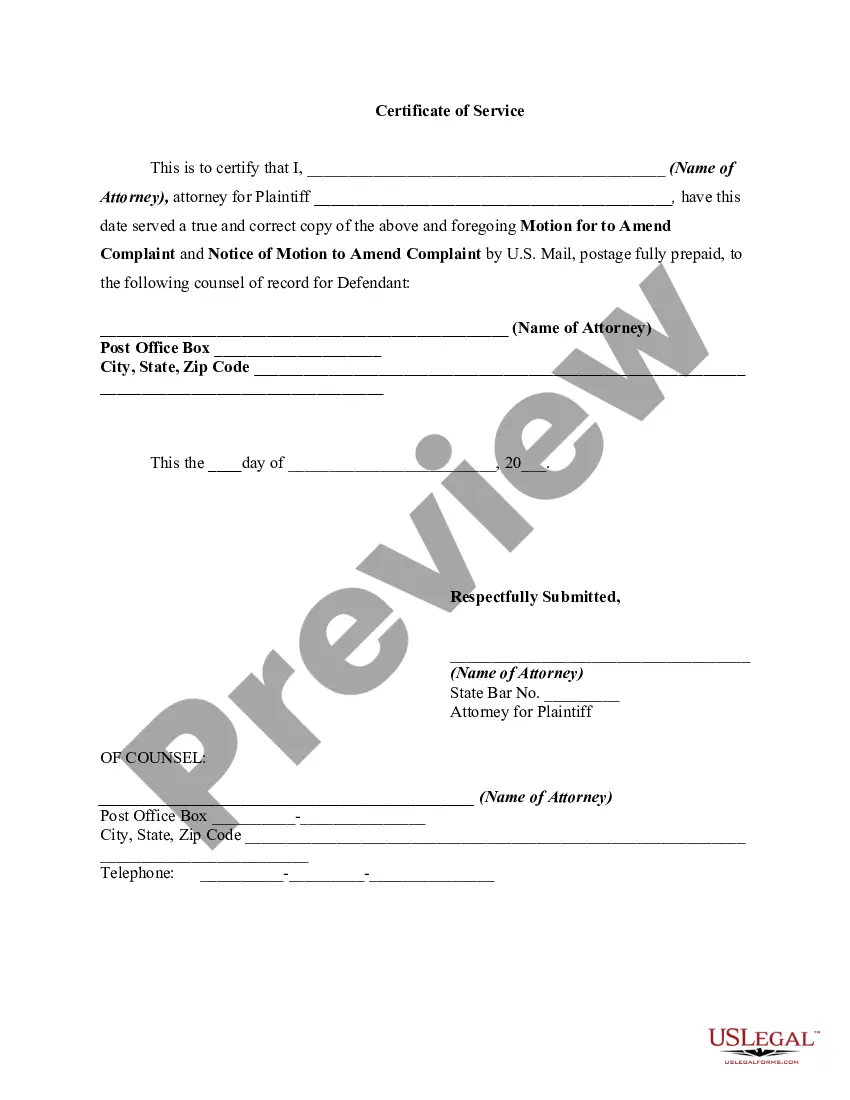

How to fill out Simple Motion To Amend Complaint And Notice Of Motion?

- Log in to your account if you're a returning user. Simply click here to access your dashboard and navigate to find the required template.

- Check the preview and descriptions of the forms available. It's essential to select the right document that aligns with your specific requirements and local jurisdiction.

- If the initial form doesn’t fit, utilize the search feature to explore other legal templates until you find the perfect match.

- Make a purchase by clicking the 'Buy Now' button for your chosen template. Choose the subscription that meets your needs to gain access.

- Enter your payment information for credit or PayPal to complete the transaction.

- Download the form directly to your device, and you can revisit it anytime via the My Forms section of your profile.

By following these simple steps, you can quickly and effectively gain access to a comprehensive array of legal documents, from minor amendments to major repairs.

Don't let the complexity of legal forms overwhelm you. Start your journey with US Legal Forms today and ensure your documentation meets all necessary legal standards!

Form popularity

FAQ

The best way to file an amended return is to complete and submit Form 1040-X, following the guidelines outlined by the IRS. Ensure you double-check all changes before submitting, as accuracy is critical. Additionally, keeping detailed records of your amendments can assist in case of future inquiries. Leveraging resources like US Legal Forms can simplify this process and help you maintain accurate records every step of the way.

Yes, you can file your amended return electronically if you use specific tax software approved by the IRS. Many platforms now support e-filing for amended returns, making the process faster and more efficient. Remember that electronic filing can expedite the processing time for your amendments. Using reliable services like US Legal Forms streamlines this experience, ensuring ease and accuracy.

To amend your H&R Block return, you need to log into your account and select the option to amend your tax return. Follow the prompts to make necessary changes and complete Form 1040-X. H&R Block will guide you in providing the right information, ensuring your changes are clear. This user-friendly process ensures that amending your return becomes a simple task aligned with 'Amend complete repair é bom.'

Generally, you won't face a penalty simply for filing an amended return. Instead, penalties may arise if your original return had errors that resulted in unpaid taxes. When you amend, focus on ensuring you report everything accurately to avoid future complications. Utilizing services like US Legal Forms can clarify the process, helping you avoid these potential pitfalls.

The best way to amend your tax return is by using Form 1040-X, which is specifically designed for this purpose. You should carefully explain each change you make and attach any necessary documentation. Consulting with a tax expert to ensure accuracy can also boost your confidence. This comprehensive approach can help you navigate your amendment while ensuring everything aligns with the principle of 'Amend complete repair é bom.'

Amending a tax return does not automatically lead to an audit, though it can increase scrutiny. The IRS examines amendments to ensure the accuracy of your submissions. Therefore, it's crucial to provide detailed documentation when you file. Using platforms like US Legal Forms can help ensure your amendments are thorough and well-documented, which can ease audit concerns.

Yes, you can file an amended return within three years of the original filing date. However, it is important to note that certain circumstances may require timely amendments. To ensure you comply with all requirements, it’s best to consult a tax professional. Remember, knowing when to amend is essential to ensure your tax details are accurate and align with your financial goals.